With New Securitization Products, Green Finance Grows Up

Regulators and investors are driving a growing demand for sustainable investment products. Traditional sustainable investment options include equity investments in companies that perform well on sustainability measures and instruments such as green bonds, which raise capital for climate and environmental projects. As the sustainable finance sector matures, however, sophisticated new securitized products are emerging, enhancing the diversity of the sustainable finance market.

In response to growing investor demand, global asset management giant BlackRock announced in January that it would be overhauling its strategy to focus on sustainable investment. BlackRock’s announcement drew fresh attention to the rapidly growing sustainable finance industry.

As the risks posed by income inequality, climate change, and resource depletion become evident, investors have been shifting capital into sustainable investment products, including equity funds focused on companies that perform well on environmental, social, and governance (ESG) measures and other socially responsible investment (SRI) options.

As assets under management with a sustainable mandate have grown, investment options have proliferated. Today, there are many equity indices and funds focused on companies with strong ESG characteristics, and many governments and companies are issuing green bonds and other green financing instruments.

One area that has, however, remained relatively underdeveloped is sustainable securitization.

Securitization is an essential component of the modern financial system. It lowers costs for borrowers and offers investors potentially attractive returns, helping to attract fresh capital. Yet sustainable securitization products have been slow to emerge because the sector faces unique challenges.

One such challenge is that securitization involves multiple parties and it is not easy to determine which party should be evaluated from an ESG or sustainability perspective. For example, the assets underlying a particular security may be sustainable, but the originator may have a poor ESG record. There are no established standards to say whether such an instrument should be considered sustainable.

Another challenge is that every securitized product is unique, which makes it difficult to develop broadly applicable standards for assessing the sustainability credentials of these products. Even in the less-complex world of equity investing, there are dozens of rival standards for assessing the ESG performance of individual companies, and their conclusions do not always agree. This problem is significantly more complex for securitized products, with their multiple parties, complicated structures, and unique underlying assets.

Despite these challenges, however, efforts are underway to grow the sustainable securitization market.

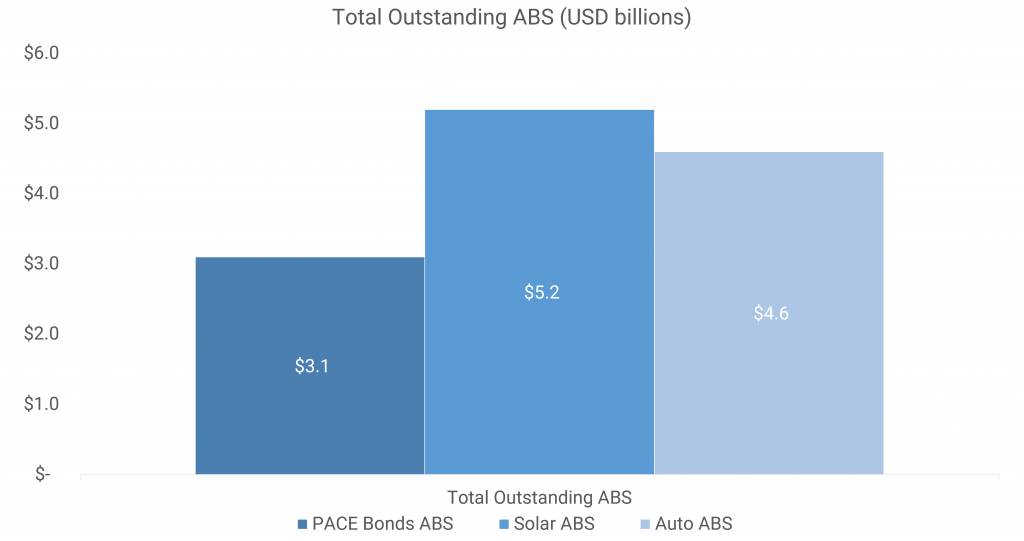

One rapidly developing area is the creation of asset-backed securities using sustainable assets. The market for solar ABS – instruments backed by loans used to finance the installation of solar energy systems – is relatively well developed, for example.

So-called PACE bonds are another popular source of sustainable assets for securitization. Property Assessed Clean Energy (PACE) financing programs in California, Florida, and Missouri allow homeowners to fund weatherizing or renewable energy renovations using money from the sale of PACE bonds, which are then repackaged and sold as PACE ABS.

Even auto manufacturers have entered the sustainable ABS market – Toyota has created green auto ABS using auto loans issued to finance the purchase of hybrid, electric, and fuel-efficient vehicles.

Source: ESG & Securitization: Early Days. Deutsche Bank.

Another emerging area is sustainable collateralized loan obligations (CLOs). CLOs are special purpose vehicles (SPVs) that house pools of leveraged loans. In Europe, fund managers are creating ESG-compliant CLOs focused on leveraged loans of companies with strong ESG practices. New green CLOs, focused on the loans of companies that are engaged in improving the environment and fighting climate change, are forthcoming.

There is also a growing market for sustainable commercial mortgage-backed securities (CMBS) and residential mortgage-backed securities (RMBS), although defining which of these MBS instruments qualify as sustainable can be complex.

The world is engaged in significant financial transition. Trillions of dollars in capital will be needed to finance climate change adaptation and mitigation and to ensure a sustainable and prosperous future, and innovative and creative financial solutions will be necessary to meet this need. Sustainable securitized products will be an essential part of the process.

Intuition Know-How has a number of tutorials that are relevant to securitization and sustainable investment:

- ESG & SRI Investing

- Securitization – An Introduction

- Securitization – MBS Types & Risks

- Securitization – US MBS

- Securitization – US Non-MBS

- Securitization – Prepayment Risk

- Securitization – Credit Risk & Ratings

- Securitization – Pricing & Analysis

- Securitization – CDOs