What is impact investing?

Impact investing is an approach that investors use to harness the power of capital to actively improve people’s lives, society, and the environment.

The term “impact investing” was first coined in 2007 to refer to the process of making targeted investments intended to solve specific environmental or social problems.

The idea of impact investing is broad and may encompass a very diverse range of strategies, asset classes, and industry actors.

Today, the most widely accepted definition of impact investment is that “Impact investments are investments made with the intention to generate positive, measurable social and environmental impact alongside a financial return.”

In this definition, impact investing has three core characteristics:

- Intention

- The generation of a positive and measurable impact

- The expectation of a financial return

Although subjective, intention is the most important element differentiating impact investing from traditional investing.

With impact investing, the non financial outcomes are intentional, declared upfront, and not regarded as externalities or side-effects of the financial activity.

Social and environmental impacts are pursued through business strategies defined at the asset level.

These impacts are tracked, measured, and reported.

Impact investments offer a range of returns, from competitive risk-adjusted returns to concessionary below-market returns.

However, they always seek to make a profit or be financially sustainable.

This differentiates impact investing from philanthropic initiatives.

Importantly, impact investing is not an asset class – it is an investment strategy that can be implemented through a variety of asset classes and investment products, from retail fixed income assets to structured private equity funds.

[What is climate risk? Definition, measurement, and regulations and guidelines]

The market size of impact investing

With many financial institutions adopting impact investing – each with a different investment approach across multiple asset classes – estimating the size of the market is challenging.

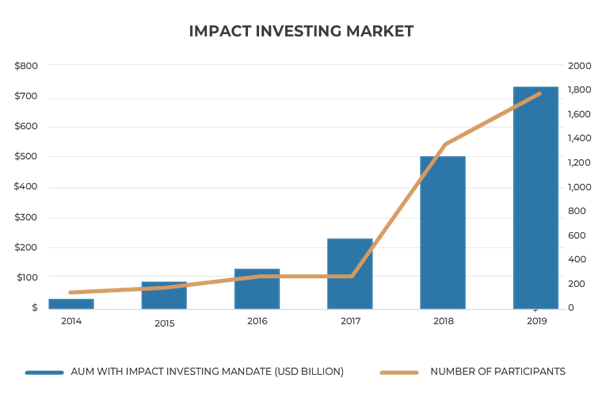

Among the best estimates is that provided by the Global Impact Investing Network (GIIN), which calculated that, in 2019, 1,720 financial institutions had assets under management (AUM) with an impact investing mandate of around USD 715 billion.

Source: GIIN Annual Impact Investor Survey 2015-2020 (data from 2014 to 2017) and GIIN Sizing the Impact Investing Market (data from 2018 and 2019).

Although impact investing assets account for a very small proportion of total global AUM of over USD 100 trillion, the market has grown rapidly from a low base, with a compound annual growth rate (CAGR) of almost 80% between 2014 and 2019, according to GIIN figures.

Measuring impact investing

The core distinguishing feature of impact investing is its intention to generate a positive, measurable social, or environmental impact.

But what is “impact”? How do investors measure it? How can we compare the social or environmental performance of different investments?

To have a reliable measure of financial performance, investors depend on many tools, frameworks, and service providers. For example, the business community agreed on International Financial Reporting Standards (IFRS) so that the financial reports of a company listed on the London Stock Exchange would be comparable to those listed on Tokyo Stock Exchange.

Companies hire independent auditors to issue opinions about their financial statements, adding transparency to the reporting process. Financial directors manage entire departments dedicated to planning, executing, and controlling companies’ financial activities, allocating both employees and information technology tools to ensure they produce timely and accurate reports for all relevant stakeholders. This makes measuring and managing financial performance both difficult and expensive.

What about measuring social and environmental impact? This is not an easy task. While financial accounting principles and techniques date back centuries, the development of tools to assess impact are only a few decades old.

Furthermore, while economists and social scientists are experienced in evaluating whether a public policy or nonprofit intervention has produced the desired impacts, it has only been a relatively short time since the business and investing community started to ask these types of questions. It takes time to develop institutional knowledge and identify best practices.

Impact investing: looking ahead

Impact investing remains a relatively new field. Its infrastructure and best practices are being developed on an ongoing basis, and it is changing rapidly.

In its first structured report about the industry in 2009, the Monitor Institute (now part of Deloitte) mapped the emerging landscape of impact investing and offered a framework to understand where the industry might evolve. At that point, impact investing was at the marketplace-building stage and the report estimated it could reach USD 500 billion in AUM within a decade.

Today, the market has grown substantially, with an estimated USD 715 billion in AUM and rising participation by large, mainstream financial organizations.

Looking ahead, there are many areas in which we can expect to see further development and growth.

A useful framework for thinking about the future of impact investing comes from the GIIN, which, in March 2008, published its Roadmap for the Future of Impact Investing: Reshaping Financial Markets. This report offered the investment community a bold vision of “a future where impact is integrated into all financial decisions.”

In its roadmap, GIIN offered six recommendations to advance impact investing:

- Strengthening the identity of impact investing and articulating a shared purpose across capital by offering different risk-return profiles and impact objectives.

- Changing investment behavior and expectations related to the responsibility of finance in society via asset owner leadership and updated financial theory.

- Expanding impact investment products for investors across the industry, from retail to institutional, including the development of risk-sharing vehicles and products to better suit the needs of investees.

- Further strengthening the investment infrastructure by developing portfolio allocation, investment analysis, and benchmarking tools and services that integrate impact alongside risk and return.

- Bolstering the education and training of rising and mid-career finance professionals and entrepreneurs launching businesses that address social and environmental problems.

- Advocating for policy and regulation that creates incentives for — and crowds in — impact investments, removes constraints such as those related to fiduciary duty, and requires impact reporting.