Sustainable Commodities – Can they play a role in the transition to a low-carbon economy?

Many commodities have become key inputs to the global economy, but their production is often associated with processes that have serious environmental and ethical issues – deforestation, greenhouse gas (GHG) emissions, and forced/child labor, to name but a few. Are the negative impacts of commodity production inevitable or can sustainability-linked initiatives ensure the commodities sector plays its part in the green transition?

A consensus is emerging that the global economy is entering into an inflationary regime in which market prices for commodities will be supported – a so-called commodities “supercycle.”

On the demand side, policy choices on the part of businesses and governments related to deglobalization, mitigation of geopolitical risks and supply chain sensitivities that promote re-shoring/onshoring/near-shoring, are reinforcing this trend.

On the supply side, commodities have suffered from years of underinvestment with investors looking for short-term guaranteed returns rather than investment for long-term growth, with consequences for pricing. There have been tendencies to limit production and this has been compounded by the movement toward environmental, social, and governance (ESG) investing that has suppressed investment into energy, metals, and other commodities perceived as ”dirty.”

[Working in sustainable finance: key facts and stats you should know]

Commodities demand on the increase

But, somewhat ironically, the move toward the green transition and energy sustainability will see increased reliance on commodities. Wholesale electrification will place great demands on copper and other metals, while the building of the infrastructure to complete the green energy transition over the longer term will be dependent on fossil fuels in the shorter term. So how to reconcile increased commodities production and investment with ESG principles?

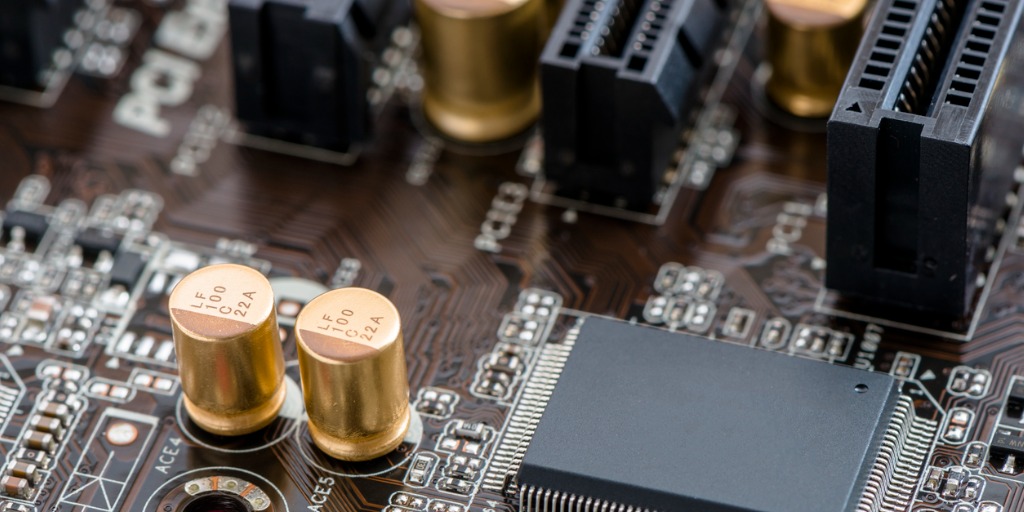

Critical metals and rare earth elements are essential to hardware such as circuits and microchips in computers, mobile phones, and networks. Aluminum and steel are used to case these elements as well as the metals used in batteries (such as cobalt, nickel, and lithium). Tin is essential to the information and communications technology (ICT) sector as it is used in soldering circuit boards. Copper is the foundation of electricity networks and renewables technologies and is also key in ICT.

Recycling rare metals

A number of measures have been advanced to mitigate ESG impacts, principally around recycling of electronic waste (e-waste) which is currently estimated to be just 20 percent of the 50 million metric tons produced annually. It has until now proved technically challenging to recycle rare metals and efforts are being made to do more at the level of product design to make re-use of components easier. Another area where ESG-minded investors are examining supply chains is in the area of agreements on observance of minimum ESG standards between lower-income, metal-mining countries, and consuming countries.

[What is the SFDR? Sustainable Finance Disclosure Regulation]

Policymaker engagement critical to ESG

The limitations of confining engagement on critical sustainability issues to individual companies is becoming apparent. The area of deforestation is exemplary here. As one asset manager puts it: “Deforestation is a material risk for investors. They are concerned with not only its financial impacts but also the broader consequences on biodiversity, climate change, and the violation of the rights of indigenous people and local communities, all of which increases potential reputational, operational, and regulatory risks. […] Engaging with companies is important to halt deforestation, but there are limits to what individual firms can achieve. Given that the responsibility for oversight of forests and nature lies with governments, investors can help enable industry solutions by engaging directly with policymakers.”

[ESG Runs into Category Confusion]

Energy subsidies equals missed opportunity

Ironically, following the Russian invasion of Ukraine and subsequent disruption to the energy market causing runaway price inflation, government policy has set back a rare opportunity to accelerate the transition to sustainable energy sources. The response to the 2008 global financial crisis that combined bailouts of the financial system with austerity measures is credited with the subsequent rise in populism. In recognition of this and, in contrast, the response to the COVID crisis was generous and redistributive. The same approach has held for the energy crisis where governments have favored massive subsidies when non-intervention would surely have suppressed demand and concentrated minds on the need to transition from fossil fuels.

Ultimately, the trend toward sustainable commodities will likely be driven by new or modified investment mandates emanating from asset owners combined with what seems like an increasing willingness of commodity consumers to bear the increased cost involved in ensuring that commodities meet requisite ESG standards.

Intuition Know-How contains many tutorials relevant to commodities, sustainability, and ESG. These include:

- Commodities – An Introduction

- Commodities – Physical Trading

- Commodities – Oil

- Commodities – Natural Gas

- Commodities – Coal

- Commodities – Electricity

- Commodities – Emissions

- Commodities – Non-Ferrous Metals

- ESG – Primer

- ESG – An Introduction

- ESG Factors

- Climate Risk – An Introduction

- Climate Risk – Banking & Decarbonization

- Sustainable & Responsible Investing – An Introduction

- Sustainable Finance – An Introduction

- Sustainable Finance – Principles & Frameworks

- Sustainable Finance in Practice

- Biodiversity & Financial Institutions