Greenflation: Why the Energy Transition is Sending Commodity Prices Soaring

As the world embraces commodity-hungry green technologies, demand for metals and minerals is soaring. Yet the push to protect the environment is also constraining investment in new mining and extraction projects. The result is rapidly rising prices for energy, minerals, and metals. This so-called “greenflation” threatens to derail the energy transition, yet solutions to the problem are elusive. The world must find a way to balance its need to cut emissions and protect the environment against green tech’s demands for more material inputs.

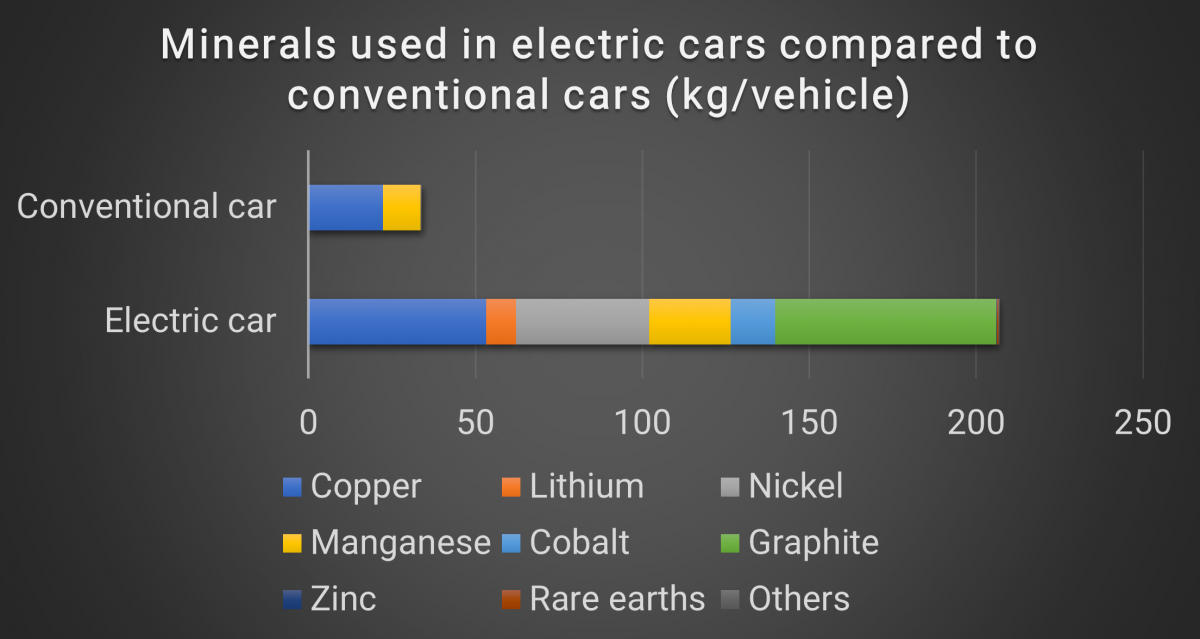

Electric cars are widely seen as a green alternative to conventional combustion engine vehicles. However, research from the International Energy Agency (IEA) indicates that, while they have a favorable greenhouse gas (GHG) emissions profile, electric vehicles use over six times more minerals than their conventional counterparts.

International Energy Agency (IEA). Minerals used in electric cars compared to conventional cars. May 2021.

Thus, the transition to electric vehicles – while positive for GHG emissions per mile/kilometer driven – will necessarily involve increased extraction of metals and minerals. And the same is true of other green energy technologies. Solar power generation, for example, uses 11 to 40 times more copper per unit of power than fossil fuel generation, while wind power plants use 6 to 14 times more iron.

The green technology paradox

It’s an unexpected paradox of the green revolution. Most green technologies dramatically reduce GHG emissions but require significantly higher amounts of minerals such as copper, aluminum, lithium, silver, graphite, rare earths, and cobalt. Thus, while they contribute meaningfully to decarbonization, they also drive potentially harmful resource extraction.

In this way, the drive to adopt green technologies is in tension with other environmental priorities, including the need to reduce investment in dirty fuels and curb harmful mining practices. And this means that, as industries try to switch to low emission technologies, they are running into a problem – supply constraints on the minerals and metals they need.

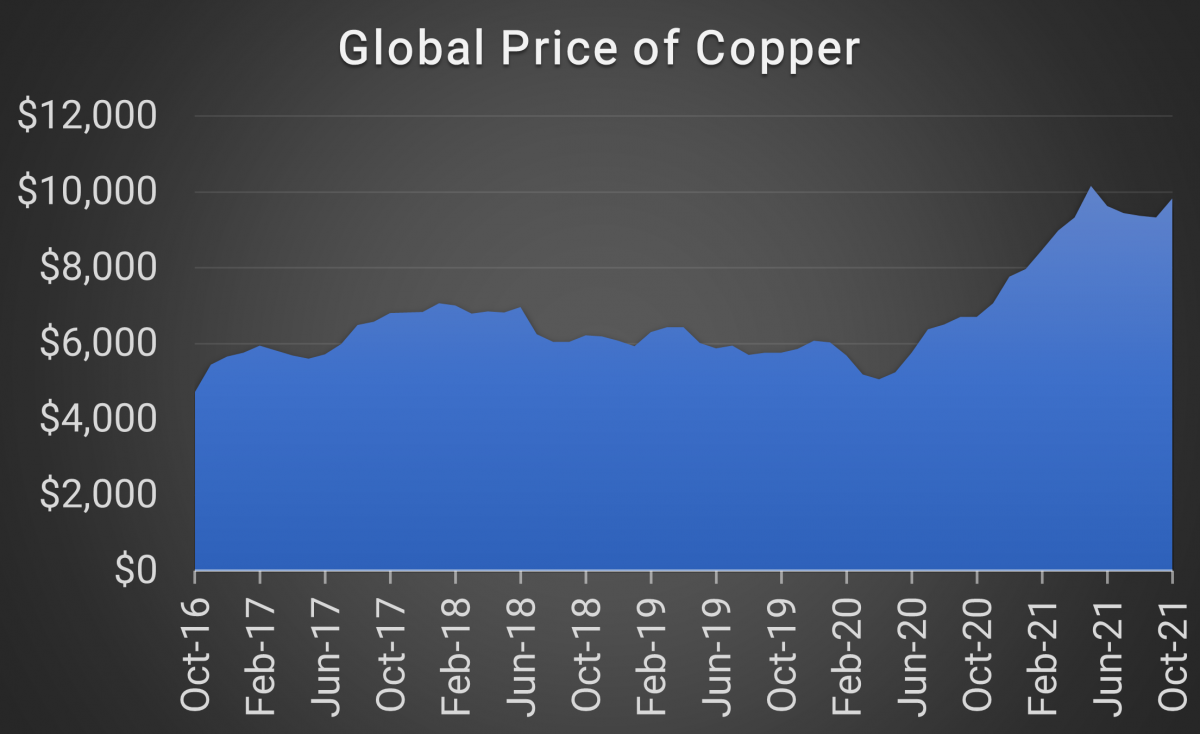

In Latin America, for example, the Financial Times reports that copper mining projects in Chile and Peru, which supply about 40% of the world’s copper, are taking twice as long to complete. Historically, mining companies could initiate a project and start delivering copper within five years.

Today, because of increased resistance from local communities and greater concern about the impact of mining on the environment, projects routinely take ten years or more. As copper demand rises, additional supply will be needed – and it’s not clear where that will come from. The result has been a steep rise in global copper prices.

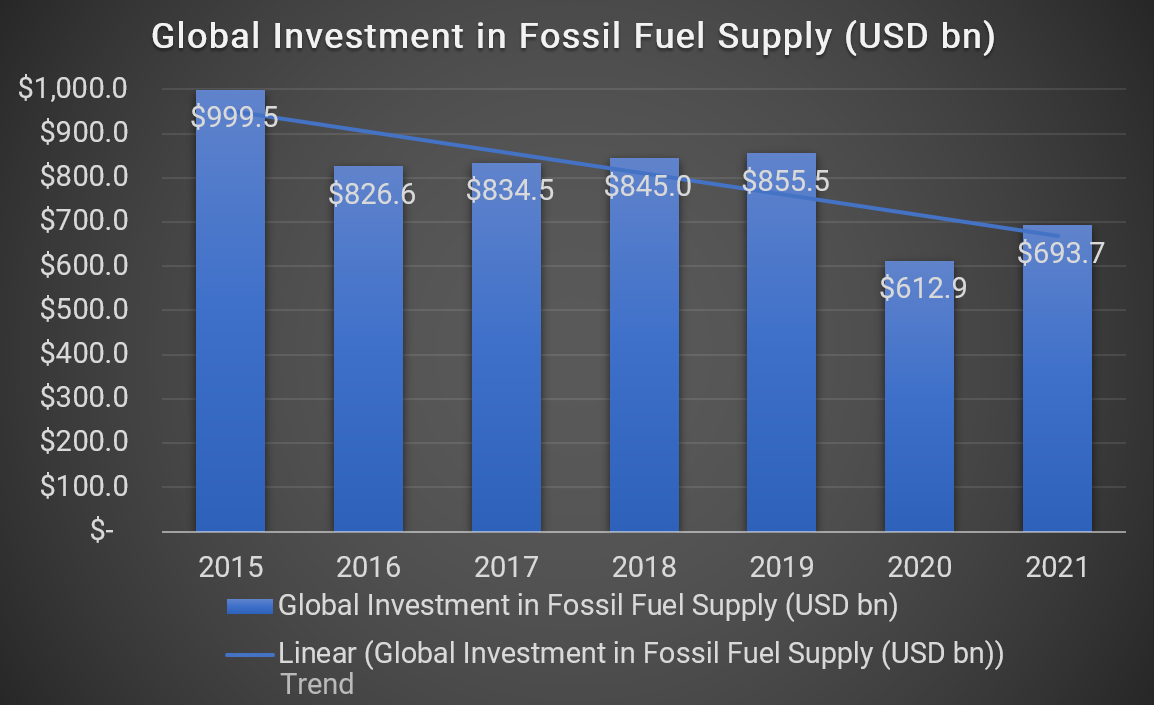

In the energy industry, the pattern is similar. Over the last few years, global investment in fossil fuel supply – including new oil and gas operations and new coal mines – has steadily declined, falling over 30% between 2015 and 2021.

IEA. International Energy Agency World Energy Investment 2021. June 2021. 2021 figures are an estimate.

Investment in renewables has been growing, but as yet, renewable energy projects are not able to meet global demand, including the demand generated by large-scale green projects. Thus, fossil fuel prices have been rising as supply growth has slowed and demand has risen.

Related article: Energy Prices are Spiking as the World Weighs its Climate Change Agenda

This combination of factors is resulting in what is known as “greenflation” – rising prices for minerals and energy caused by global efforts to reduce our environmental impact. On the one hand, demand is increasing due to the intensive mineral needs of green technologies. On the other hand, supply is being constrained by the impact of environmental and social imperatives.

Squaring the circle

Looking ahead, the world must find a way to balance competing environmental demands. It may, for example, be necessary to allow increased mining in the short term to facilitate the manufacturing of green energy technologies. New oil wells may be necessary to ensure we have enough energy to develop renewable projects affordably.

If supply constraints do not ease, there is a risk that the cost of transitioning to green technologies will rise too far, too fast, and make the transition unaffordable. It would be an irony if environmental mandates were to undermine the very cause they seek to promote.

Related article: Global Supply Chains are Under Pressure and it’s a Problem

Pragmatism and forethought are needed to make sure that doesn’t happen. Governments must be clear on their environmental priorities and must create a regulatory environment that allows for the extraction of the minerals we need to build the tools required to decarbonize. If we do not find a way to ensure that the green transition can be done affordably, we risk not doing it at all.

Intuition Know-How has a number of tutorials that are relevant to the green transition and the knock-on impacts:

- ESG – An Introduction

- ESG Factors

- ESG Investing – An Introduction

- ESG Investing – Strategies

- Impact Investing

- Sustainable Finance – An Introduction

- Sustainable Finance – Principles & Frameworks

- Sustainable Development Goals (SDGs) – An Introduction

- Commodities – Non-Ferrous Metals

- Commodities – Ferrous Metals

- Commodities – Oil

- Commodities – Natural Gas

- Commodities – Coal

- Inflation – An Introduction

- Inflation Indicators