Greenwashers Beware – Regulators Focus on ESG Ratings Agencies

Investor appetite for sustainable assets has been growing rapidly. As institutions and organizations have increased their production of climate-friendly instruments and assets that incorporate environmental, social, and governance (ESG) concerns, the market for ESG ratings has exploded. However, in the absence of clear, global guidelines, some investors worry that ESG ratings may not be reliable. Increasingly, fears of greenwashing and a lack of transparency threaten the continued development of the market. In response, global regulators are taking action to ensure the legitimacy of the expanding ESG rating industry.

Interest in sustainable assets that incorporate the consideration of ESG factors is at record highs.

As the effects of climate change become increasingly clear, investors are seeking out green assets in a bid to help finance – and profit from – the transition to a low carbon economy. The global pandemic has further encouraged the flow of funds into ESG assets by highlighting the importance of the social role of business.

According to market data provider Morningstar, global inflows into ESG funds increased by 88% in the fourth quarter of 2020. Europe accounted for the largest proportion of these inflows – approximately 79% of the $152 billion total – followed by the United States at 13%.

Yet even though the market for ESG assets has grown, the global financial sector has yet to develop relevant, reliable, and universal standards for sustainable instruments, including reporting standards for companies and guidelines for investors and ratings agencies. This has kept some investors and institutions on the sidelines – many worry that assets marketed and rated as “green” are in fact only “greenwashed.”

What is greenwashing?

Greenwashing is a process of conveying – generally through marketing or PR spin – a false or misleading impression of a company’s products or services as being green, sustainable, or environmentally friendly.

The goal of greenwashing is to convince consumers (or investors) that a product, service, or instrument will help the environment, thereby making it more attractive to them, while in reality, the underlying has no positive environmental impact or qualities.

Time to act

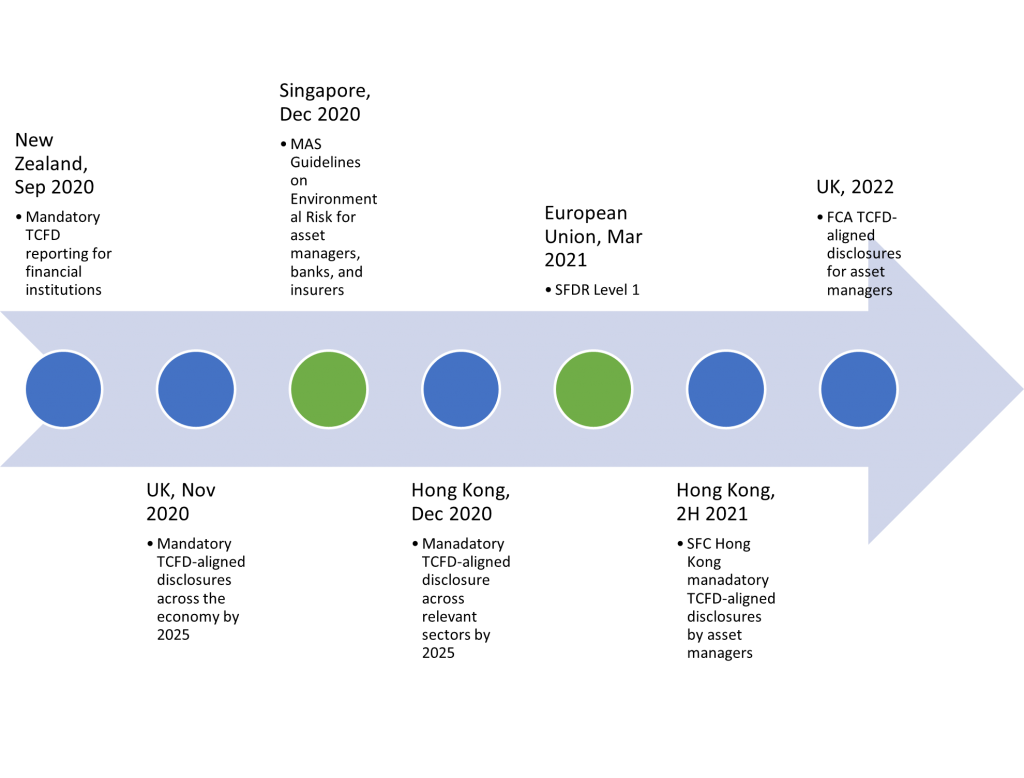

Around the world, regulators are starting to grapple with this problem. Some progress has been made in standardizing reporting rules, for example, with many countries adopting frameworks aligned with the recommendations of the Financial Stability Board’s Task Force on Climate-related Financial Disclosures (TCFD).

IOSCO. Recommendations on Sustainability-Related Practices, Policies, Procedures, and Disclosure in Asset Management. June 2021. Green circles represent policies currently in force

However, the regulation and oversight of ESG raters – which are key players in the sustainable asset ecology – has long been overlooked.

Happily, this is changing. The International Organization of Securities Commissions (IOSCO) announced in late June that it would shortly be publishing regulatory guidance for ESG raters in a bid to address growing concerns about the reliability, relevance, and quality of their ratings. It is hoped that the forthcoming guidelines – which are subject to industry comment and review – will enhance confidence in ESG ratings and, therefore, in the sustainable asset market.

Bigger picture

IOSCO’s announcement comes as it works with the International Financial Reporting Standards (IFRS) Foundation – which helps oversee global financial reporting standards through the independent International Accounting Standards Board (IASB) – to establish a broader set of global rules for reporting on ESG issues.

The IFRS Foundation is in the process of establishing an International Sustainability Standards Board (ISSB) to sit alongside the IASB and oversee global sustainability reporting standards. The Foundation is collaborating with many partners – including IOSCO and the TCFD – to advance global norms for the ESG investment market across several key areas.

These moves highlight the growing importance and increasing formalization of the ESG market. With rising pressure on governments and businesses to act in the face of climate change and inequality, setting global rules is an important step in the process of transforming global finance and the real economy.

Intuition Know-How has a number of tutorials that are relevant to sustainable investing and ESG ratings:

- ESG & SRI – Primer

- ESG & SRI – An Introduction

- ESG & SRI – Investing

- ESG Factors

- SRI Strategies

- ESG & SRI Reporting

- Green Assets

- ESG & SRI Scenario – Retail

- ESG & SRI Scenario – Institutional