Know-How: Comprehensive learning for wealth management

As the financial services industry continues to evolve at a rapid pace, staying competitive in the field of wealth management requires continuous learning and development. Investment in learning not only enhances employee engagement and customer satisfaction, but also drives higher profitability.

In this article, we will explore the essential components of learning and development that all wealth departments should consider. We will delve into the importance of lifelong learning, the benefits of investing in learning and development, and the specific topics that should be covered. Additionally, we will provide tips for implementing an effective learning and development program.

The importance of lifelong learning within wealth management

In the world of wealth management, lifelong learning is not just a buzzword; it is a fundamental aspect of professional growth and success. Lifelong learning refers to the ongoing, voluntary, and self-motivated pursuit of knowledge for personal and professional reasons.

Responsible and ambitious financial advisors must embrace lifelong learning to stay up to date with the ever-changing landscape of the industry.

Benefits of learning and development for wealth management

Investing in learning and development can yield numerous benefits for financial services companies, particularly in this realm. By providing employees with the knowledge and skills they need to excel, companies can experience increased employee engagement, improved customer understanding and outcomes, and an enhanced brand reputation. Moreover, companies that prioritize learning and development are more likely to attract and retain top talent, giving them a competitive advantage in the marketplace.

Essential learning and development topics for wealth management companies

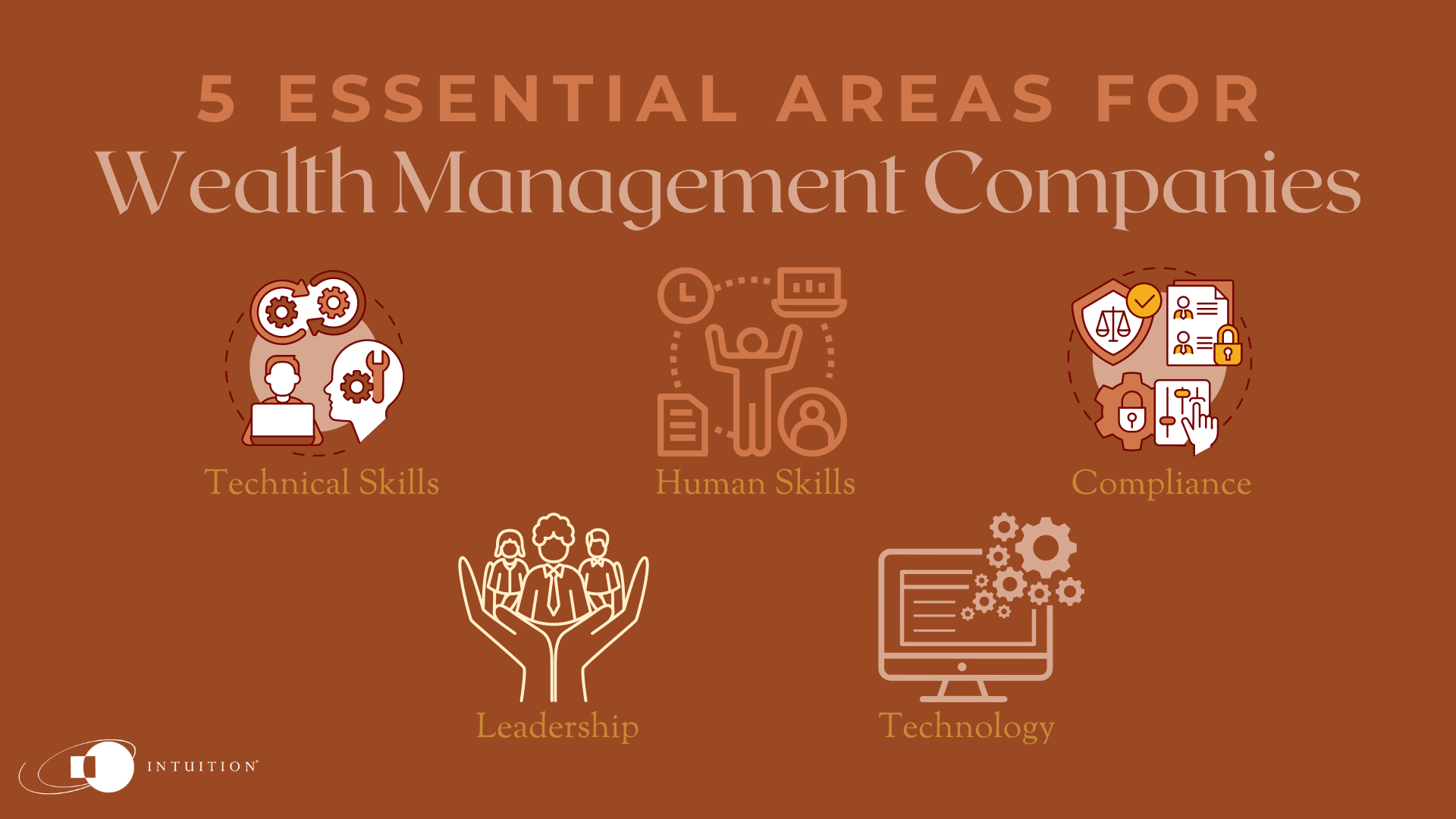

To unlock the full potential of comprehensive knowledge, wealth management companies should cover a range of topics in their learning and development programs. Here are five essential areas that every wealth management company should consider:

Technical skills

Wealth management professionals need to possess a strong foundation in technical skills such as financial analysis, portfolio management, and risk management. These skills should not be treated as a one-time learning endeavor but rather should be revisited and built upon regularly to keep up with industry trends and advances.

Human skills

In addition to technical skills, employees in all roles within a wealth management company need to develop strong human skills. Effective communication, collaborative working, and leadership abilities are crucial for success in the financial services industry.

Compliance

Compliance is a critical area that every wealth management company must acknowledge and address. Employees need to be well versed in the regulations and guidelines that govern the industry and understand how to comply with them. Training in compliance should be dynamic and reflective of real-world scenarios to prepare employees for the challenges they may encounter.

Leadership

Developing strong leaders is essential for building a successful wealth management company. Employees should receive training in leadership skills such as people management, strategic planning, and decision-making. Effective leaders can drive innovation, motivate teams, and foster a positive work culture.

Technology

The financial services industry is undergoing a digital transformation, and wealth management companies need to stay abreast of the latest technological trends. Investing in training on technologies such as artificial intelligence, machine learning, and data analytics can help companies stay ahead of the curve and deliver better services to their clients.

Implementing an effective learning and development program

Implementing a successful learning and development program requires careful planning and execution. Here are three tips to ensure the effectiveness of any learning and development program:

1 Develop a clear strategy

Before launching a learning and development program, it is crucial to develop a clear strategy that outlines the goals, objectives, and metrics for success. Identify the key areas of development that will have the most transformative effect on the business and prioritize them accordingly.

2 Engage employees

Employee engagement is vital for the success of any learning and development program. Companies should involve employees in the development and implementation of the program to ensure buy-in and participation. Consider implementing incentives to encourage employees to embrace development opportunities.

3 Measure results

To gauge the effectiveness of the learning and development program, it is essential to measure the results. Track metrics such as employee engagement, customer satisfaction, and profitability to assess the program’s impact. These metrics should be agreed upon at the outset, allowing you to gauge the success of your learning initiatives.

Implementing Know-How into your day-to-day

At Intuition, we understand the importance of comprehensive learning for wealth management professionals. Our Know-How content library offers a wide range of courses and resources designed to equip financial services professionals with the knowledge they need to excel. With a focus on wealth management, our content covers areas such as investment management, private wealth management, compliance, and more.

By leveraging our Know-How platform, asset managers in wealth management can access over 600 tutorials, 250 Excel simulations, carefully crafted case studies, true-to-life scenarios, and 1,600 videos. Our content is regularly updated to ensure relevance and accuracy, and we offer localization options to cater to a global audience. Our platform is fully customizable and can be integrated with your existing learning management system or accessed via our NX Learning platform.

To experience the benefits of Know-How for asset managers in wealth management, schedule a demo with our client success team. We will work with you to optimize the usage of Know-How.

Conclusion

In the fast-paced world of wealth management, continuous learning and development are essential for staying competitive and delivering superior client experiences. By prioritizing learning and development, wealth management companies can unlock the potential of their employees, drive engagement and satisfaction, and achieve higher levels of success. With comprehensive content libraries like Know-How, financial professionals can stay ahead of industry trends, enhance their skills, and navigate the complexities of the financial services landscape with confidence. Invest in learning for wealth management and unlock a world of opportunities for your organization and your clients.

Explore similar articles in this series: