Banks Slow to Act on Climate and Environmental Disclosures

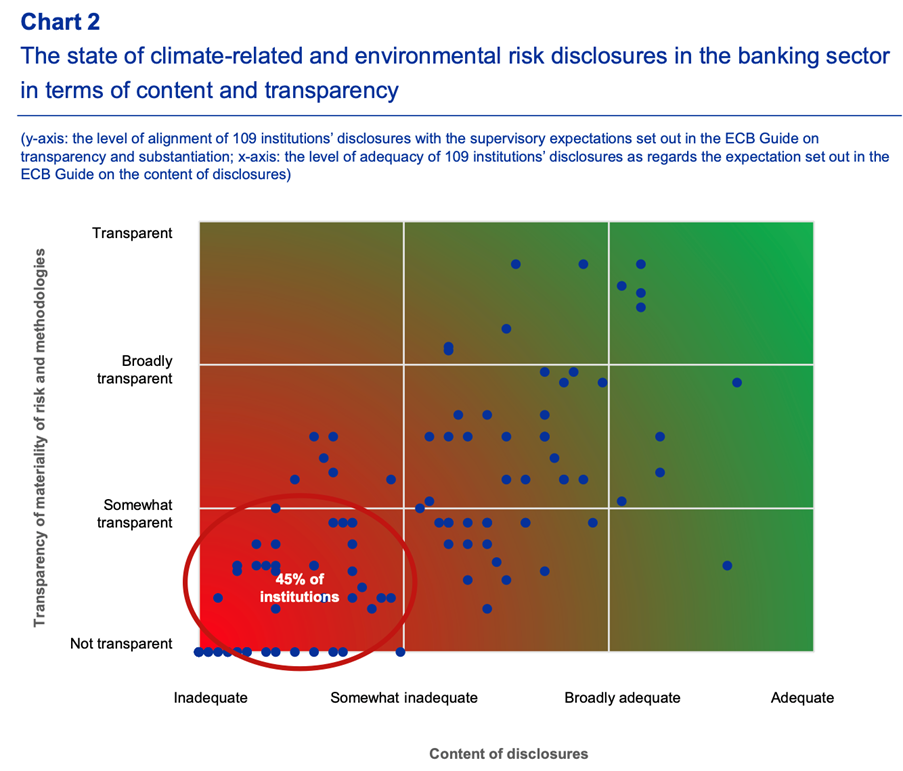

As momentum builds internationally for meaningful climate-related and environmental disclosures, an ECB report finds that European banks have made slow progress. Additionally, where disclosure is made, there is a marked lack of substantiation behind the figures.

Europe’s banks have made little progress on climate-related and environmental (C&E) disclosures since the European Central Bank (ECB) published its first stocktake of banks’ C&E disclosures back in November 2020. That is the message from the publication in March of the Bank’s latest report on the progress – or lack of it – made by the 112 European banks under the ECB’s direct supervision with €24 trillion in combined assets.

The first stocktake coincided with the publication of the ECB Guide on climate-related and environmental risks, a milestone document that set out supervisory expectations relating to C&E risk management and disclosures. At that point, the ECB notes, virtually none of the banks under its supervision met expectations: they were invited to assess themselves against Guide expectations and to submit action plans detailing how they would bring their practices into line.

The findings for 2021 show that improvement in the quality of banks’ disclosures has been slight. Seven in ten banks disclosed information about C&E risk management and governance (compared to five in ten in 2020). Only four in ten shared relevant information about the incorporation of C&E risks into their strategic considerations (up from three in ten in 2020). None of the banks fully met the ECB’s supervisory expectations for disclosures.

Momentum builds for C&E disclosures

Banks are not alone in being exposed to increasing regulatory pressure to disclose C&E risks. Worldwide, there is a broad push from regulators towards such disclosures for banks, corporate companies, and even for financial products.

The EU’s scrutiny of European banks’ efforts to meet their C&E requirements takes place against a background of multiple initiatives relating to C&E disclosures.

As far back as 2017, the Financial Stability Board (FSB) published the Final Report of the Task Force on Climate-related Financial Disclosures (TCFD). This Report issued recommendations for helping businesses disclose climate-related financial information that apply across all sectors. The guidance has become something of a benchmark for financially material climate-related information and a number of financial institutions already publish specific “TCFD reports”. The TCFD regularly publishes status updates and focus reports, for instance on metrics and targets.

One final noteworthy development was the adoption in April 2021 by the European Commission for a proposal for a Corporate Sustainability Reporting Directive (CSRD), designed to ensure that companies report the relevant, comparable and reliable sustainability information needed by investors and other stakeholders. The CSRD is expected to come into effect for reporting periods starting on or after January 1, 2023.

In November 2021, the International Financial Reporting Standards (IFRS) Foundation Trustees announced the creation of a new standard-setting board – the International Sustainability Standards Board (ISSB). The ISSB is to deliver a global baseline of sustainability-related disclosure standards that provide investors and other capital market participants with information on companies’ sustainability-related risks and opportunities.

In Singapore, one of the main financial centres of the world, both the Singapore Exchange and the financial regulator MAS in the last two years announced mandatory C&E disclosures for corporates and financial institutions. From 2023, climate reporting will be made mandatory for businesses listed in Singapore that are active in the financial, energy, agriculture, food, and forest products sectors. Reporting will be made mandatory for businesses in the materials and buildings and transportation sectors from 2024.

Just last month, the Taskforce on Nature-Related Financial Disclosures (TNFD) released its beta framework for organizations to report and act on evolving nature-related risks, incorporating nature-related risk and opportunity analysis into the heart of corporate and financial decision making.

In the latest initiative, also last month on the 21st of March, the US Securities and Exchange Commission (SEC) is proposing that public companies be required to disclose in their annual reports their direct greenhouse gas emissions and these disclosures would need to be verified by a third party. SEC-registered firms would also need to disclose plans to reduce emissions.

Delivering on regulatory expectations?

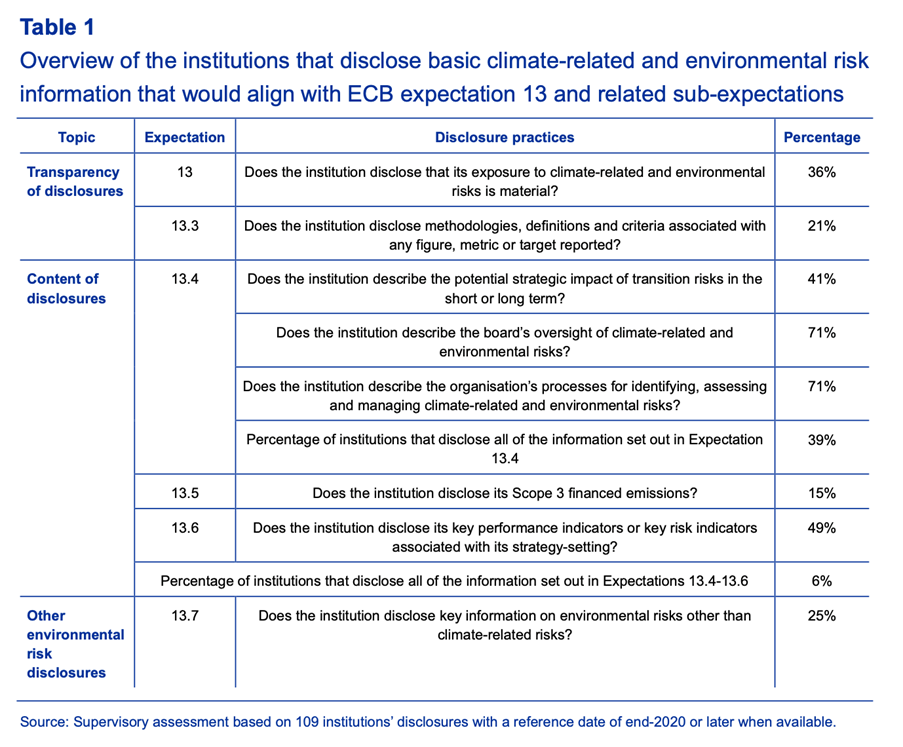

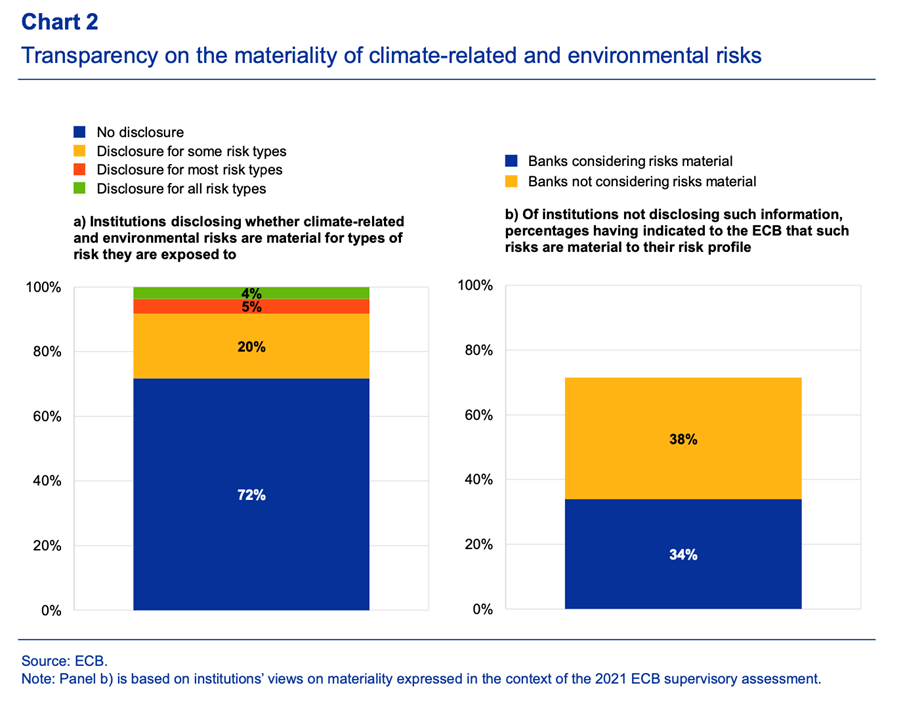

The key Expectation 13 in the ECB Guide states that institutions are expected to disclose “meaningful information and key metrics on climate-related and environmental risks that they deem to be material.” While there is no common threshold for materiality, the ECB prescribes that institutions conduct an assessment tailored to their business model and risk profile over short and longer time horizons. Conclusions on the materiality of information should be “based on concrete quantitative and qualitative thresholds.”

The 2021 stocktake found that roughly three-quarters of the institutions do not disclose whether climate related

and environmental risks have a material impact on their risk profile.

This, according to the ECB, indicates a lack of awareness of the potential impact of the risks on their balance sheets or, as is the case with half of these institutions, they are aware of the impact but choose not to transparently disclose it.

Lack of validation

Critically, there was low levels of substantiation of such disclosures as were made and considered material. Expectation 13.3 states that when institutions disclose figures, metrics, and targets as material, they are expected to disclose or reference the methodologies, definitions, and criteria associated with them.

The report noted that substantiation is particularly relevant when institutions commit to contributing to climate-related and environmental goals, for example by committing to align with the objectives of the Paris Agreement. Users of institutions’ disclosures not only will focus on various metrics and targets but “will increasingly seek information on the methodologies, definitions, and criteria relating to these commitments.”

Following the report publication, a keynote speech by Frank Elderson, Member of the Executive Board of the ECB and Vice-Chair of the Supervisory Board of the ECB, asserted that there was “very little justification” for this lack of substantial progress, especially given “the vast amount and quality of climate related data, tools and information shared by different international and European organizations and institutions in recent years.”

“The sheer speed at which regulation and metrics are developing in this field should leave no room for any doubt: addressing climate-related and environmental risks, and publishing good-quality disclosures, is not optional. Banks can and must do much better to improve the quality of their disclosures, and they need to do it quickly.”

~ Frank Elderson, Member of the Executive Board of the ECB and Vice-Chair of the Supervisory Board of the ECB

There is a “considerable disconnect” between banks’ perception of the importance of C&E risks, as communicated to the supervisor, and what banks choose to publicly disclose.

“Banks are trying to compensate for the poor quality of their disclosures by issuing a great volume of information around green topics,” said Elderson. “We end up with a lot of white noise and no real substance on what both markets and supervisors really want to know: how exposed is a bank to C&E risks and what is it doing to manage that exposure?”

In the light of these findings, and the need for institutions “to make significant efforts to transparently disclose their exposures to climate-related and environmental risks and further improve their disclosure practices,” the ECB has sent individual feedback letters to the banks under its supervision setting out key gaps in their disclosures. It expects them “to take decisive action to ensure they convey their risk profile comprehensively” so as to “accelerate institutions’ preparedness for meeting impending technical requirements.”

Intuition Know-How has a number of tutorials relevant to the content of this article:

- ESG – Primer

- ESG – An Introduction

- ESG Factors

- ESG Reporting

- Climate Risk – An Introduction

- Climate Risk Measurement – An Introduction

- Climate Risk Measurement – Approaches

- Climate Risk – Banking & Decarbonization