New Risks, Old Models: The Asset Management Business

The asset management business is undergoing a period of unprecedented change. Asset managers are struggling to deliver the products and returns that aging populations in Asia and the West demand against the backdrop of negative interest rates and slow growth. As fee levels fall under pressure from low-cost passive funds, asset managers must also grapple with new risks such as climate change, disruptive technology, and cyber threats. This perfect storm demands innovative responses. Asset managers must ask whether their traditional analysis and risk models can cope with the changing environment and adjust them as needed.

Perfect storm

Asset management was once a relatively low-risk business. Against the backdrop of a benign investment environment, asset managers focused on maximizing client returns and enjoying well-established revenue streams. Insulated from the credit risk inherent in banking and – thanks to their agency business model – from most investment risk, asset managers also managed to fly largely under regulators’ radar.

Related tutorial: Asset Management – An Introduction

Times have, however, changed. Today, the industry faces an unprecedented number of new and emerging challenges that are putting growing pressure on business strategies, risk models, and capacity. Even as global assets under management (AUM) hit new highs, downward pressure on fees and rising costs are forcing asset managers to rethink the traditional ways of doing things. At the same time, regulators, concerned about systemic risks, are taking a closer-than-ever look at asset managers’ operations. It all adds up to a time of unprecedented challenge – but also enormous opportunity.

New risks

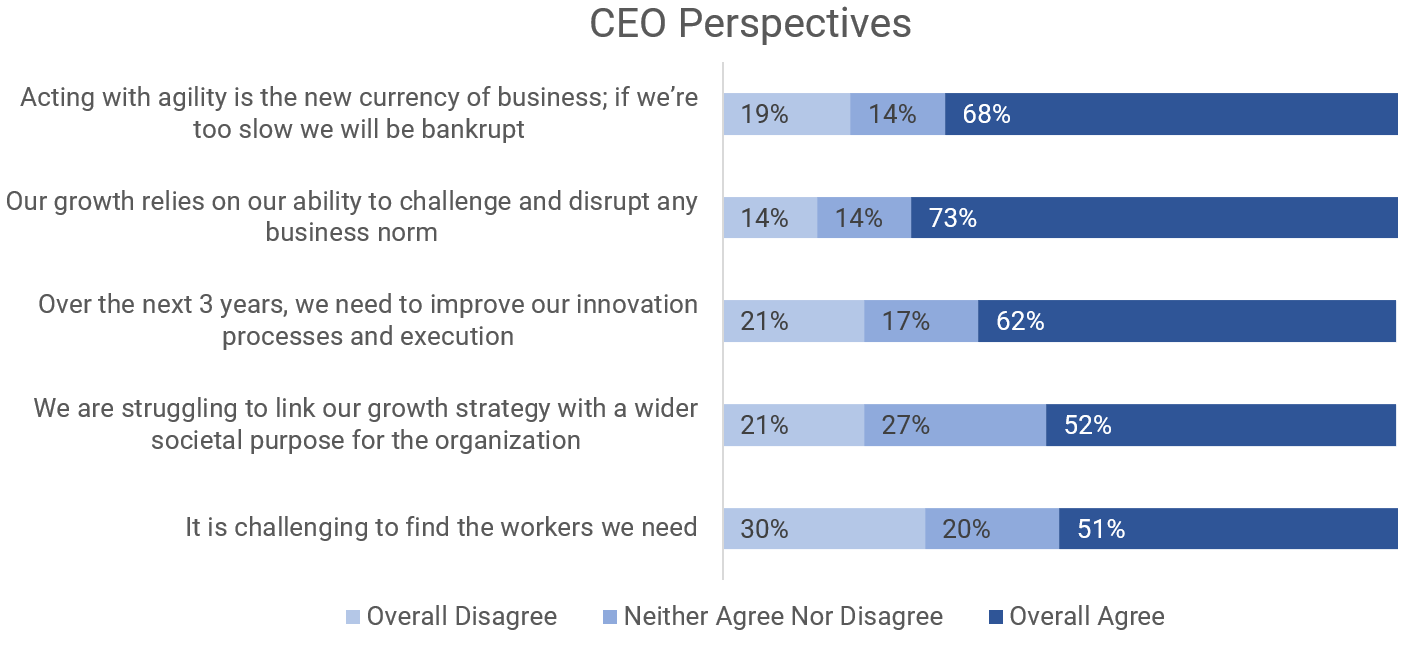

KPMG’s 2019 Global Asset Management CEO Outlook, which surveys the leaders of the world’s largest asset management firms, reports that CEOs today regard climate change risk as the number-one threat to their companies’ growth.

Source: KPMG 2019 Global Asset Management CEO Outlook

Almost 70% of the CEOs surveyed agreed that their ability to anticipate and navigate the global shift to a low-carbon, clean technology economy would be decisive in determining their companies’ future growth trajectories.

Asset managers must not only grapple with the climate impact of their own business, but must also consider how climate change is affecting the risks inherent in the assets they invest in. This means enhancing their investment models, moving beyond financial metrics and governance concerns to fully integrate environmental and climate considerations. In particular, asset managers must understand the extent to which their portfolios are exposed to growing climate risks and seek ways to mitigate those risks before they arise.

Unfortunately, there is evidence that asset managers are squandering opportunities to take action on climate-related risks. A report from the Washington DC-based Majority Action and the Climate Majority Project found that global asset management firms have consistently voted against climate amendments at energy companies such as ExxonMobil. While these votes may make sense in the short-term, in the long-term, firms risk exposing themselves and their clients to potentially enormous climate-related liabilities.

Related Tutorial: Risk Management for Asset Managers

At the same time as climate change is reshaping investment risk, technology is transforming the asset management industry, creating new hazards even as it opens up new opportunities.

In 2019, cybersecurity risk emerged as a top-five concern for asset managers surveyed by KPMG. After a decade of high-profile data hacks, data losses, and cyberterrorist attacks, asset managers are increasingly recognizing that they must find ways to protect their most valuable asset, their data. This is especially true as many firms, seeking to create a seamless environment for employees and clients, are in the process of migrating their data to the cloud.

While cyber threats pose a risk, technology also offers opportunities. Emerging and disruptive technologies – including FinTech innovations such as automated asset allocation, robotic process automation, and distributed ledger technology – offer the potential for creating new products and targeting new markets.

Asset managers recognize that they must adapt to new technology and find ways to implement it to help their businesses grow. Nevertheless, identifying opportunities, finding tech talent, and ensuring that new processes and products are compliant with an ever-growing host of regulations are major challenges.

Looking ahead

To respond to these challenges, asset management firms must embrace change at both the operational and portfolio levels. They must adapt their investment models to account for the changing global environment and the potential costs of the transition to a low-carbon economy. They must also integrate technology more deeply into their operations and identify ways in which new systems can be deployed to offer innovative products in new and untapped markets.

Source: KPMG 2019 Global Asset Management CEO Outlook

CEOs recognize the challenges. Looking ahead, the firms that succeed will be those that capitalize on opportunities while taking a prudent and cautious approach to managing new risks.

Intuition Know-How has a number of tutorials that are relevant to asset management, risk, and technology:

- Asset Management – An Introduction

- Risk Management for Asset Managers – An Introduction

- Asset Management – Operational Risk

- Asset Management – Market Risk

- Asset Management – Credit Risk & Counterparty Credit Risk (CCR)

- Asset Management – Liquidity Risk

- Asset Management – Other Risks

- Data Analytics

- Robotic Process Automation (RPA)

- Artificial Intelligence (AI)