The Individual Accountability Framework (IAF): Enhancing accountability in Financial Services

In today’s evolving financial landscape, the need for robust accountability measures has become increasingly apparent. To address this, the Central Bank of Ireland has introduced the Individual Accountability Framework (IAF), a comprehensive set of regulations aimed at enhancing governance, performance, and accountability in the financial services sector. In this article, we will explore the key elements of the IAF along with the Central Bank’s approach to enforcement.

Understanding the Individual Accountability Framework (IAF)

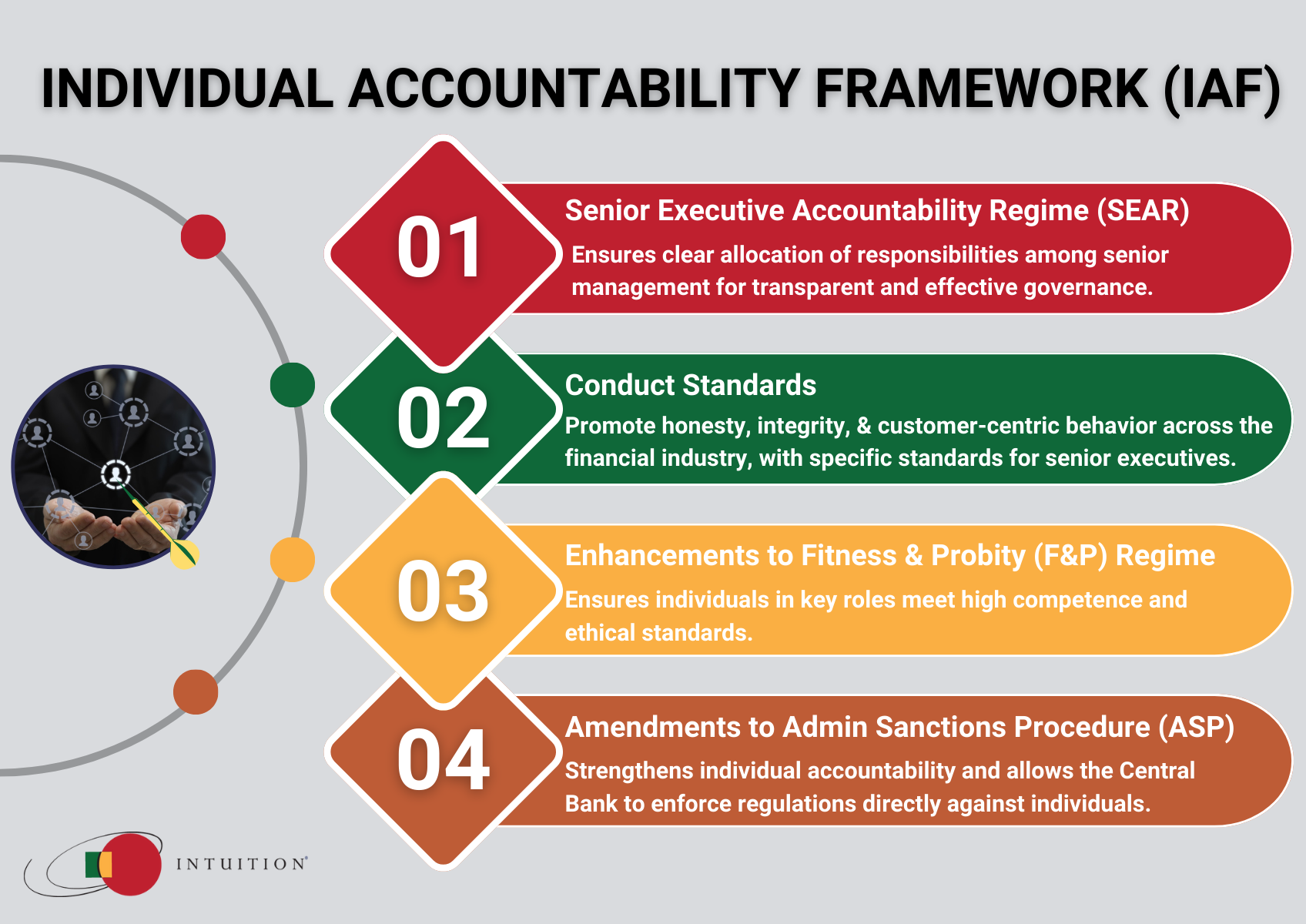

The IAF, which was signed into law on March 9, 2023, introduces significant changes to the Central Bank’s administrative sanctions procedure (ASP). It aims to establish a framework that holds individuals accountable for their actions and decisions within regulated firms. The IAF consists of several key elements, including the Senior Executive Accountability Regime (SEAR), Conduct Standards, enhancements to the Fitness & Probity (F&P) regime, and amendments to the ASP.

Senior Executive Accountability Regime (SEAR)

Under the SEAR, in-scope firms are required to clearly define and document the responsibilities and decision-making authority of their senior management. This ensures that accountability is clearly allocated within the organization, promoting transparency, and effective governance. The SEAR aims to prevent a diffusion of responsibility and enable regulators to identify individuals who are responsible for specific decisions or actions

Conduct Standards

The IAF introduces a set of Conduct Standards that apply to individuals in all regulated firms. These standards include acting with honesty, integrity, due skill, care, and diligence, as well as acting in the best interest of customers. Additionally, senior executives are subject to Additional Conduct Standards that are specific to their roles and responsibilities. By setting clear expectations for behavior and ethical conduct, the Conduct Standards promote a culture of professionalism and trust within the financial services industry.

Enhancements to the Fitness & Probity (F&P) Regime

The Fitness & Probity regime has been enhanced to further strengthen the Central Bank’s oversight of individuals carrying out specified functions within regulated firms. Firms are now required to proactively certify that individuals in these roles are fit and proper, ensuring that they possess the necessary qualifications, skills, and integrity to perform their duties effectively. This enhancement aims to amplify the integrity of the financial services industry by ensuring that individuals in key roles meet the highest standards of competence and ethical conduct.

Amendments to the Administrative Sanctions Procedure (ASP)

The ASP has been updated to align with the provisions of the IAF. The Central Bank now has the authority to take enforcement action directly against individuals for breaches of their obligations, rather than solely focusing on breaches committed by firms. This change strengthens individual accountability and provides the Central Bank with greater flexibility in enforcing regulatory requirements.

The Central Bank’s approach to enforcement

The Central Bank is committed to ensuring effective enforcement of the IAF and holding individuals accountable for their actions. The enhanced ASP provides the Central Bank with the necessary tools and powers to take action directly against individuals. The Central Bank’s enforcement approach focuses on fairness, proportionality, and consistency, taking into account the specific circumstances of each case.

Conclusion

The introduction of the Individual Accountability Framework represents a significant step towards enhancing accountability in the financial services industry. Through the SEAR, Conduct Standards, enhancements to the F&P regime, and amendments to the ASP, the IAF aims to promote transparency, professionalism, and ethical conduct. By holding individuals accountable for their actions, the Central Bank seeks to strengthen the integrity of the financial services industry and protect the interests of consumers.