Active Investing Remains the Foundation of Fund Management

Rock-bottom fees have propelled the popularity of passive funds over recent years but there are many reasons why active management will always have primacy in the business of fund management.

Active fund management rallied in Europe in January, with mutual fund inflows of some USD 50 billion. This compared with an USD 18 billion net inflow for passively managed funds, according to data from Broadridge.

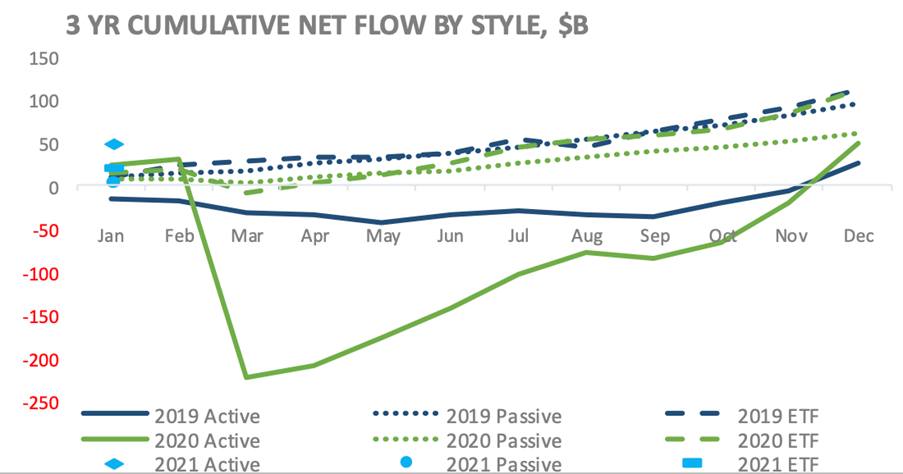

This seems worthy of comment as one of few instances where active funds have been preferred to passive over the past decade. According to Broadridge data, 3-year cumulative net flows for actively managed funds in Europe only entered into positive territory toward the end of last year, lagging well behind passive funds and exchange-traded funds (ETFs) which are overwhelmingly passively managed.

Source: Broadridge

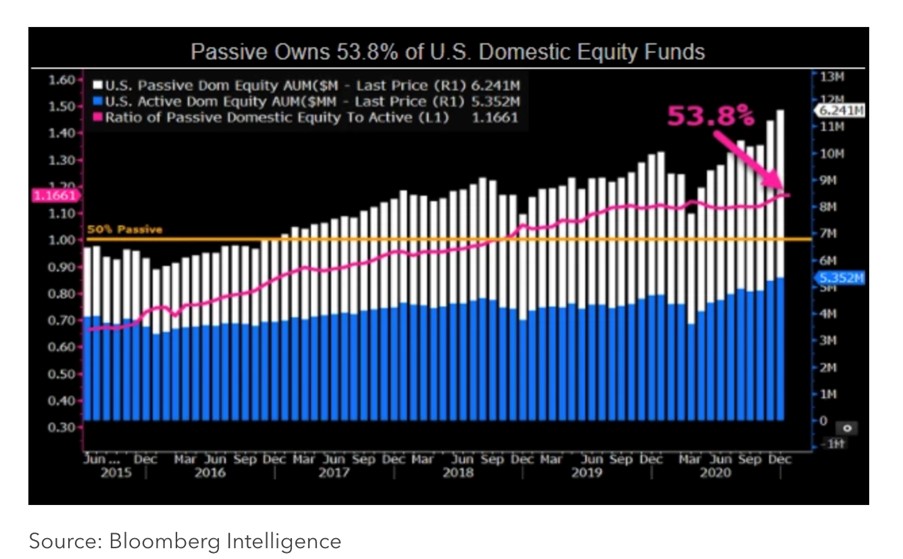

The rise of passive investing at the expense of active has been a major theme in fund management for years. According to Bloomberg, passive investing in the US is set to overtake active within five years due to a widening gap in equities (passive overtook active in 2018) and a growing advantage in fixed income.

Passive investing is a strategy that tracks a market-weighted index or portfolio. This is normally achieved by buying an index fund that seeks to replicate the performance of a specific index.

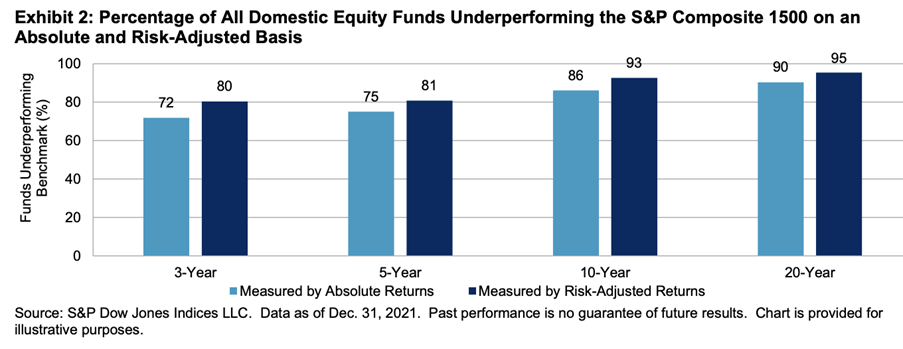

The rise of passive is predicated on the acceptance of a core belief: that it is impossible for investors to outperform the market consistently on a risk-adjusted basis. Ironically, it is impossible for passive asset managers even to match their benchmark because of the drag of fees, but investors increasingly choose passive over active because fee levels are considerably lower.

Active performance lags

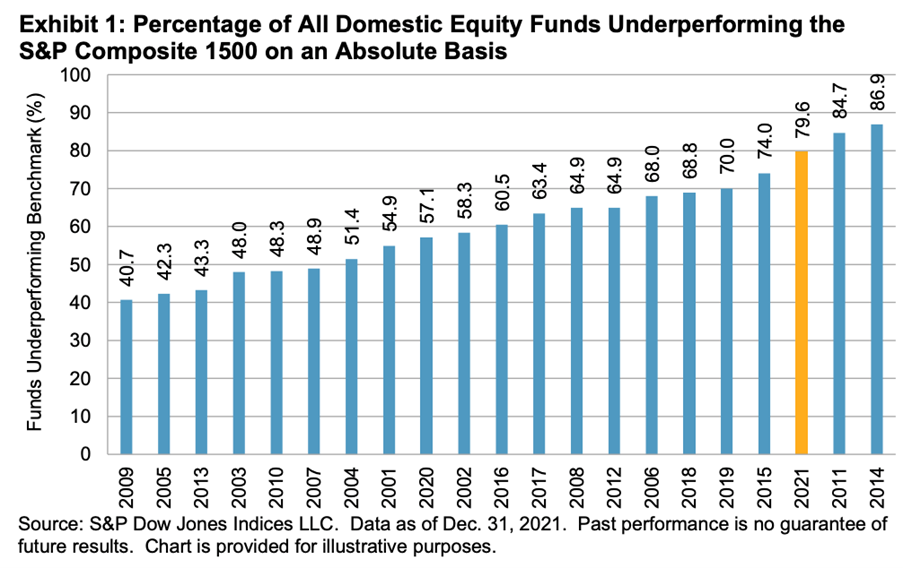

This choice seems to be justified, according to performance data. S&P found that 79.6% of all (active) domestic equity funds underperformed the S&P Composite 1500 on an absolute basis.

On the face of things it would appear that, from an investor viewpoint, pursuit of an active investment strategy is ultimately a futile strategy – but in fact there are a number of major defenses of an active management approach.

Flawed assumptions of passive

Flawed assumptions of passive

First, the rationale for passive investing is based on a fundamental untruth: the assumption that markets are 100% efficient and that participants act rationally and have access to all relevant information all of the time. This cannot possibly be true, and so there is always ample room for stock-pickers to identify mispriced securities that are the result of emotional biases and bad or incorrectly interpreted information.

Passive investing based on index funds also needs a minimum level of volume, liquidity, and low trading costs to function effectively: this rules out their participation in the niche and less efficient markets where information is harder to find and where research and active investing skills can profit.

Above all of these investor considerations is the fact that the inexorable rise of passive investing is ultimately unsustainable. Passive investing distorts markets through inefficient resource allocation – directing capital toward the largest companies rather than those capable of generating the highest returns. Similarly, because stocks whose share prices have risen are given greater representation in a capital-weighted benchmark, the approach is based on past successes rather than future prospects.

Your Content Goes Here

Conflict with ESG

This often conflicts with ESG principles, particularly in emerging markets where the largest businesses may be environmentally suspect. Likewise, there is the issue of effective stewardship: passive investors are less likely than active to engage with company management in areas such as strategy, management, and ESG.

The inevitable flow of passive funds to large companies also has implications for risk. This is because it can lead to overvaluation of large companies and undervaluation of small, thereby creating the conditions for valuation bubbles. Actively managed funds have far more flexibility and agility in these situations. Active managers are also able to incorporate high conviction and a long-term perspective into their strategy, freed as they are from the constraints of having to replicate a benchmark.

Passive investment will always underperform the index because, once fees are taken into account it is designed to do just that. While active investing inevitably underperforms net of fees on a global basis, it leaves open the possibility of individual outperformance.

And while the further advance of passive at the expense of active seems likely, it is worth remembering that as more and more assets flow into passive vehicles, so the active opportunity increases.

So, ultimately, active investing remains the foundation of asset management: without active management, passive investing strategies cannot exist.

Intuition Know-How has a number of tutorials relevant to the content of this article:

- Equity Markets – An Introduction

- Equity Trading – An Introduction

- Equity Indices

- Equity Trading Strategies

- Investment – An Introduction

- Efficient Markets

- Portfolio Management – Passive vs. Active Approaches

- Portfolio Performance – Measures