A new era of financial crime

Crime has digital momentum

From sophisticated AI-driven scams to crypto laundering networks, financial crime is becoming more agile, automated, and invisible. Criminals are adapting faster than ever, while compliance teams remain constrained by outdated systems and manual controls.

The stakes get higher every day

The result? Rising regulatory penalties, reputational risks, and operational strain across the global financial ecosystem. Institutions that once relied on static rulebooks are now recognizing the need for more adaptive, intelligence-driven compliance approaches. Many organizations are now turning to structured capability programs like Intuition Know-How to strengthen regulatory fluency and real-world decision-making.

Only 64% of institutions feel equipped to manage financial crime risks — leaving over a third exposed.

Source:

Oliver Wyman & ACAMS (2021)

Where compliance is falling behind

A new era of financial crime

Crime has digital momentum

From sophisticated AI-driven scams to crypto laundering networks, financial crime is becoming more agile, automated, and invisible. Criminals are adapting faster than ever, while compliance teams remain constrained by outdated systems and manual controls.

The stakes get higher every day

The result? Rising regulatory penalties, reputational risks, and operational strain across the global financial ecosystem. Institutions that once relied on static rulebooks are now recognizing the need for more adaptive, intelligence-driven compliance approaches. Many organizations are now turning to structured capability programs like Intuition Know-How to strengthen regulatory fluency and real-world decision-making.

Only 64% of institutions feel equipped to manage financial crime risks — leaving over a third exposed.

Source:

Oliver Wyman & ACAMS (2021)

Where compliance is falling behind

Fragmented frameworks

Many institutions operate across disjointed data systems and siloed teams. This fragmentation prevents timely detection of suspicious activity and reduces the visibility required for effective Anti-Money Laundering (AML) and fraud management.

Manual monitoring

Traditional rules-based approaches still dominate transaction monitoring. But static thresholds and human review cannot keep pace with dynamic, technology-enabled threats that evolve daily.

Reactive approach

Financial crime response often begins only after breaches occur. Instead of predictive analytics, many firms rely on retrospective reviews, delay detection, and increase damage.

Skills gap

AML, sanctions, and cyber risks now intersect, yet most compliance teams lack the hybrid skill sets in data analytics, technology, and ethics needed to handle these complex overlaps.

Money laundering accounts for 2–5% of global GDP — up to US $2 trillion each year.

Source:

UNODC (2024)

Fragmented frameworks

Many institutions operate across disjointed data systems and siloed teams. This fragmentation prevents timely detection of suspicious activity and reduces the visibility required for effective Anti-Money Laundering (AML) and fraud management.

Manual monitoring

Traditional rules-based approaches still dominate transaction monitoring. But static thresholds and human review cannot keep pace with dynamic, technology-enabled threats that evolve daily.

Fragmented frameworks

Many institutions operate across disjointed data systems and siloed teams. This fragmentation prevents timely detection of suspicious activity reducing the visibility required for effective Anti-Money Laundering and fraud management.

Manual monitoring

Traditional rules-based approaches still dominate transaction monitoring. But static thresholds and human review cannot keep pace with dynamic, technology-enabled threats that evolve daily.

Reactive approach

Financial crime response often begins only after breaches occur. Instead of predictive analytics, many firms rely on retrospective reviews, delay detection, and increase damage.

Reactive approach

Financial crime response often begins only after breaches occur. Instead of predictive analytics, many firms rely on retrospective reviews, delay detection, and increase damage.

Skills gap

AML, sanctions, and cyber risks now intersect, yet most compliance teams lack the hybrid skill sets in data analytics, technology, and ethics needed to handle these complex overlaps.

Skills gap

AML, sanctions, and cyber risks now intersect, yet most compliance teams lack the hybrid skill sets in data analytics, technology, and ethics needed to handle these complex overlaps.

Money laundering accounts for 2–5% of global GDP — up to US $2 trillion each year.

Source:

UNODC (2024)

The cost of falling behind

Regulatory risk

Regulators are tightening oversight, with non-compliance penalties at record highs. Even minor lapses can result in multi-million-dollar fines and long-term monitoring requirements.

Regulatory risk

Regulators are tightening oversight, with non-compliance penalties at record highs. Even minor lapses can result in multi-million-dollar fines and long-term monitoring requirements.

Operational strain

Public trust remains one of a firm’s most valuable assets. A single high-profile breach can damage stakeholder confidence and brand equity overnight.

Operational strain

Public trust remains one of a firm’s most valuable assets. A single high-profile breach can damage stakeholder confidence and brand equity overnight.

Reputational loss

Public trust remains one of a firm’s most valuable assets. A single high-profile breach can damage stakeholder confidence and brand equity overnight.

Reputational loss

Public trust remains one of a firm’s most valuable assets. A single high-profile breach can damage stakeholder confidence and brand equity overnight.

Ethical implications

Beyond regulation, financial institutions face a growing moral responsibility to safeguard clients, prevent exploitation, and uphold the integrity of the financial system.

Ethical implications

Beyond regulation, financial institutions face a growing moral responsibility to safeguard clients, prevent exploitation, and uphold the integrity of the financial system.

The cost of falling behind

Regulatory risk

Regulators are tightening oversight, with non-compliance penalties at record highs. Even minor lapses can result in multi-million-dollar fines and long-term monitoring requirements.

Operational strain

Investigations divert valuable time and talent from innovation and growth, creating friction between compliance and business performance.

Reputation loss

Public trust remains one of a firm’s most valuable assets. A single high-profile breach can damage stakeholder confidence and brand equity overnight.

Ethical implications

Beyond regulation, financial institutions face a growing moral responsibility to safeguard clients, prevent exploitation, and uphold the integrity of the financial system.

Compliance costs reached US $85 billion across EMEA, with 98% of firms reporting rising year-on-year spend.

Source:

LexisNexis Risk Solutions, 2024

Source:

LexisNexis Risk Solutions, 2024

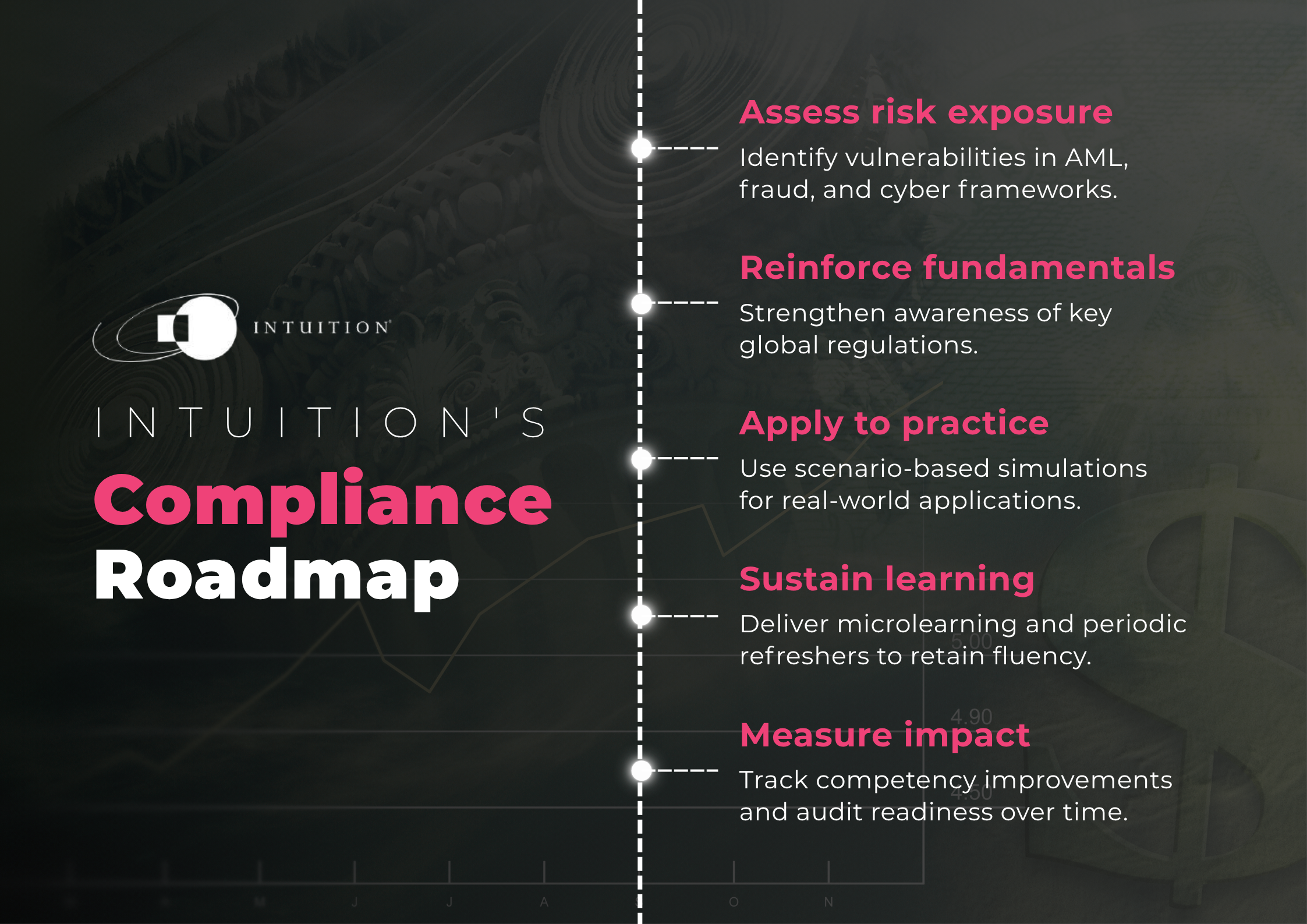

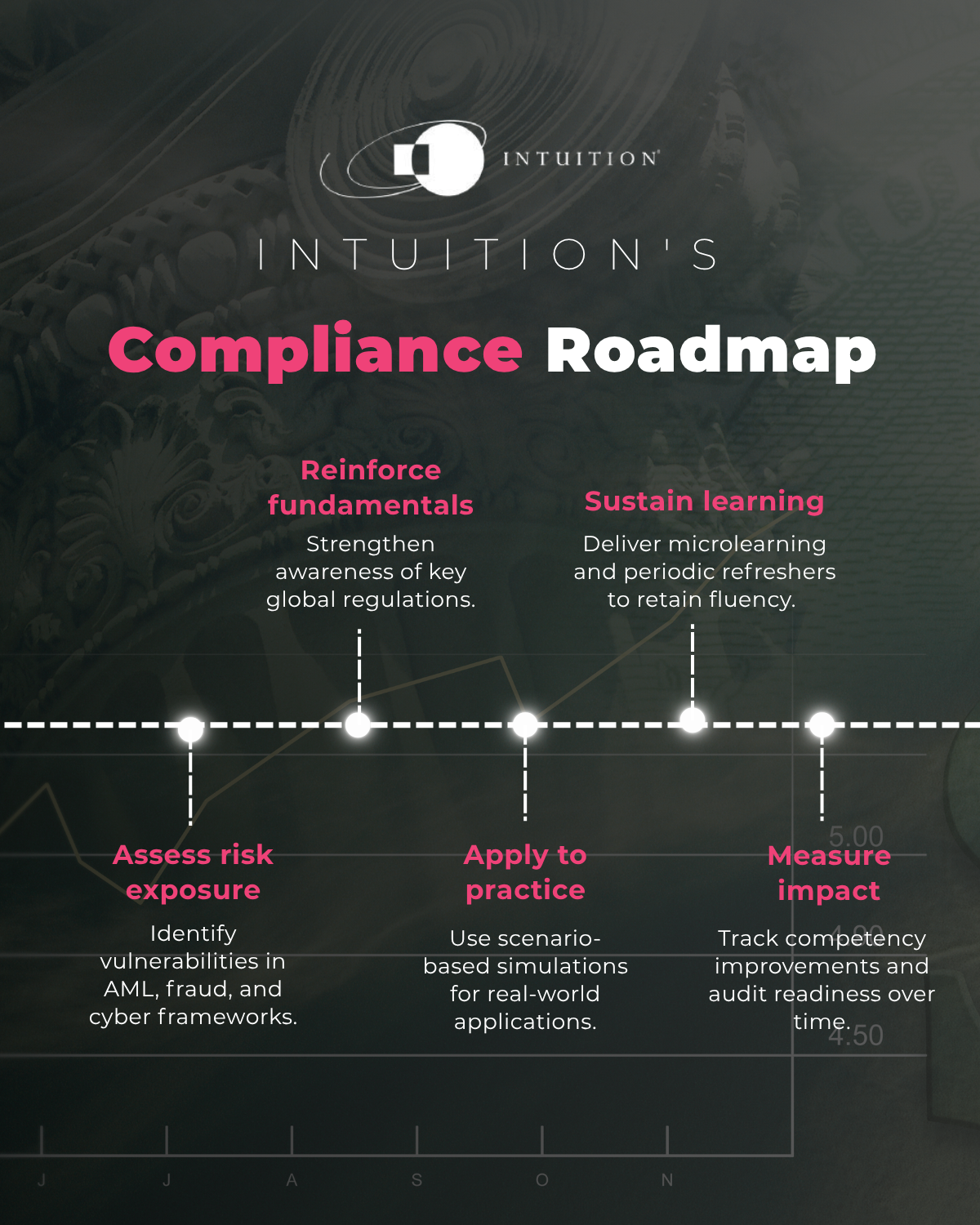

From reactive to resilient: building modern compliance – a roadmap

From reactive to resilient: building modern compliance – a roadmap

Financial institutions need more than stronger policies; they need smarter, more adaptive systems. Intuition Know-How’s Regulation & Compliance channel delivers role-specific, interactive tutorials that help teams anticipate threats and maintain regulatory fluency.

By embedding continuous learning and applied simulation into compliance training, firms can shift from reactive control to proactive prevention.

Financial institutions need more than stronger policies; they need smarter, more adaptive systems. Intuition Know-How’s Regulation & Compliance channel delivers role-specific, interactive tutorials that help teams anticipate threats and maintain regulatory fluency.

By embedding continuous learning and applied simulation into compliance training, firms can shift from reactive control to proactive prevention.

Why Intuition Know-How works

Why Intuition Know-How works?

Smarter learning for smarter compliance

Intuition Know-How bridges the gap between regulatory expectations and operational reality. With expert-written modules across Anti-Money Laundering (AML), fraud, sanctions, cyber, and ethics, it empowers professionals to keep pace with an evolving risk landscape while maintaining audit-ready confidence.

Coverage across AML, fraud, sanctions, cyber,

and ethics

Mobile-ready, SCORM-compliant, CPD/CPE

accredited

Updated quarterly to reflect global regulatory

change.

Accessible through KHX

or your existing LMS

Smarter learning for smarter compliance

Intuition Know-How bridges the gap between regulatory expectations and operational reality. With expert-written modules across Anti-Money Laundering (AML), fraud, sanctions, cyber, and ethics, it empowers professionals to keep pace with an evolving risk landscape while maintaining audit-ready confidence.

Coverage across AML, fraud, sanctions, cyber, and ethics

Mobile-ready, SCORM-compliant, CPD/CPE accredited

Updated quarterly to reflect global regulatory change

Accessible through KHX or your existing LMS

Who is this for?

Who this is for?

Preview of what you’ll learn

Global Financial Regulation

How global policy frameworks and supervisory bodies shape market conduct and oversight.

Basel Framework

Capital, liquidity, leverage, and risk-reporting standards under Basel III — made practical.

Anti-Money Laundering (AML)

Risk-based CDD/KYC, red flags, monitoring, and escalation aligned to global AML standards.

Sanctions & Financial Crime Controls

Screening, ownership/evasion risks, and operating across complex multi-jurisdictional regimes.

Fraud & Cybercrime Risks

Digital and AI-enabled fraud patterns, detection approaches, and response coordination.

Ethics, Conduct & Culture

Judgment, accountability, conflicts, and how culture underpins resilient compliance.

Data Protection & Privacy

GDPR and global privacy principles: lawful processing, data minimization, and controls.

Regional Regulatory Frameworks

Key differences across US, UK, EU, Ireland, Singapore, and other major jurisdictions.

Preview of what you’ll learn

Global Financial Regulation

How global policy frameworks and supervisory bodies shape market conduct and oversight.

Basel Framework

Capital, liquidity, leverage, and risk-reporting standards under Basel III — made practical.

Anti-Money Laundering (AML)

Risk-based CDD/KYC, red flags, monitoring, and escalation aligned to global AML standards.

Sanctions & Financial Crime Controls

Screening, ownership/evasion risks, and operating across complex multi-jurisdictional regimes.

Fraud & Cybercrime Risks

Digital and AI-enabled fraud patterns, detection approaches, and response coordination.

Ethics, Conduct & Culture

Judgment, accountability, conflicts, and how culture underpins resilient compliance.

Data Protection & Privacy

GDPR and global privacy principles: lawful processing, data minimization, and controls.

Regional Regulatory Frameworks

Key differences across US, UK, EU, Ireland, Singapore, and other major jurisdictions.

Turn compliance into a continuous capability

Regulatory awareness alone isn’t enough. Teams need the confidence to identify risks, interpret controls, and act quickly in real situations. The Regulation & Compliance channel reinforces training with practical, scenario-based learning that bridges theory and day-to-day application.

The result: teams build lasting fluency across AML, sanctions, fraud, cyber, ethics, and conduct, not just awareness.

Turn compliance into a continuous capability

Regulatory awareness alone isn’t enough. Teams need the confidence to identify risks, interpret controls, and act quickly in real situations. The Regulation & Compliance channel reinforces training with practical, scenario-based learning that bridges theory and day-to-day application.

The result: teams build lasting fluency across AML, sanctions, fraud, cyber, ethics, and conduct, not just awareness.