Sustainable Funds Labelling Under Examination

The public appetite for sustainable investment is by now well understood and something that is uppermost in the minds of those responsible for the marketing of investment fund products. But the ability of concerned investors looking to target funds that adhere to environmental, social, and corporate governance (ESG) standards is compromised by confusion over terminology related to investment practices.

The claims and credentials of “sustainable” funds are under increasing scrutiny. Recent evidence of this was the reported decision of Morningstar to remove more than 1,200 funds with a combined $1.4trn in assets from its European sustainable investment list following a review of investor disclosures in prospectuses and annual reports.

How to define ‘ESG’

Confusion over the terminology applicable to investment products with a sustainable brief begins at the definitional level. Terms such as sustainable investing, impact investing, responsible investing, and ESG investing are habitually used interchangeably with little regard for the nuanced differences between them.

The reality is that what is typically called “sustainable investing” as an umbrella term covers a spectrum of investment approaches rather than a single, unified methodology. These range (at the lower end) from the avoidance of negative outcomes in an investment or real-world context – which is, technically speaking, responsible investing – to (at a more demanding level) actively advancing positive outcomes – which is known as impact investing.

Related article: What is ESG Investing? Environmental, Social, Governance

From portfolio exclusions to active ownership

So, at the lower end of the ESG spectrum, investors can apply exclusions to their portfolio, rejecting issuers involved in providing certain products or services or involved in a particular industry such as tobacco or armaments. Moving up the ladder they may seek to limit ESG risk: here they rely on ESG information that usually takes the form of ESG company ratings supplied by various providers. This same information can also help to identify and prompt investment in companies that are sustainability leaders. Ultimately investors with the highest level of ESG commitment may look to influence positive ESG outcomes by practicing active ownership through engaging directly with companies on ESG issues.

What is clear is that without reliable ESG information effective sustainable investing is an impossible task. At the level of investment funds, Europe leads the way. The labelling of investment funds in a sustainability context is enjoying a new degree of clarity since the European Union introduced its Sustainable Finance Disclosure Regulation (SFDR) just over one year ago. This landmark regulation obliges asset management companies to provide certain information on their products’ ESG risks. The objective is to promote responsible and sustainable investing while preventing greenwashing.

Classifying funds under SFDR

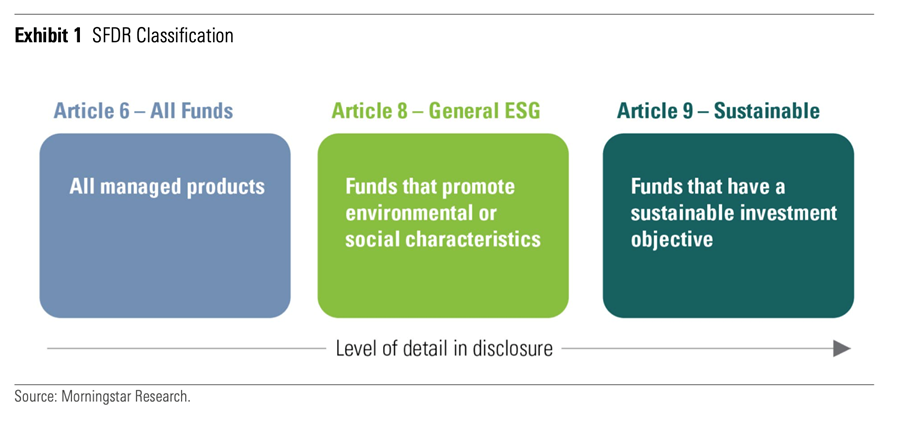

Under the SFDR, investment funds for sale in the EU must be classified by their managers as Article 6, 8, or 9, depending on their sustainability objectives.

Under Article 6, all funds are obliged to provide some ESG disclosure. The “light green” Article 8 category includes financial products that promote environmental and/or social characteristics where the underlying companies follow good governance practices. Article 9 (dark green) investment vehicles have more demanding ESG disclosure requirements; they must have an explicit sustainable investment objective.

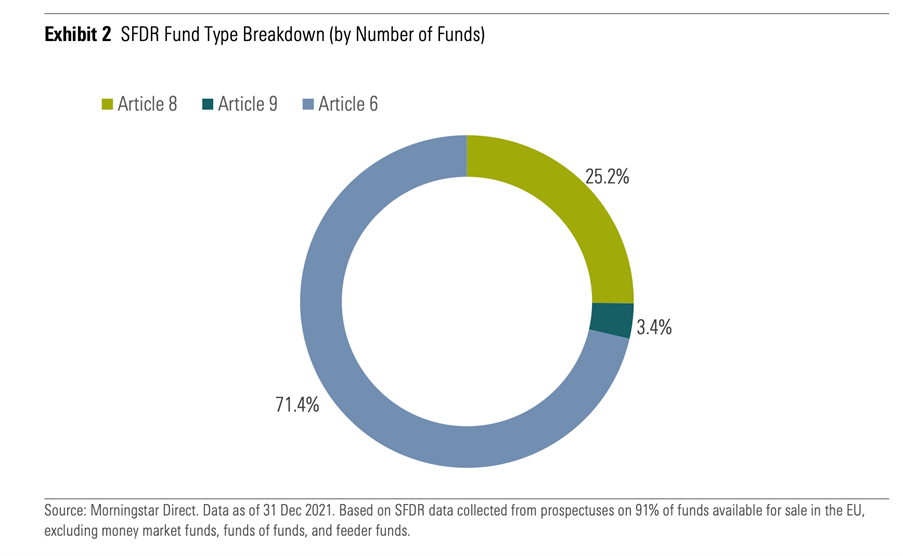

Clearly the new labeling regime has had an impact on investor behavior. Assets in Article 8 and Article 9 funds reached EUR 4.05 trillion at the end of December 2021. This sum represented 42.4% of all funds sold in the EU. Indeed, in the fourth quarter of last year, Article 8 and Article 9 funds captured 64% of EU fund inflows, at EUR 81.4 billion.

The impact of the SFDR was also felt in terms of product development with just under 200 new Article 8 and Article 9 funds, or 54% of new fund launches, coming on stream in the EU in Q4 2021.

Morningstar also noted that asset managers continued to reclassify strategies from Article 6 into Article 8 or Article 9 “by enhancing ESG integration processes, adding ESG exclusions, or switching to brand-new strategies.” But, ominously, “changes to justify a reclassification vary in depth and breadth.”

SFDR prompts investment funds upgrades

According to Morningstar, asset managers have “retooled” Article 6 funds by enhancing their ESG integration processes and/or adding binding ESG criteria to their investment objectives and/or investment policies. “The changes applied to these funds vary greatly, ranging from adding exclusionary screens to a complete overhaul of the investment objective, investment policy, and holdings.”

Related article: What is the SFDR?

Additionally, since the introduction of SFDR on March 10, 2021, around 1,800 funds were upgraded either from Article 6 to Article 8 or Article 9, or from Article 8 to Article 9. A minority of these upgraded products changed their name.

Yet Morningstar identified numerous examples where ESG disclosure practices leave something to be desired and this would seem to be behind the company’s decision to remove funds from its sustainable investing list.

Such light-touch and business-as-usual approaches have legitimately raised concerns that asset managers are greenwashing their product ranges, and that investors could be misled in thinking that funds marketed as promoting ESG characteristics or pursuing sustainable goals are noticeably different from what they were prior to SFDR or different from similar offerings that haven’t been classified as Article 8 or Article 9.

Source: Morningstar, SFDR Article 8 and Article 9 Funds: 2021 in Review

In mitigation, Morningstar notes that SFDR classification is concerned with disclosure of relevant ESG information and does not constitute an ESG label. To assess funds’ ESG credentials, additional analysis and metrics are required. Guidelines around ESG metrics under SFDR are being formalized by the EU’s Taxonomy Regulation, which is a classification system for environmentally sustainable economic activities – something that will greatly increase transparency and equip investors with the information they need to align their investment practices with their ESG principles.

Intuition has a number of tutorials relevant to the content of this article:

- ESG – Primer

- ESG – An Introduction

- ESG Factors

- Sustainable & Responsible Investing – An Introduction

- Sustainable & Responsible Investing – Strategies

- Impact Investing

- ESG Reporting

- Sustainable Finance Disclosure Regulation (SFDR)

- Taxonomy Regulation (Europe) (Coming Soon)