Coronavirus May Infect Derivatives Markets, Sending Counterparties Crashing

As the novel coronavirus spreads rapidly around the world, financial markets are becoming increasingly volatile. Equities have plunged into bear market territory, upending a decade-long expansion, and corporate credit markets are facing the possibility of widespread downgrades and defaults. Against this backdrop, derivatives markets are seeing activity spike. Over time, mounting margin calls and economic disruption may see counterparty credit risk (CCR) emerge as a key financial market vulnerability.

By March 23, confirmed cases of the coronavirus topped 340,000, affecting almost every country in the world. As the death toll rises and the spread of the virus accelerates, many nations are grappling with potentially enormous economic costs and financial markets are reeling in the face of rising global risk.

Economic impact

The spread of the coronavirus – which the World Health Organization (WHO) has declared a pandemic – is causing both supply and demand shocks.

Production lines and workplaces are being affected by quarantines, closures, and absent workers, reducing the production and supply of certain goods and services. At the same time, consumers are curtailing their activities, traveling less, and reducing their spending in fear of job losses, reducing demand. These combined disruptions are threatening global economic growth.

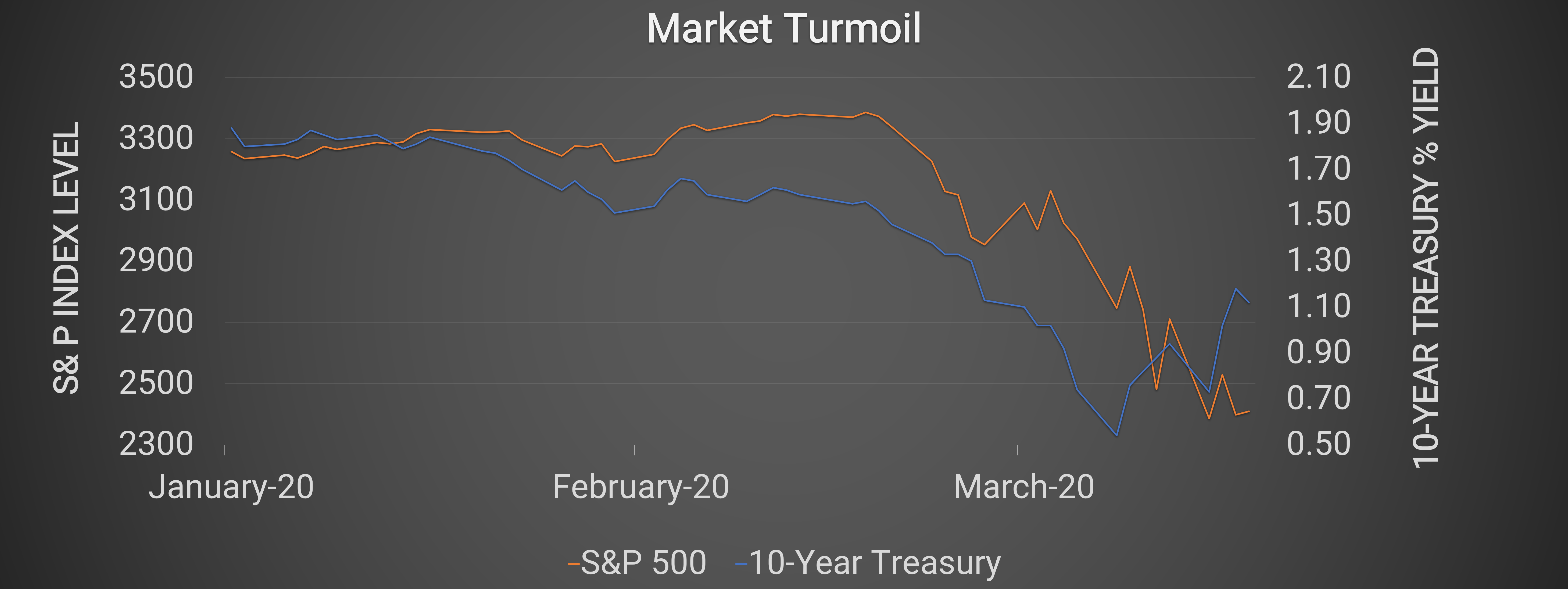

In response, investors have sold off equities, sending global stock markets decisively into bear territory and pushing down yields on government debt amidst a flight to safety. At the same time, yields on corporate debt have spiked as investors worry about the rising risk of defaults by companies affected by the coronavirus.

Source: Federal Reserve Bank of St. Louis. March 23, 2020.

Against this backdrop, some are sounding a note of caution in other key markets, especially derivatives markets. As volatility rises, firms on both sides of derivatives contracts may face rising counterparty credit risk (CCR).

CCR in a time of market chaos

The use of derivatives contracts is widespread among both banks and nonbank companies. For example, many nonbank corporates use foreign exchange or interest rates derivatives to hedge key risks. In normal times, these contracts inevitably create a degree of CCR. In times of extraordinary volatility, however, that risk can spike.

Many over-the-counter (OTC) derivatives require the party that is out of the money to provide collateral to cover potential losses. When the market moves and potential losses mount up, the party on the losing side of the transaction may face collateral calls.

As markets become increasingly volatile and market movements increase in size, such margin calls may become larger and more frequent. For companies already facing disruptions associated with the economic shock of the coronavirus, the need to provide liquid assets as collateral against mounting derivatives losses may put extreme pressure on cash flows, potentially tipping otherwise healthy businesses into default. This would greatly increase CCR throughout derivatives markets.

OTC derivatives also face potential payment and settlement disruptions. Quarantines and lockdowns may disrupt workflows and affect companies’ ability to make timely payments. This could potentially trigger force majeure clauses in trading agreements that reference the 2002 ISDA Master Agreement, leading to the unexpected early termination of contracts.

As the coronavirus pandemic continues to evolve, companies must monitor and evaluate a growing pool of risk. Rising CCR may become an increasingly important component of this risk as market volatility and disruption increase.

Intuition Know-How has a number of tutorials that are relevant to CCR and other topics discussed above:

- Risk – Primer

- Risk Management – An Introduction

- Risk Management – Risk Types & Measurement

- Counterparty Credit Risk (CCR) – An Introduction

- Counterparty Credit Risk (CCR) – Measurement

- Counterparty Credit Risk (CCR) – Management

- Asset Management – Credit Risk & Counterparty Credit Risk (CCR)