Banking In A Post-Pandemic World – What To Expect

Banks had an unprecedented year in 2020. In a matter of months, they transformed into almost fully digital operations with remote workers delivering services from their homes. To support them, regulators eased capital requirements and provided liquidity, and banks were able to play a key role in stabilizing economies by offering lending and transmitting government stimulus. But many institutions have entered 2021 in a fragile state. Low interest rates and elevated economic uncertainty are weighing on many banks, and rapid transformation has stretched their leaders and employees. What does the future of banking look like in the post-pandemic world?

As the pandemic passes its one-year anniversary, banks worldwide are poised on a knife-edge. On the one hand, they have a once-in-a-generation opportunity to reinvent their business models for the 21st century. On the other hand, they face potentially catastrophic macroeconomic challenges ranging from slow recoveries to low rates to unanticipated inflation. As they try to build business models that work in this new environment, they must grapple with a host of new risks – and new opportunities.

A tough year for banking

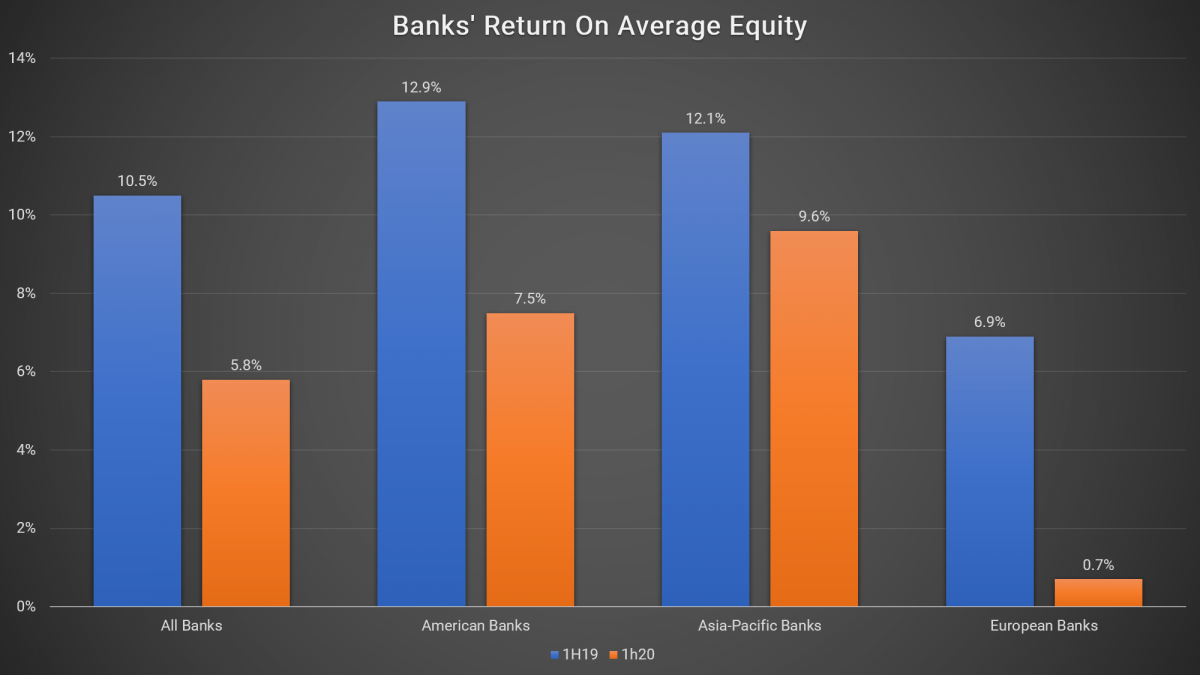

As it was for many industries, 2020 was a difficult year for banks. As countries around the world implemented lockdowns and tough economic restrictions in a bid to slow the spread of the coronavirus, banks had to upend their business models almost overnight. Interest rates plunged from their already low levels, loan demand dried up, busy workplaces were shuttered in the first half of the year, and bank profitability nosedived. This was particularly true at commercial and retail banks – investment banks and universal banks were somewhat insulated thanks to rebounding trading profits.

EY. Can Banks Turn Today’s Disruption into Tomorrow’s Transformation? November 2020.

Happily, however, financial institutions showed enormous resilience and adaptability – and governments were quick to roll out key supports. Seizing the opportunities offered by technology, financial institutions switched rapidly to digital-first models. Customers quickly learned to do their banking online, using increasingly sophisticated apps and digital portals. Managers and IT departments rapidly adapted to managing remote workers and services transitioned almost seamlessly to remote provision.

At the same time, central banks – particularly in the rich world – eased liquidity and capital requirements and pumped out funding, helping banks avoid downgrades. Thus, while profitability slumped, most banks seemed to enter 2021 in reasonably good shape. Bank failures last year were rare despite the adverse conditions, and banks were able to play a key role in transmitting government stimulus and supporting clients. Yet their apparent health is deceptive – it rests on a fragile foundation and there are many potential headwinds ahead.

Downside risks abound

Despite their apparent health, banks face a frightening array of downside risks.

Slow Recovery

One key risk facing banks is that economies will fail to rebound in 2021. In general, the outlook for GDP growth is positive. The IMF in January predicted that all major economies would return to growth in 2021.

IMF. World Economic Outlook Update, January 2021: Policy Support and Vaccines Expected to Lift Activity. January 2021.

However, this is not guaranteed. Already, the slow vaccine rollout in Europe poses a risk to its economic recovery, and uncertainty in bond markets threatens many emerging markets. More generally, there is a real risk that new variants of the coronavirus may undermine the impact of vaccination and derail the reopening of the world’s economies.

Should growth fail to rebound as anticipated, banks could face an avalanche of nonperforming loans, which would crush their balance sheets and could lead to downgrades or even bank failures – although regulators are unlikely to allow it to come to that, at least in developed economies.

Interest rates & inflation

Banks face a two-sided risk when it comes to interest rates and inflation. If low rates and low inflation persist, bank profitability will continue to be squeezed. This is a particular concern in Europe and Japan, where negative interest rates have become embedded.

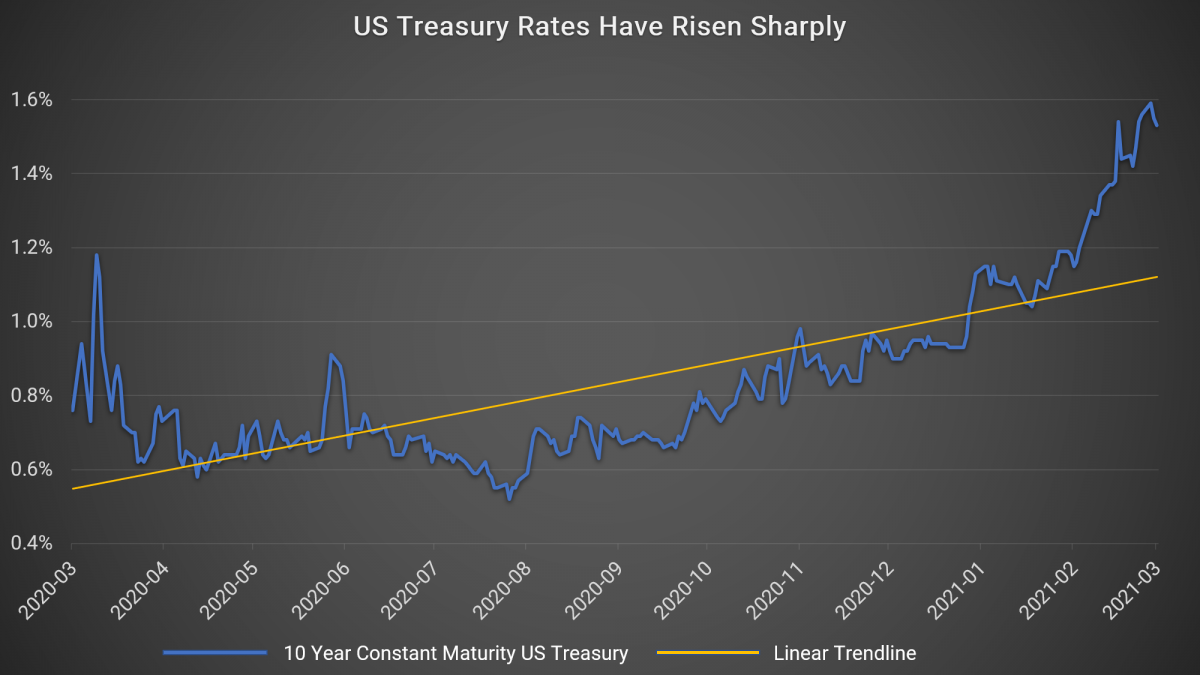

On the other hand, should inflation rise, forcing interest rates higher, banks could also suffer. Higher rates and rising inflation could push more companies into bankruptcy, driving up nonperforming loans. Of particular concern are rising US interest rates. Since their mid-year 2020 low, the interest rates on US Treasuries have risen sharply as the US economy has shown a strong recovery thanks to record fiscal and monetary stimulus. This has put downward pressure on global bond prices (rising bond yields indicate falling prices), which is bad news for economies still stuck in recessions such as those in Europe – they can ill afford rising interest rates.

Board of Governors of the Federal Reserve System, 10-Year Treasury Constant Maturity Rate, March 2021.

If rates rise too fast in economies that are still struggling to recover, insolvencies and bankruptcies will rise and lending will suffer, spelling bad news for banks.

Asset price uncertainty

As the example of bond prices above illustrates, there is significant uncertainty in asset prices as the world waits to see whether the coronavirus has been defeated. Of particular concern are loans and real estate – two sectors to which banks are highly exposed. On the loan front, there is growing concern that corporates – particularly in the US – are carrying too much debt. This is particularly true as many government business support programs have taken the form of loans, meaning that many corporates are unusually highly leveraged. Should interest rates rise, many of these corporate loans could default,straining bank balance sheets.

Similarly, both residential and commercial real estate markets are in flux. The rapid growth of online retail and remote working has led to a major reshuffling in many cities. Many white-collar workers, believing that remote working will remain a long-term option, have opted to move out of cities into more comfortable suburban homes. At the same time, commercial office space and retail properties have lost value as demand has fallen on the back of changing shopping and working habits. There are also likely to be other, broader changes to industries and behaviors. It’s too soon to tell if these patterns will persist, but if they do, banks could face a painful adjustment to their mortgage books and – in some cases – real estate portfolios.

Seizing opportunities

Despite these serious risks, banks are also poised on the brink of major opportunities. The best-run and most innovative institutions are likely to emerge from 2021 in a stronger position than those that fail to adapt.

Cost management

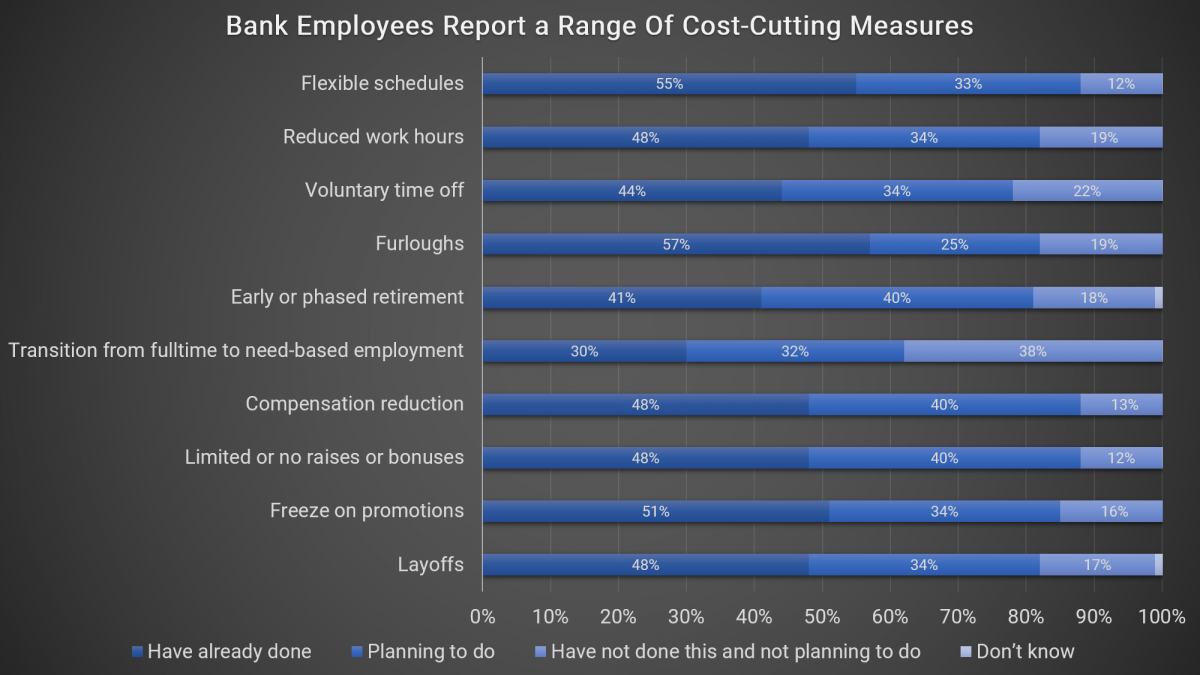

The great reshuffling in banking has opened up new opportunities for aggressive cost management. Banks have learned that many roles can be safely performed by remote workers and that many clients are content to conduct their business online.This has accelerated branch closures and layoffs of frontline staff, helping banks trim costs as profits have declined.

Deloitte. 2021 Banking and Capital Markets Outlook. November 2020.

As banks have embraced new models, they have also explored a range of new cost-cutting measures, experimenting to right-size their operations to function effectively in the changed environment. The switch to digital banking has also encouraged banks to experiment more aggressively with cost-saving automation technology and artificial intelligence. From chatbots to digital advisors, banks are finding many new solutions to cut costs and increase efficiency.

Consolidation

The widespread uncertainty and variable performance of different banks opens up the possibility of further banking consolidation. Particularly in over-banked markets like Europe, there is great scope for stronger institutions to acquire weaker competitors and for struggling banks to join forces in 2021. A period of consolidation could help spread best practices, increase returns on equity, cut banking costs, and improve capitalization.

Innovation & Technology

Technology offers banks opportunities that go far beyond lower costs. Customers have demonstrated high levels of comfort with digital solutions and have embraced digital payments as never before. The move toward cashless societies has accelerated and a growing array of providers are offering payment solutions that are fast, cheap, and accessible. This may mean that banks accelerate their integration of technological tools and perhaps pursue acquisitions of startups in the financial technology (FinTech) space.

Banks must adapt to this new reality, not only by closing branches but also by embracing new service models such as cashless branches focused on advice, improving apps and online portals, increasing the use of straight-through processing, and offering greater service personalization powered by AI systems.

Banks that take the opportunity to retool by hiring programmers and technologists and developing improved products and channels will be rewarded with greater market share, increased customer satisfaction, and higher share-of-wallet. This will drive improved profitability and give the best banks a strong foundation for the future.

Intuition Know-How has a number of tutorials that are relevant to banking and the topics covered in this article:

- Banking – Primer

- Business of Investment Banking

- Business of Corporate Banking

- Problem Credit Management – An Introduction

- Problem Credit Management – Early-Stage Problem Credits

- Problem Credit Management – Late-Stage Problem Credits

- Business of Consumer (Retail) Banking

- Digital Banking

- Payments – An Introduction

- Digital Money & Mobile Payments

- Consumer Banking – Omnichannel Delivery