European Funds Warn of Greenwashing Epidemic Amid Confusion Over Sustainability Disclosure Rules

As European asset managers scramble to implement the Sustainable Finance Disclosure Regulation (SFDR), they are warning of a significant risk of greenwashing. With little clarity on what makes a fund “sustainable,” it is possible that asset managers may mislabel instruments, leading to investor confusion and errors. The muddle over the new rules highlights a key issue that has long bedeviled the ESG industry: A lack of universal definitions and terminology. It’s a problem that has the power to undermine good faith efforts to make investing more sustainable and destroy investor confidence in the industry, and solving it will not be easy.

Most asset managers agree that the goals of the SFDR are both laudable and important. As world leaders gathered at the COP26 summit in Scotland, investors worldwide were giving serious thought to the role their investment money can play in building a more sustainable economy and staving off the ravages of climate change. Better disclosure on sustainability matters should help these investors make wiser choices and drive faster systemic change.

However, while financial professionals support the objectives of the SFDR, they are increasingly worried about its implementation.

Related article: What is the SFDR? Sustainable Finance Disclosure Regulation

With no guidance, errors are inevitable

Among the requirements of the SFDR is that all investment funds must explicitly disclose their sustainability status to investors. The idea is that this will empower those investors to choose funds that align with their personal sustainability goals.

But fund managers are finding it almost impossible to label their funds accurately because the rules for doing so are unclear and unfinished. Even though the deadline for disclosing funds’ sustainability status is January 1, 2022, the guidelines for evaluating funds have not yet been finalized. The Regulatory Technical Standards (RTS), which are supposed to help fund managers interpret the green taxonomy that underpins all of Europe’s new sustainable finance rules and apply it to fund classification, have been delayed as lawmakers struggle with the complexity of their task.

This has left fund managers unable to accurately label their funds. What’s more, according to the European Fund and Asset Management Association (EFAMA), this is creating a troubling risk: Asset managers may mislabel their funds as Article 8 or 9 (the highest category of sustainability), thereby either inadvertently or intentionally greenwashing their products based on the incomplete rules. This could mislead investors and undermine trust in the classifications and the asset management industry

A complex problem

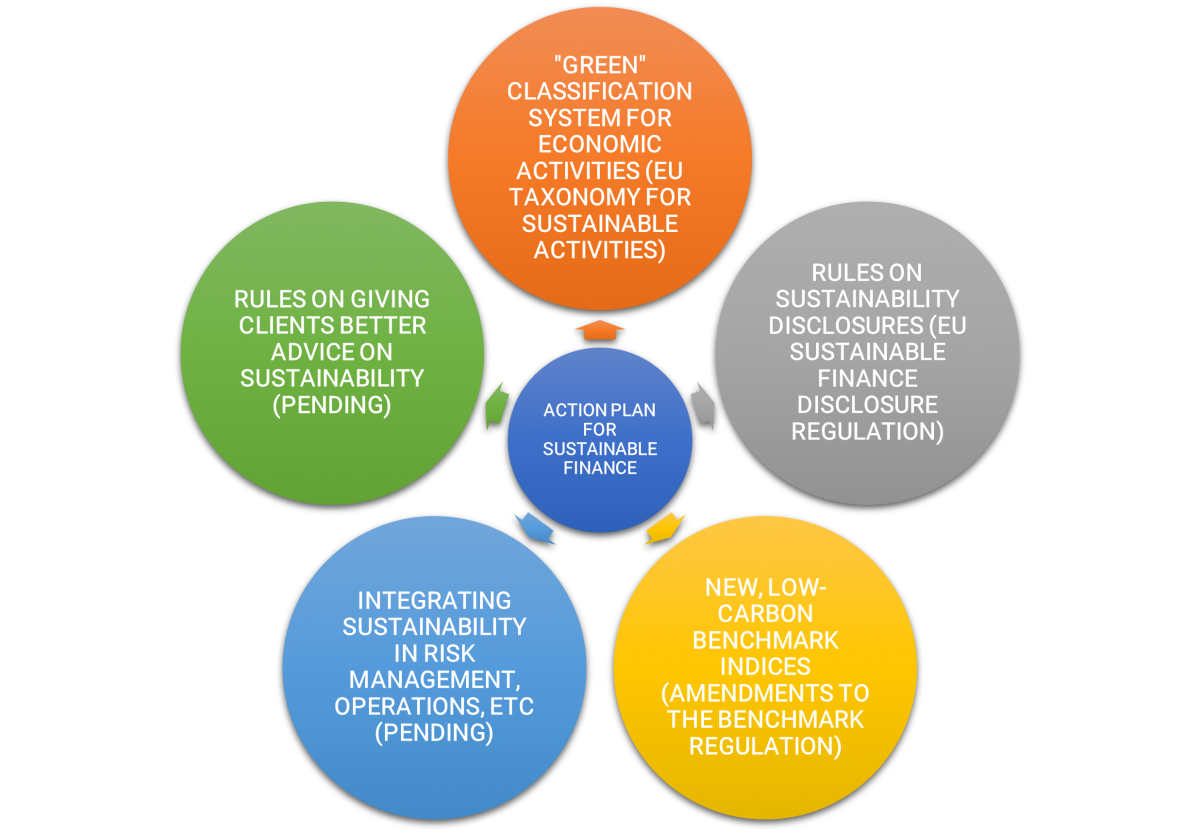

The SFDR is part of the EU’s broader action plan for sustainable finance, which consists of a series of legislative actions designed to boost the proportion of funding directed at sustainable activities (see graphic). The foundation of the plan is the EU Taxonomy for Sustainable Activities, which defines a wide range of activities that can be considered truly sustainable. The SFDR is meant to use the taxonomy as the basis for its classification of funds.

Irish Funds. European Union Action Plan on Sustainable Finance: Disclosures Regulation. November 2019.

This approach is intended to overcome one of the biggest issues facing the transition to sustainable finance: Identifying what funds or activities or companies truly count as sustainable.

Related article: Sustainable Finance: How is the Regulation Progressing?

It’s a complex problem that has long dogged would-be ESG investors. A company may, for example, be an industry leader in workers’ rights and governance, but may engage in activities like fossil fuel burning. Alternatively, a company may be developing green technologies but have a reputation for human rights violations and financial chicanery. Should these companies be part of a sustainable portfolio or not?

The taxonomy is designed to answer questions like those by assigning activities scores and creating thresholds for what should be considered “sustainable.” However, the delays in creating the RTS highlight the complexity and difficulty of the task.

As fund managers await greater clarity, ESG investors around the world should take note of these unfolding events. If the EU succeeds in building a workable framework for defining, categorizing, and measuring sustainability, it will represent an enormous step forward for sustainable finance.

Intuition Know-How has a number of tutorials that are relevant to ESG-related investing and sustainable finance:

- ESG – An Introduction

- ESG Factors

- ESG Investing – An Introduction

- ESG Investing – Strategies

- Impact Investing

- ESG Reporting

- Sustainable Finance – An Introduction

- Sustainable Finance – Principles & Frameworks

- Sustainable Development Goals (SDGs) – An Introduction

- Sustainable Finance Disclosure Regulation (SFDR)