Which Companies Will Pass the Coronavirus ESG Test?

As the coronavirus ravages economies worldwide, companies are struggling to pay workers and keep the lights on. Declining economic activity has sent carbon emissions plummeting and unemployment soaring, and many businesses are now reliant on the government for working capital. Against this backdrop, many are questioning companies’ commitment to sustainable environmental, social, and governance (ESG) practices and corporate social responsibility (CSR). As businesses struggle for survival, the coronavirus crisis is presenting an ESG and CSR acid test. Which organizations will pass it?

One of the major themes in investment circles lately has been the rapid growth of sustainable or socially responsible investing (SRI). Increasingly, investors expect companies to engage in positive environmental, social, and governance (ESG) practices and to pursue a corporate social responsibility (CSR) approach in their relationships with stakeholders.

With the rise of climate risk, demands for clear emissions targets, low-carbon business plans, and better collaboration between companies, employees, regulators, and communities have grown stronger and an ever-growing proportion of global assets under management (AUM) have an SRI mandate. Both investors and companies have started to embrace the idea that businesses should be part of the solution to share global problems.

Today, however, the coronavirus crisis presents a unique and unexpected challenge to the rise of SRI and ESG. Both investors and companies are questioning their assumptions about the value of ESG, SRI, and CSR, and asking what good practices look like in our changed environment.

Corporate balancing act

Companies increasingly find themselves balancing the need to pursue sound ESG policies and take a CSR approach against the financial imperatives created by the crisis.

Related tutorial: ESG & SRI Investing

Consider, for example, relations between workers and employers. ESG standards require that firms provide employees with a safe and healthy workplace environment, fair remuneration, and the time they need to balance family and work responsibilities.

The coronavirus crisis has altered the employee/employer relationship almost beyond recognition. On one extreme, employers such as hospitals and grocery stores are struggling to protect workers from exposure to infection while managing surging demand. On the other end, firms shuttered by lockdowns are trying to keep employees on the payroll as revenues collapse.

Some firms are prioritizing their connection to workers. Companies that are able to – prominent among them social media and tech companies like Facebook, Twitter, and Google – have embraced remote working. CEOs at companies such as hotel chain Marriott, carmaker Fiat Chrysler, and airline Qantas have accepted cuts to their base salaries in solidarity with furloughed or laid-off workers.

Other companies, however, are focusing on the bottom line. Firms such as Halliburton, General Motors, and McDonald’s have been criticized for laying off workers while maintaining generous share buyback and dividend programs. Others, such as Amazon, Whole Foods, and Instacart have come under fire for perceived failures in protecting frontline workers from the risk of infection.

As companies walk the line between protecting shareholder interests and responding to the demands of other stakeholders, the future of ESG is unclear.

Shareholders’ response

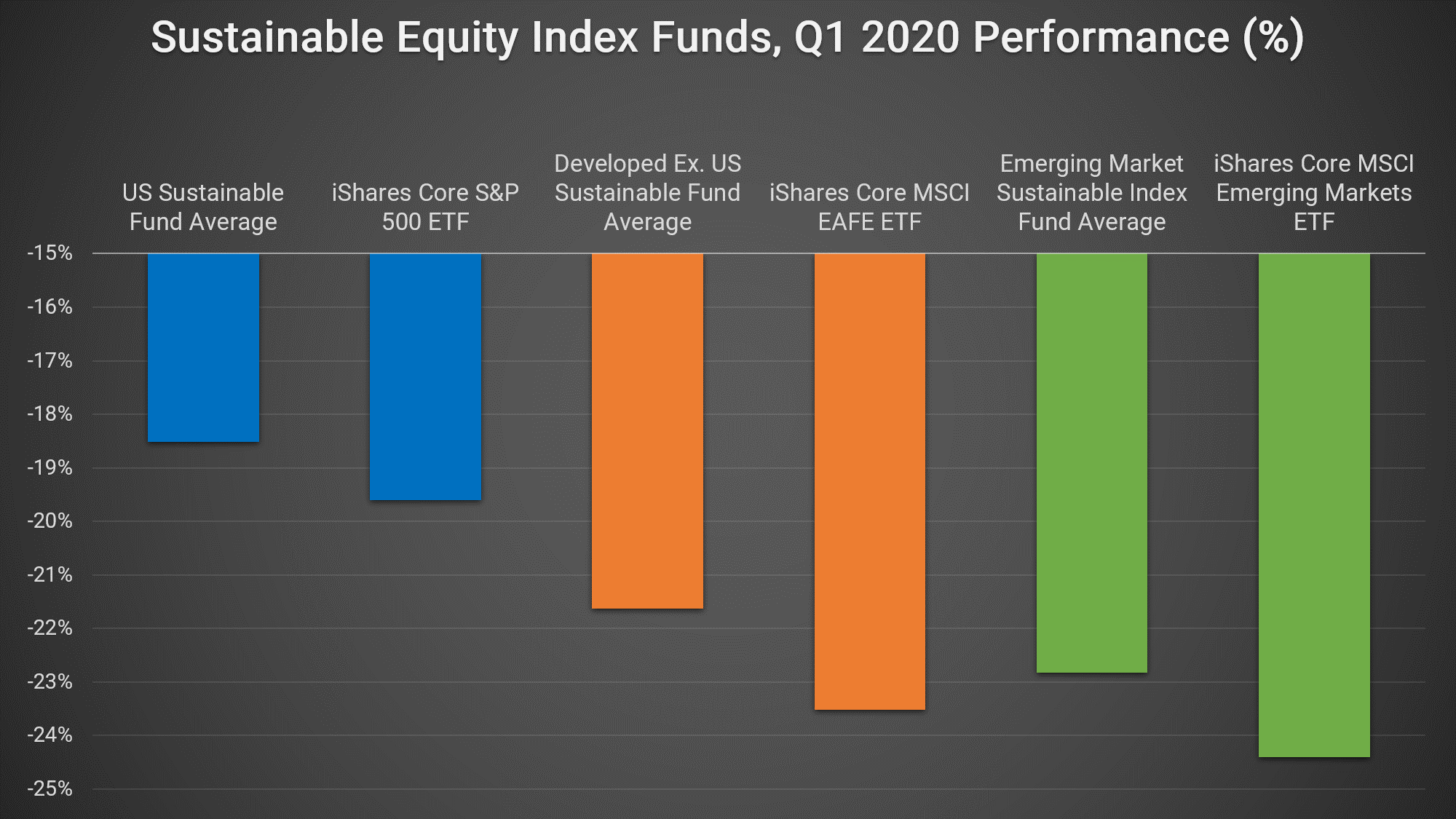

One key determinant of whether corporate commitments to CSR will be upheld is how the markets respond to different strategies. So far, there is some early evidence that investors are rewarding companies that demonstrate sound ESG practices. Morningstar, for example, found that sustainable/ESG index funds outperformed broader indices in the first quarter amidst broader stock market decline.

Morningstar. Sustainable Funds Weather the First Quarter Better Than Conventional Funds. April 2020.

However, it is unclear whether investors will continue to favor ethical businesses in a prolonged downturn. Some argue that the next few months will vindicate SRI investing strategies and that sustainable funds will outperform the broader market, demonstrating their value as lower-risk, return-enhancing assets. Others argue that investors – anxious to maintain returns – will abandon ESG-aligned companies in favor of those doing whatever is necessary to sustain shareholder returns.

Outlook

The outlook for ESG and SRI investing remains uncertain. Already, however, many investors are demanding that firms outline plans to maintain the lower greenhouse gas (GHG) and more family-friendly employment practices that have emerged from the coronavirus crisis. Workers and unions are lobbying to improve sick and family leave policies, and governments are, in some cases, imposing new restrictions on companies that seek state-funded bailouts, such as limitations on share buybacks or layoffs.

At the same time, investors are anxious about future growth and profitability, with some concerned about rebuilding revenues by any means necessary. As lockdowns lift and economies restart, the long-term impacts of coronavirus on ESG and SRI investing and CSR programs will slowly become clear.

Intuition Know-How has a number of tutorials that are relevant to ESG, CSR, and other topics discussed above:

- Corporate Governance

- Corporate Social Responsibility (CSR)

- ESG & SRI Investing

- Investment – An Introduction

- Business of Asset Management

- Risk Management for Asset Managers – An Introduction