The EU’s Record-Breaking Social Bonds Issue & The Labeled Bond Market

The European Union’s inaugural social bonds issue set a global demand record in October – the multi-billion-euro, two-part offer was nearly 14 times oversubscribed. Some observers hailed this success as a testament to the strength of the sustainable finance market, while others argued that investors were attracted primarily by the fact that the bonds are backed by the full faith and credit of the AAA-rated EU. Most agree, however, that the introduction of a new, safe-asset social bond is likely to further stimulate the rapidly growing labeled bond market.

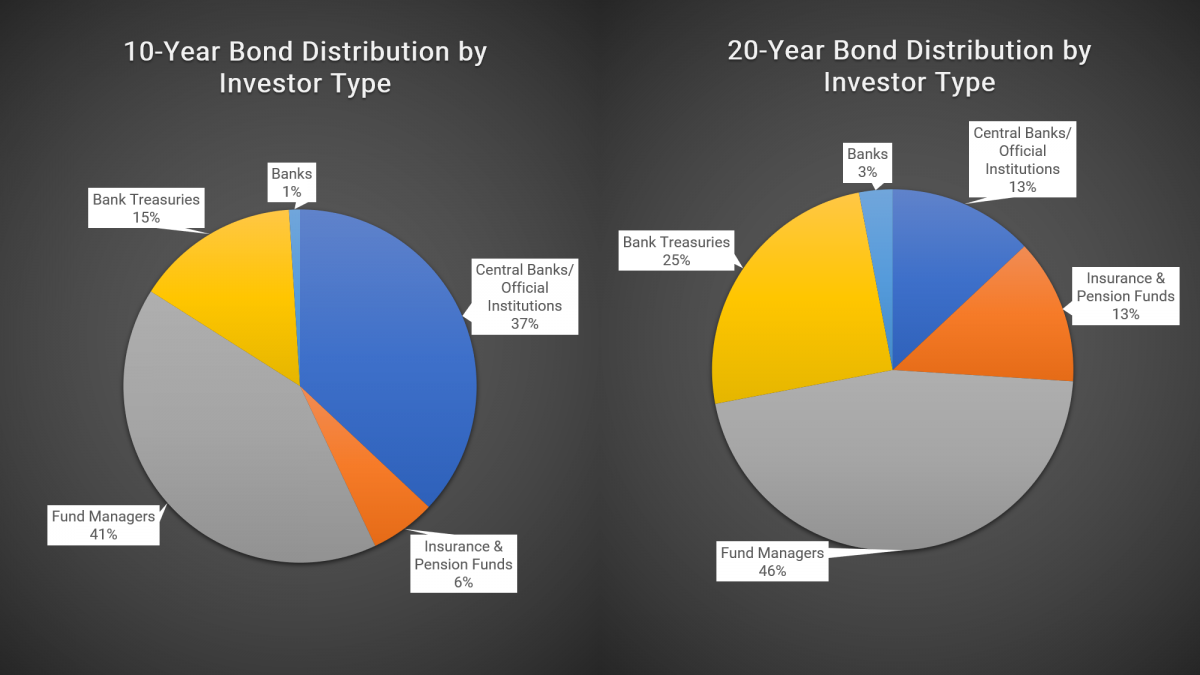

Against the backdrop of an unprecedented year, the EU’s first-ever social bonds issue has been an unparalleled success. The €17-billion offer – representing the largest-ever bond issuance by the European Commission (EC) – drew orders of more than €233 billion from a mix of global fund managers, central banks, insurance and pension funds, and others.

What accounts for investor enthusiasm for the EU’s social bonds, and what does this mean for the future development of the labeled bonds market?

The EU’s blockbuster bond

The EU’s October 2020 social bonds issue consisted of two bonds, a €10-billion, 10-year bond, and a €7-billion, 20-year bond. Strong investor appetite saw the bonds achieve relatively attractive terms – the 10-year bond was priced at 3 basis points (bps) above mid-swaps and the 20-year bond was priced at 14 bps over mid-swaps.

Although it’s hard to compare directly, the spread on the new bonds is estimated to be 1 and 2 bps above the market spread for existing EU bonds for the 10-year and 20-year tranches respectively, making them relatively attractive in a yield-starved market. This accounts for some of the success of the issue.

Another key part of the attraction, however, is that the bonds represent a joint debt issue by the EU – the first since the bloc announced its record-setting pandemic recovery deal – and thus enjoy the EU’s top-notch credit rating. Against the backdrop of a global recession, such high-grade credit has been increasingly scarce, making this issue highly attractive to investors.

European Commission. European Union EUR 17 billion dual tranche bond issue due October 4th, 2030 and 2040. October 2020.

The bonds were formally issued by the EC under the new SURE program (temporary Support to mitigate Unemployment Risks in an Emergency), which aims to finance EU-wide efforts to ameliorate the negative impacts of the coronavirus pandemic on communities.

As the first of many planned SURE program bond issues – the EC had announced earlier in October that it would be financing the entire SURE program with up to €100 billion in social bonds – the October 2020 offer was widely seen as a key gauge of investor appetite for EU social bonds.

Investors’ enthusiastic response to the new debt instruments, with their excellent credit rating and relatively attractive yields, all but guarantees that the EC will continue to issue successful SURE social bonds over the next twelve or so months. This is big news for the labeled bonds market.

The 800-pound gorilla

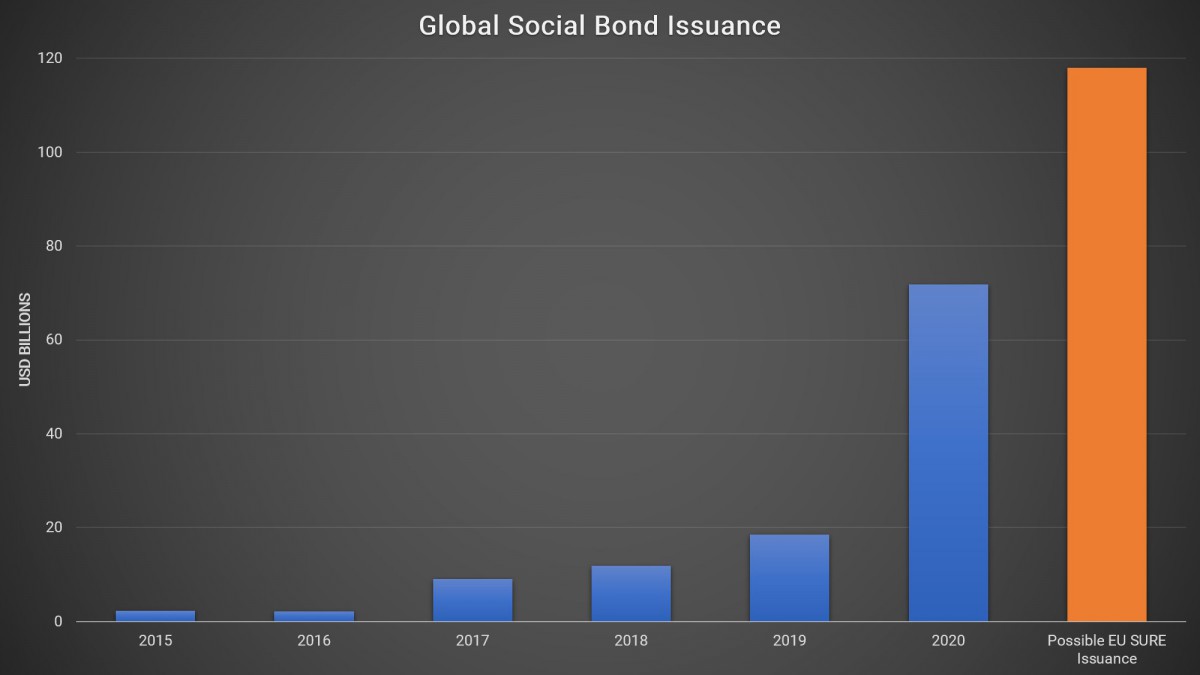

The labeled bond market has been growing rapidly for several years. With the EU’s SURE bond program, however, this growth is set to explode. The October issue dwarfed all previous European social bond offers – the prior record-holder was a 10-year, €5-billion offering from the French agency CADES – and has already helped drive a record year for the industry in 2020.

Bloomberg. EU’s Social Bonds Draw $275 Billion to Set Global Demand Record. October 2020.

Should the EU’s SURE program unfold as expected, the total issuance of EU social bonds could exceed any previous year’s total issuance. This has the potential to reshape the market – the existence of a large pool of highly-rated social bond debt could bring new legitimacy to the market and act as a catalyst for increased activity by other sovereigns and agencies.

Intuition Know-How has a number of tutorials that are relevant to social bonds and the EU bond market:

- Bond Markets – An Introduction

- European Bond Market

- ESG & SRI – Primer

- ESG & SRI – An Introduction

- ESG & SRI – Investing

- ESG Factors

- SRI Strategies