ESG backlash gathers pace

The recent statement by the CEO of one of the world’s largest asset managers that henceforth he would stop using the ‘weaponized’ term ‘ESG’ is clearly a consequence of a backlash against ESG investing that has been building for years.

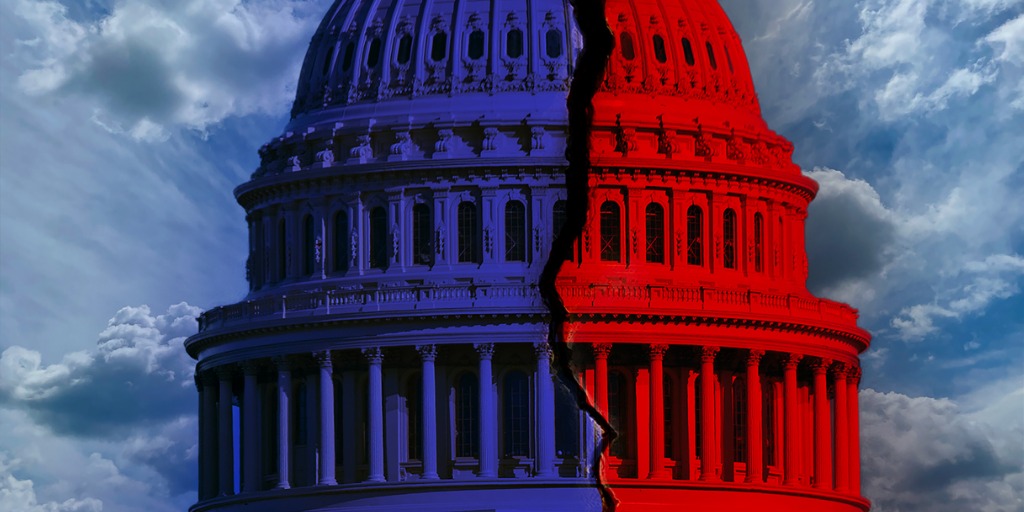

The issue of environmental, social, and governance (ESG) factors may or may not be weaponized, but it has certainly been highly politicized, notably in the United States where Republican politicians tend to view ESG as a cover for promotion of an economically liberal agenda, while Democrats look to defend the sustainable investing movement. The outcome of ESG being dragged into the ‘culture war’ has seen “Red” states propose and enact “anti-boycott” bills that prohibit state business with firms (asset managers) that divest from specified industries (industries likely to transgress against ESG such as fossil fuels). “Blue” states, meanwhile, are of a mind to mandate divestments from such industries.

Anti-ESG lobby focuses on investment returns

Leaving aside political or ‘culture’ considerations, a core aspect of the ‘anti-ESG’ backlash has focused on the implications of ESG for investor returns. Anti-ESG proponents point to the limiting nature of ESG investing, with its tendency to exclude companies from its investment universe that offend ESG principles – an approach they contend has negative implications for returns (indeed, Morningstar has identified some 27 ‘anti-ESG’ funds which “take the opposite tack” to sustainable investing). This notion was boosted significantly by the Ukraine war that saw sectors such as defense and energy enjoy spectacular profits with investment returns that would have been entirely missed by ESG-observant investment vehicles.

[Green bonds explained and the different types of green asset]

ESG supporters highlight risks

Supporters of ESG, on the other hand, contend that ESG integration in investment decisions is the only option to fulfil their fiduciary duty and to ensure long-term, sustainable value creation. They point to the numerous risks attendant in ignoring ESG factors.

Environmental risk posed by exposure to issuers that may potentially be causing, or affected by, environmental degradation and/or depletion of natural resources.

Climate transition risk arising from exposure to issuers that may potentially be negatively affected by the transition to a low-carbon economy due to their involvement in exploration, production, processing, trading, and sale of fossil fuels.

Climate physical risk from the exposure to issuers that may potentially be negatively affected by the physical impacts of climate change.

Social risk from association with issuers that may potentially be negatively affected by social factors such as poor labor standards, human rights violations, damages to public health, data privacy breaches, or increased inequalities.

Governance risk arising from investments that may be negatively affected by weak governance structures.

[Biodiversity explained: What is its impact on the finance industry?]

Sustainable funds growth slows

The evidence of (and effect of) anti-ESG sentiment can be seen in the stark difference in ESG fund volume and flows between the US and Europe.

Morningstar’s Global Sustainable Fund Flows report for Q1 2023 showed that global sustainable funds attracted USD 29 billion of net new money in the first quarter of 2023. This figure was down from nearly USD 38 billion in the previous quarter on account of macroeconomic pressures, including rising interest rates, inflation, and a looming recession that continued to weigh on investor sentiment. Morningstar noted that ESG product development “cooled down” and that “Europe saw a significant reduction of new sustainable fund launches, amid regulatory uncertainty and fears of greenwashing accusations.”

Meanwhile, sustainable funds in the United States experienced their third quarter of outflows in a year. Nonetheless, despite lower inflows (but helped by higher valuations) global sustainable fund assets continued their recovery to reach USD 2.74 trillion at the end of March. Notably, however, some 84% of that total was attributable to European-domiciled funds and their US equivalents accounted for just 11%.

ESG supporters promote active engagement

The geographical and ideological divide on the subject of ESG is becoming stark. But sustainable investing practice need not mean exclusion of ’problematic‘ companies. Most asset managers that expound ESG principles prefer an active engagement approach with such companies. This involves dialogue with company management in support of the pursuit of sustainable business practices that the asset manager believes more likely to generate long-term value. This approach will normally be coordinated with voting practices consistent with the same end.

The argument is that excluding “bad” players does not deliver financial, environmental, or social return. In fact, in the words of one asset manager, “Selling a polluter with transition potential to another buyer does not reduce emissions released into the environment. It’s like throwing your garbage onto the neighbor’s lawn. There will always be speculators willing to take on additional risk for greater potential return in the short term. This is why numerous studies have shown that engagement is more effective than exclusion at changing corporate behavior.”

Ironically, given the severe divide between pro- and anti-ESG investment camps, neither party would necessarily disagree with this statement in principle; nonetheless, that should not be to disguise the profound implications of the ESG backlash both for investment funds flows and asset management industry politics.

Intuition Know-How has a number of tutorials relevant to the content of this article:

- ESG – Primer

- ESG – An Introduction

- ESG Factors

- Climate Risk – An Introduction

- Sustainable & Responsible Investing – An Introduction

- Sustainable & Responsible Investing – Strategies

- Impact Investing

- ESG Reporting