5 FinTech Stats Every Finance Professional Should Know

FinTech continues to disrupt the world of trading, banking, financial advice and financial products. The industry is growing rapidly, with new entrants creating opportunities to reinvent traditional banking for both consumers and businesses.

Rising investment, growing deal sizes, higher levels of merger & acquisition activity, and the expanding geographic spread of deals characterize the maturing FinTech sector. According to a KMPG study, the global FinTech market reached nearly $112 billion in 2018, a 120% increase from the year before.

Several other interesting statistics have been published by various leading financial firms, including:

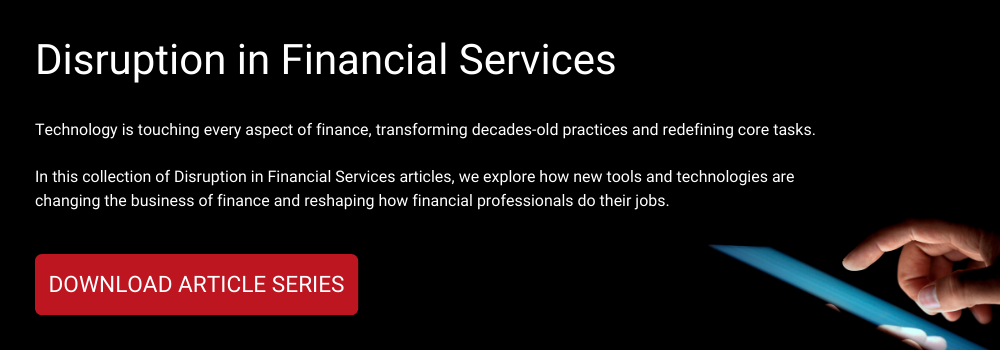

1 By 2026 the business value added by blockchain will grow to slightly over $360 billion, then surge to more than $3.1 trillion by 2030

Gartner

Blockchain’s unique application of distributed ledger technology enables the creation of an unalterable and shared permanent record of business transactions. With the promise of increased security, smarter contracts, and dramatically lower costs, blockchain has the potential to reshape entire economies. FinTech businesses will be at the forefront of this revolution.

Blockchain’s unique application of distributed ledger technology enables the creation of an unalterable and shared permanent record of business transactions. With the promise of increased security, smarter contracts, and dramatically lower costs, blockchain has the potential to reshape entire economies. FinTech businesses will be at the forefront of this revolution.

To remain competitive, financial firms will have to commit to innovation and attracting industry experts. Gartner forecasts blockchain will generate an annual business value of more than $3 trillion by 2030, PwC explains that “it’s possible to imagine that 10% to 20% of global economic infrastructure will be running on blockchain-based systems by that same year.” Perhaps even more exciting is the emergence of new ways of utilizing blockchain. These include tax regulations and compliance, equity trading, and medical record keeping. Whether you are directly involved in the digital currency space or not, it’s essential to develop an understanding of blockchain as it is transforming how we do business in all industries.

2 Successful banking-related chat bot interactions will grow 3,150% between 2019 and 2023

Juniper

Client-facing systems such as text chats, voice systems, or chatbots can deliver human-like customer service or expert advice at low cost. Juniper Research estimates 826 million working hours will be saved by chatbots by 2023, which will make artificial intelligence (AI) one of the most successful advancements in FinTech.

Client-facing systems such as text chats, voice systems, or chatbots can deliver human-like customer service or expert advice at low cost. Juniper Research estimates 826 million working hours will be saved by chatbots by 2023, which will make artificial intelligence (AI) one of the most successful advancements in FinTech.

The same research predicts operational cost savings from using chatbots in banking is to reach nearly $7.3 billion by 2023 and continue to increase as more financial and technology firms implement these services. As chatbots become more advanced, banks will need to have a conversational banking strategy that includes investing in the right human talent with skills in AI development and natural language processing experts who can keep up with technological advancements and integrations. As a result, banks will need to increase the focus on digital security to protect sensitive information.

3 AI will power 95% of all customer interactions within 5 to 10 years, with consumers expected to eventually prefer interaction with machines over humans

Servion

In the next 10 years, businesses will implement advanced AI assistants designed to be proactive, anticipate customer needs, and engage on an emotional level. Experts say only 5% of customer interactions will require human involvement, although retaining the “human touch” will be a key challenge for emerging FinTech companies to avoid consumers feeling like they are dealing with some faceless entity and to persuade clients (particularly older clients) to abandon their traditional banks.

In the next 10 years, businesses will implement advanced AI assistants designed to be proactive, anticipate customer needs, and engage on an emotional level. Experts say only 5% of customer interactions will require human involvement, although retaining the “human touch” will be a key challenge for emerging FinTech companies to avoid consumers feeling like they are dealing with some faceless entity and to persuade clients (particularly older clients) to abandon their traditional banks.

However, improvements in online banking services mean users no longer feel the need to visit physical locations. According to PWC’s Digital Banking Consumer Survey, despite consumers seeing value in having local branches, 62% of respondents said their visit frequency has dropped from “a few times a month” to “a few times a year”.

4 93% of companies now use at least one cloud-based software

SpiceWorks

The story of companies’ cloud migrations has become a lot less about the hype and buzzwords and a lot more about the reasoning behind the trend – the power of data visualization. Cloud-based software allows people to view and explore information in new ways.

The story of companies’ cloud migrations has become a lot less about the hype and buzzwords and a lot more about the reasoning behind the trend – the power of data visualization. Cloud-based software allows people to view and explore information in new ways.

As in many sectors, cloud computing in finance began with non-core business processes, such as human resources and admin systems. Today, we are seeing core processes such as credit risk management, payment transactions, and customer due diligence moving to the cloud. Spiceworks reported the top three most-used cloud services are web hosting (76%), followed by email hosting (56%), and cloud storage and file-sharing (53%).

As a highly regulated sector that handles some of our most sensitive personal information, public cloud service providers are continuing to work closely with finance industry players and regulators in order to effectively address security, governance, and compliance requirements.

5 The total transaction value of digital payments in 2019 was $4.1 trillion. In 2020, it is expected to reach nearly $4.8 trillion

Statista

Digital payments are a driving force in the FinTech sector. Their adoption and impact are more robust and widespread than ever. With a 12.8% projected compound annual growth rate from 2019 to 2023, the total value of transactions is expected to reach $6.7 trillion by 2023.

Digital payments are a driving force in the FinTech sector. Their adoption and impact are more robust and widespread than ever. With a 12.8% projected compound annual growth rate from 2019 to 2023, the total value of transactions is expected to reach $6.7 trillion by 2023.

In order to fulfill an unprecedented rise in the demand for augmented user-friendly payment experiences, banks have become proactive adopters of these exciting developments. They are rapidly partnering, supporting, and promoting players in the FinTech space and adopting software, programs, and applications.

In conclusion, as we move into the 2020s, financial technology solutions will become an integral part of modern life. Mobile apps, AI, blockchain, and extended-reality technologies will continue to grow. This emphasizes the need for companies to prioritize innovation, or risk getting left behind.

Compliance, cyber security, and skills gap education are just a few of the challenges facing emerging FinTech firms. At the same time, big banks and traditional financial institutions are being confronted with the reality that consumers are shifting their focus to ease of access and use. They are feeling pressure to grow, innovate, create better operating environments, utilize new capabilities, improve culture, and operate flawlessly all while meeting strict regulatory requirements.

Sources:

PWC: https://www.pwc.ru/en/press-releases.html

Gartner: https://www.gartner.com/smarterwithgartner/the-cios-guide-to-blockchain/

Juniper: https://www.juniperresearch.com/press/press-releases/bank-cost-savings-via-chatbots-reach-7-3bn-2023

Servion: https://servion.com/blog/what-emerging-technologies-future-customer-experience/

Singularity University: https://su.org/

Spice Works: https://www.spiceworks.com/press/releases/2016-03-08/

Satista: https://www.statista.com/outlook/296/100/digital-payments/worldwide

Carsurance: https://carsurance.net/blog/fintech-statistics