US deregulation poses dilemma elsewhere

Since returning to office, US President Donald Trump and his administration have embarked on a campaign of wholesale deregulation in areas related to banking and finance. These measures have far-reaching and profound implications across the sector and for jurisdictions elsewhere.

The US deregulation drive has industry-wide and global implications for financial services. Perhaps the most significant changes relate to the Basel III “endgame” proposals – recent updates to the post-2008 Basel III framework, designed to further strengthen bank capital positions.

Softening of capital adequacy and leverage requirements

The amounts of capital a bank holds directly influence its ability to lend and take on risk, making capital adequacy rules a core part of bank regulation. The Trump administration has signaled a lighter touch than the 2023 Basel III proposal, which would have raised capital requirements for large banks.

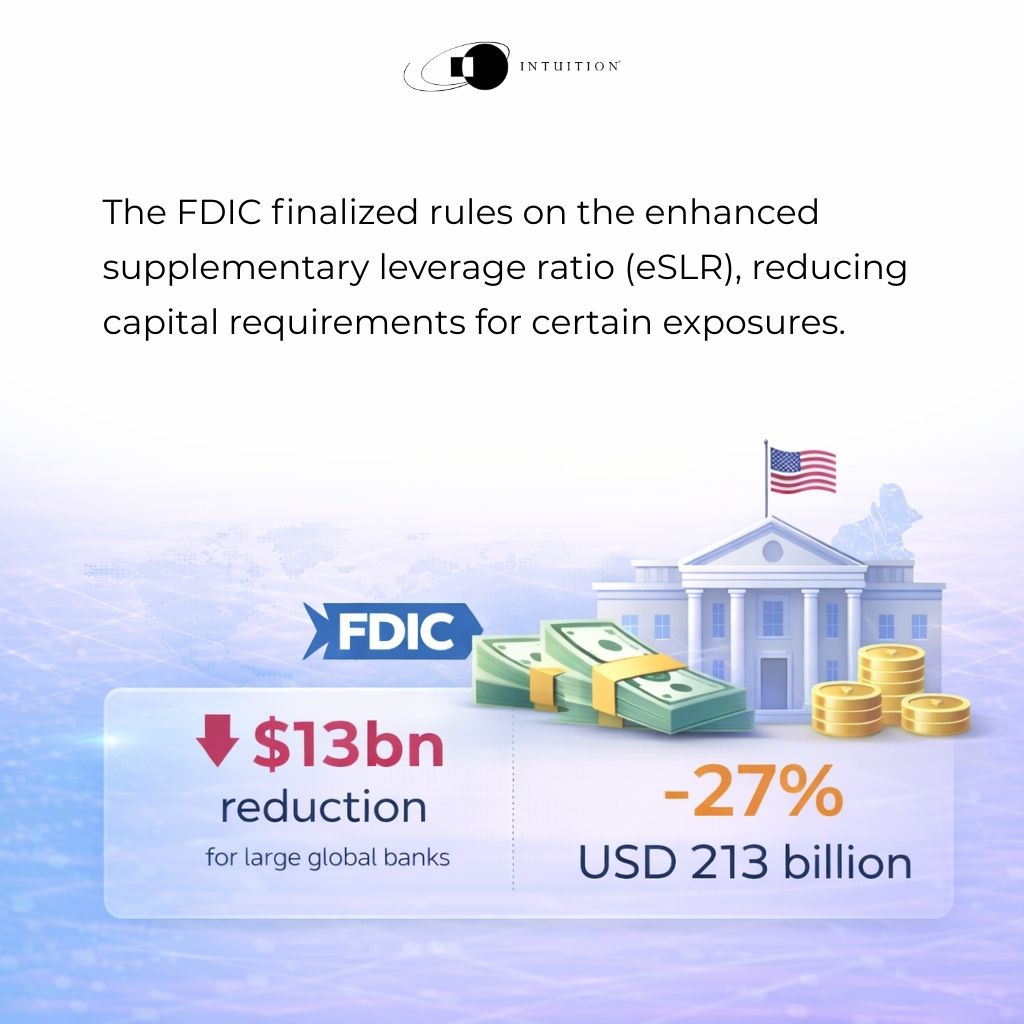

In a related move, the FDIC finalized rules on the enhanced supplementary leverage ratio (eSLR), reducing capital requirements for certain exposures. According to some estimates, these changes lower overall capital for large global banks by USD 13 billion (under 2%), while depository subsidiaries see a 27% reduction, equivalent to USD 213 billion.

Consumer protection in retreat

US consumer protection has seen a major rollback. Last May, the Consumer Financial Protection Bureau (CFPB) revoked nearly 70 guidance documents covering retail financial services, including fair lending guidance aimed at reducing discrimination risks for immigrants and non-citizens.

Supervision of crypto and digital assets has also eased considerably. The US appears to be positioning itself as a more permissive environment for issuance, trading, and on-shore structuring of crypto and digital assets.

Enforcement has followed suit. Over the past year, the Department of Justice’s crypto enforcement team has effectively disbanded, while the SEC has paused or dismissed several high-profile cases, signaling a markedly lighter regulatory stance.

Lighter regulation for digital assets

The Office of the Comptroller of the Currency (OCC) is making it easier for banks, FinTechs, and other nonbank companies to launch digital asset businesses – including via full-service or limited-purpose bank charters.

In December, the OCC conditionally approved five applications to charter or convert institutions into national trust banks focused on digital asset activities. Critics argue these banks face lighter requirements than full-service banks, suggesting that regulatory discipline is being relaxed in pursuit of an “innovative” regime.

The US is also diverging from global norms in anti-money laundering (AML) and beneficial ownership. FinCEN removed beneficial ownership reporting requirements for US companies and US persons, while resetting deadlines for foreign entities, as part of a broader “reduce burden” agenda.

Regulation of AI follows a similar pattern. The US largely relies on existing frameworks for model risk, operational risk, and consumer protection, rather than comprehensive AI legislation. This has created a patchwork landscape compared with the EU, with strong indications that the administration favors a federal approach, limiting states’ ability to implement stricter rules.

Challenge posed to other jurisdictions

The US deregulatory push has significant knock-on effects. Major jurisdictions are understandably hesitant to implement global standards when the US lags behind.

Capital requirements illustrate the dilemma. The EU has postponed market-risk implementation to 1 January 2027, explicitly citing delays and divergences in other major jurisdictions. Similarly, Canada and the UK have paused implementation.

Last summer, Claudia Buch, Chair of the Supervisory Board of the ECB, highlighted the EU’s approach in a speech titled “Simplification without deregulation: European supervision, regulation and reporting in a changing environment.” She framed the challenge clearly:

“Simplification means maintaining resilience with a more effective and efficient supervisory and regulatory framework; deregulation means weakening regulation and supervision at the expense of resilience. In practice though, it can be difficult to draw a clear line between simplification and deregulation.”

Buch acknowledged the perception of an EU “addicted to complex rule-making” that can seem disadvantageous, while underscoring the difficulty of balancing efficiency and regulatory strength.

Conclusion

Buch acknowledged the perception of an EU “addicted to complex rule-making” that can seem disadvantageous, while underscoring the difficulty of balancing efficiency and regulatory strength.

It’s impossible to say where this all leads. At one extreme, a lax regulatory environment could set the stage for financial shocks or crises, reminding everyone why rules exist and why they tend to get tightened after major financial crises. At the other end, markets and institutions may adapt smoothly, in which case the post-2008 regulatory framework will be judged to have been overly draconian.

Intuition Know-How has a number of tutorials relevant to the content of this article:

- Basel III – An Introduction

- Basel III – Liquidity & Leverage

- Basel III – Pillar I & Capital Adequacy

- Banking Regulation – An Introduction

- Crypto Assets – An Introduction

- Digital Assets

- Crypto Regulation – An Introduction

- AI Applications – Regulation & Compliance