The benefits of an industry-wide perspective on asset finance

In the last quarter of 2022, Intuition was privileged to deliver a new asset finance training program for a leading firm. This article highlights three reasons why this new form of training can be so impactful.

1 Representing around 3.5% of total debt finance to UK businesses, Asset Finance’s importance in supporting the UK economy is clear

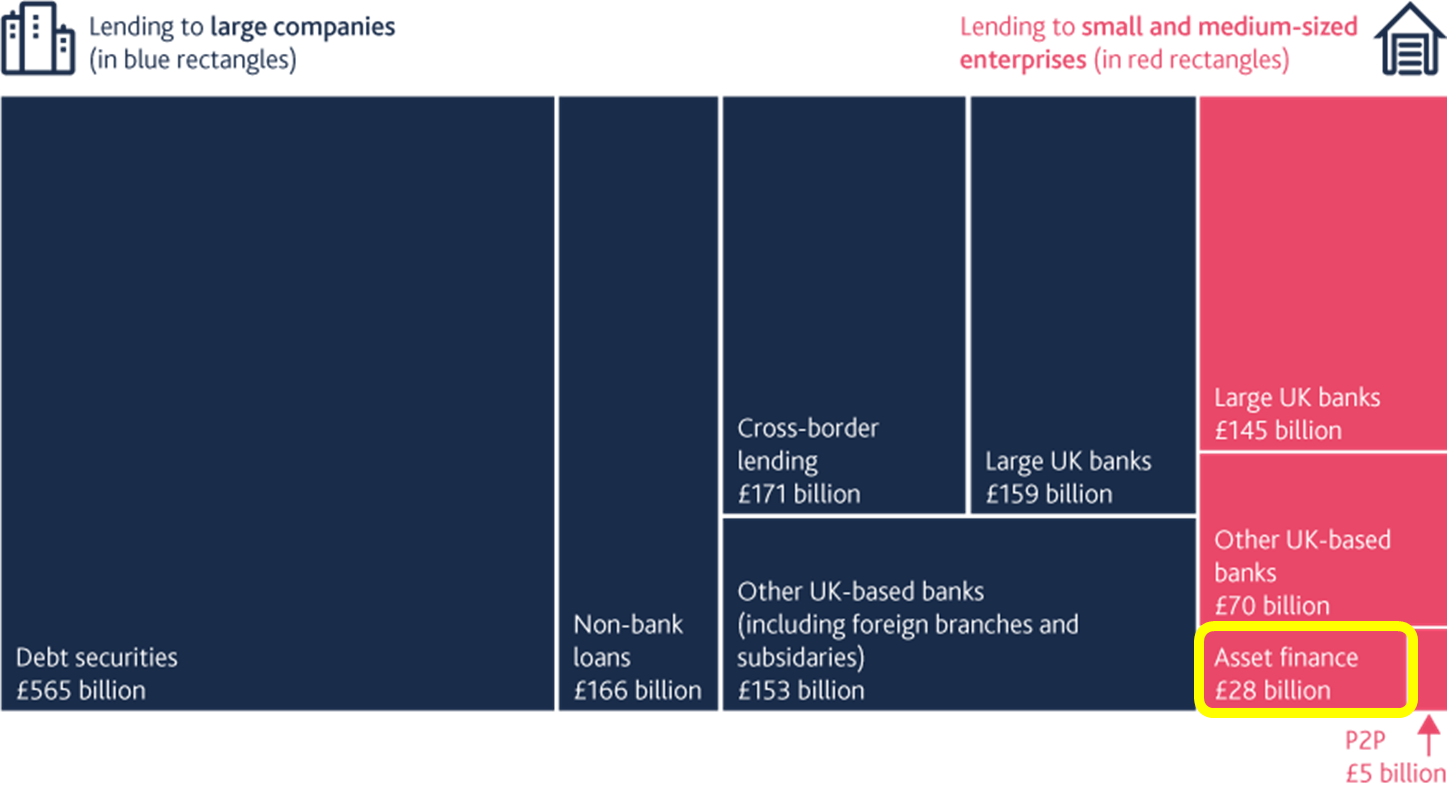

The Bank of England chart below shows the composition of external debt finance to UK businesses in March 2021, with total debt of around £1.4 trillion. Towards the bottom right is asset finance, with £28 billion of outstanding finance. But that is not the complete picture, as large companies also use asset finance, and this is not broken out in the chart.

The Asset Finance 50, the industry ranking survey, suggests the top 50 firms in the industry had £40.9 billion of outstanding business leases in 2021, based on accounting book values. Given the industry also supports equipment finance using loans that are not classified as leases, and firms outside of the Asset Finance 50, total industry size might be around £50 billion book value. That is around 3.5% of total debt finance to UK businesses.

External debt finance to UK companies 2021. Source: Bank of England

Meanwhile, of around 1.1 million people employed in financial services in the UK according to TheCityUK, Asset Finance 50 data suggests there are around 10,000 in asset finance – just under 1% of total financial services jobs.

What can we take from this? We need, as an industry, to ensure that there is wide recognition of the importance of the asset finance sector and protect our reputation for delivering this form of finance with professional care. To help counter this, Intuition aims to:

- Show how asset finance delivers unique benefits for businesses, small and large (looking at quite a granular level to be confident on when different benefits are likely to be relevant to users, whether they are product features, rates, tax, or accounting considerations)

- Appreciate the importance of maintaining a high reputation of professionalism across the industry and understand how firms achieve this across both regulated and unregulated business (looking at regulations and relevant voluntary codes of conduct and case studies)

- Consider the potential enhanced role of asset finance in supporting the UK Government’s ‘Net Zero Strategy’ (looking at the reasons why lessors’ asset expertise is critical to business investment in more sustainable assets)

2 Mitigating risk, particularly fraud, is a shared responsibility across the industry

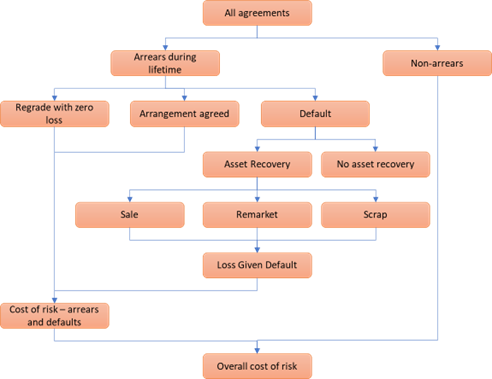

Asset finance has been proven to be a lower risk form of lending than unsecured business finance, with a high proportion of leases that do go into arrears either fully recovering by the end of the term, or the proceeds of asset recovery covering most of the outstanding exposure. This is a critical factor for banks, allowing them to achieve more efficient capital treatment for their leasing division.

Components of asset finance risk. Source: Leaseurope

To protect and enhance our low cost of risk, particularly in the faster-moving digital environment, there is a need for cooperation across the industry to mitigate risks and beat fraudsters. To help achieve this, Intuition aims to:

- Assess the components of cost of risk in asset finance (looking at empirical evidence on probability of defaults and loss given defaults)

- Consolidate the knowledge of attendees of different risk types and how they are mitigated (looking at key aspects of underwriting and documentation)

- Understand the drivers of asset finance fraud (looking at case studies of the exceptional frauds of the past twenty years that had a major impact across the industry, and how the industry has responded)

3 Seeing things from a customer perspective shows the importance of industry-wide communications

Throughout the course, Intuition aims to take a customer perspective, considering when businesses are likely to need asset finance and how they find out about leasing products and compare them to alternatives. We review the different types of lessors in the market, the direct and indirect channels to market (for example this graph shows the locations of most of the c. 450 specialist asset finance broking firms in the UK), and the many different sources of information that potential lessees may come across.

Here, Intuition aims to:

- Explore the choices available to businesses considering leasing (looking at types of lessors, the role of intermediaries, and alternative ways of financing assets)

- Help delegates to understand what potential new lessees may be thinking or expecting (looking at alternative sources of information available to them)

Locations of asset finance brokers.

Source: Asset Finance Policy

The case for industry-wide training

Given all the other priorities facing firms in this highly competitive industry, investing in learning about the wider asset finance industry is not an obvious priority. But this type of training can deliver important benefits, helping attendees to understand the unique nature of the industry – in terms of its role in supporting the economy and now in particular the shift to Net Zero; understanding what makes the industry successful for both lessors and lessees; and raising awareness of the benefits of being part of the strong UK leasing community.

If you would like to speak to a learning solutions specialist about industry-wide training, please click here.