Transforming Finance: The pivotal role of Big Data

As we transition into an era marked by digital intelligence, one of the most significant transformations is the shift in how businesses, particularly within the finance industry, are leveraging Big Data for growth and development.

This article offers an exploration of the substantial influence of Big Data on the finance industry.

Big Data: A brief overview

The term “Big Data” refers to large sets of structured and unstructured data, often too complex to be processed by traditional data-processing software. With the rise of digital technology, businesses generate massive amounts of data daily. Financial institutions, renowned for being data-intensive, are now harnessing this data to gain insights, enhance decision-making processes, and offer personalized services.

[How computers add value to business: Modeling & Decision-making]

The old vs. the new: A shift in customer service model

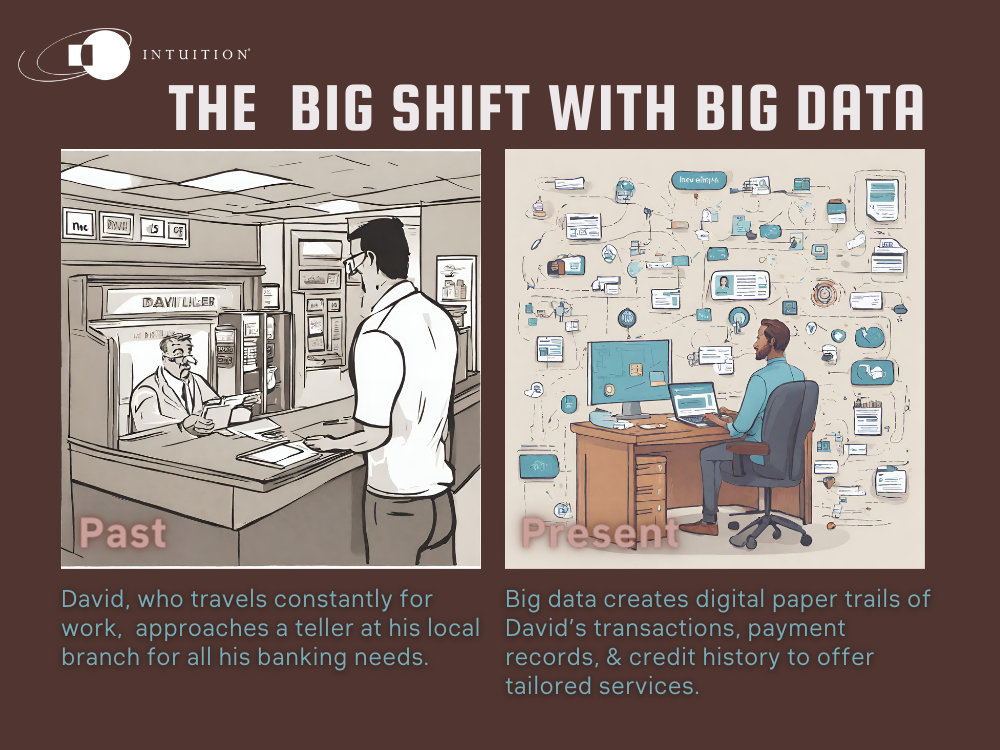

Traditionally, financial institutions operated on a system where personalized service was delivered through face-to-face interactions. However, the advent of Big Data has enabled a shift to a more dynamic, data-driven model.

For instance, consider David, a fictitious customer who has moved to various cities due to work commitments. In the past, his banking needs would have been handled by a single teller at his local branch. Contrastingly, in the present scenario, no single teller could keep up with David’s changing locations and financial activities. This is where Big Data steps in, creating a digital paper trail of David’s transactions, payment records, credit history, and interactions, which can be analyzed to offer personalized services.

The power of Big Data in Banking

Banks are increasingly harnessing the power of Big Data in a multitude of ways. The data gathered from customers such as David is used to create a digitized knowledge base, which is then put to work through behavioral analytics.

This knowledge base enables banks to understand customers’ financial behavior better, anticipate future needs, and offer tailored products and services. Moreover, banks can learn a customer’s preferred channel of communication, thus enhancing the overall customer experience.

Banks can also leverage Big Data to enhance security. By analyzing transactions for fraud across multiple channels in real time, banks can provide security measures that were previously unimaginable.

The role of Big Data in Investment

The use of Big Data extends beyond banking, profoundly impacting the investment sector. Investment processes are becoming more efficient and accessible due to automation in asset allocation, financial planning, and security settlement.

Moreover, Big Data and machine learning technologies enable the interpretation of historical financial data and more accurate future predictions. These advanced statistical models are utilized to better interpret patterns in the data, conduct better statistical inferences, and make more accurate predictions.

The emergence of Fintech

The marriage of finance and technology has given birth to the emerging sector of Fintech. This sector encompasses firms in retail financial services, risk analytics, and payment systems, with a significant focus on Big Data and the algorithms required to transform datasets into marketable tools.

Fintech businesses are creating innovative platforms for crowdfunding, peer-to-peer lending, and novel open banking applications. They are developing modular systems that exploit current services to provide innovative IT solutions, emphasizing customer flexibility and adaptability to changes.

The use of unstructured data

Unstructured data, such as text, images, and videos, are becoming increasingly valuable in the finance industry. With the competition for Alpha intensifying, investors are turning to the analysis of unstructured financial data using sophisticated models.

Documents such as annual reports contain vast amounts of unstructured data that can offer valuable insights. Natural language processing tools can convert this text into a form that can be fitted into machine learning models, enabling the extraction of information and signals that go beyond the numbers.

The future of Big Data in Finance

The impact of Big Data in the finance industry is undeniable and is set to continue growing. As more businesses recognize the benefits of leveraging Big Data, it is predicted that this technology will become an integral part of financial institutions’ operations.

The future may see banks developing more intuitive and tailored services for small businesses, commercial and corporate banking, taking customer service to unprecedented heights.

The revolution of Big Data in the finance industry is just the beginning. As technology continues to evolve, so too will the ways in which financial institutions utilize these tools to enhance their operations, improve customer service, and drive growth.

Conclusion

In conclusion, Big Data is no longer just a buzzword in the finance industry. It’s a powerful tool that’s changing the way businesses operate, making processes more efficient, and helping to provide a better, more personalized customer experience.

The power of Big Data in finance is just beginning to be realized, and its potential is limitless.