Best execution: US looks to eliminate conflicts

Toward the end of 2023, two US-based broker-dealers were subjected to multi-million dollar penalties levied by the Financial Industry Regulatory Authority (FINRA) on grounds of failure to provide “best execution” to their customers. The timing of these sanctions coincided with the introduction by the Securities and Exchange Commission (SEC) of Regulation Best Execution (Reg NMS Rule 606) – the first regulation specifically targeting best execution, as the SEC increases its scrutiny of the actions of broker-dealers in light of their customer obligations.

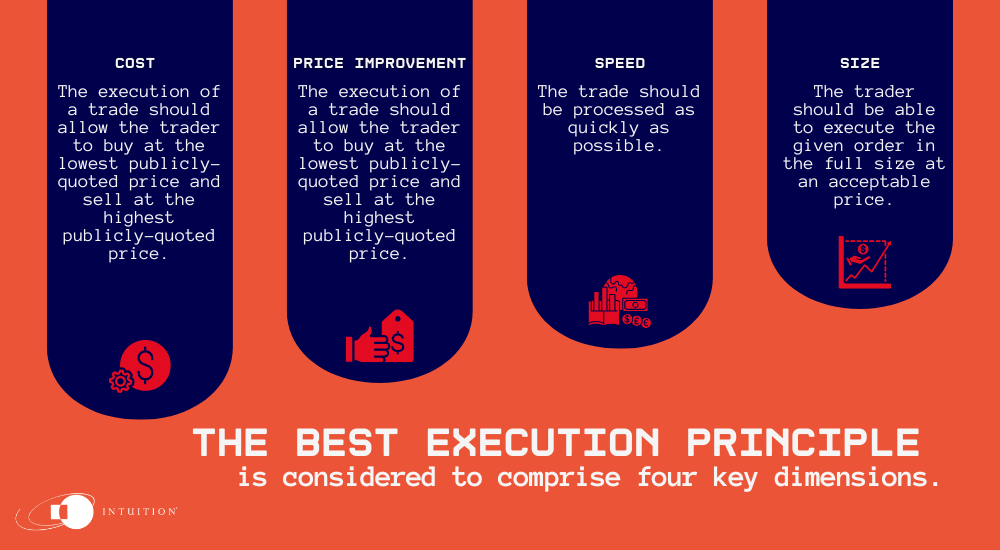

The duty of best execution requires a broker-dealer to execute customers’ trades at the most favorable terms reasonably available under the circumstances. The best execution principle is considered to comprise four key dimensions.

- Cost: The execution of a trade should allow the trader to buy at the lowest publicly-quoted price and sell at the highest publicly-quoted price.

- Price improvement: The execution should allow the trader to take advantage of opportunities to trade at prices that are superior to publicly-quoted prices.

- Speed: The trade should be processed as quickly as possible.

- Size: The trader should be able to execute the given order in the full size at an acceptable price.

While FINRA and the Municipal Securities Rulemaking Board (MSRB) provide rules and guidance around best execution, it wasn’t until last year that the SEC proposed Regulation Best Execution – Reg NMS Rule 606, within Regulation NMS (National Market System) – marking the first instance of rules specifically targeting best execution practices. The regulation was introduced in the belief that “customers would benefit from consistently robust best execution practices by broker-dealers, and the execution of retail customer orders by broker-dealers that have certain order handling conflicts of interest warrants heightened attention by those broker-dealers.”

Compliance with best execution

Reg NMS Rule 606 requires broker-dealers to “establish, maintain, and enforce written policies and procedures reasonably designed to comply with that best execution standard.” Those policies and procedures aim to address:

- Compliance with the best execution standard, including identifying material potential liquidity sources and incorporating them into order handling practices, while ensuring efficient access to each source.

- Determining the best market for customer orders received, which involves assessing reasonably accessible and timely pricing information and opportunities for price improvement.

Rule targets broker-dealer conflicts of interest

The rule recognizes the conflicts of interest for broker-dealers that retail customer transactions can present, such as payment for order flow (PFOF) or internalization.

PFOF is a method of transferring a portion of market makers’ trading profits to the brokers that route customer orders to those market makers for execution.

Internalization occurs when a dealer exclusively matches customer orders without allowing other market participants to compete. This enables the dealer to profit from trading against its own customers’ orders.

The conflicts of interest here lie between brokers’ incentive to maximize PFOF and internalization profits for their firms and their fiduciary obligation to route their customers’ orders to the best markets. According to the SEC, this revenue could be partially passed on to investors in the form of either reduced commissions or rebates.

Best execution policies and procedures

Consequently, Reg NMS Rule 606 require a broker-dealer’s policies and procedures to address this, including how it would assess a broader range of markets than it would for nonconflicted transactions.

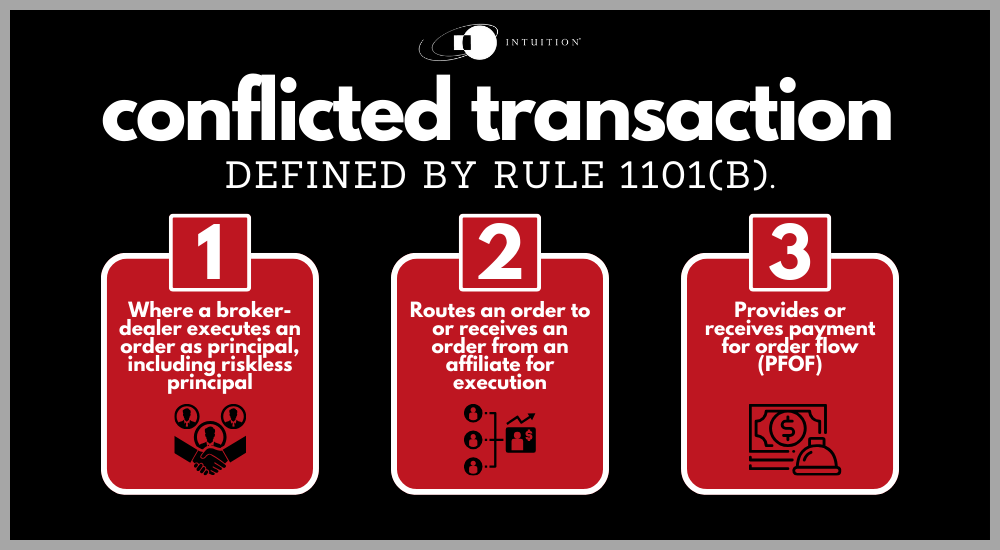

Further, broker-dealers that engage in conflicted transactions with respect to retail customer orders would be subject to additional obligations. Rule 1101(b) of the Regulation defines a conflicted transaction as:

- Where a broker-dealer executes an order as principal, including riskless principal

- Routes an order to or receives an order from an affiliate for execution

- Provides or receives PFOF

Additional requirements include:

- Compliance documentation: Broker-dealers must document their compliance with the best execution standard for transactions and any existing PFOF arrangements.

- Execution quality review: Broker-dealers are mandated to conduct at least quarterly reviews and documentation of the execution quality of customer transactions. These reviews should compare the execution quality obtained with what could have been achieved from other markets. Insights from these reviews should inform the revision of best execution policies and procedures.

- Annual review of policies and procedures: The regulation necessitates an annual review of best execution policies and procedures. This review should encompass order handling practices, and broker-dealers are obligated to prepare and present written reports detailing the results to their boards of directors or equivalent governing bodies.

Europe revisiting its best execution requirements

Meanwhile, Europe is taking steps that on the face of it might seem like a partial relaxation of some of its best execution rules, specifically around reporting obligations. This may be surprising to some, given Europe’s reputation for some of the toughest regulations globally and the fact that best execution is a cornerstone of Europe’s flagship Markets in Financial Instruments Directive (MiFID II).

However, what transpired was more like a case of removing superfluous rules rather than a change of heart by European regulators on the importance of best execution practices. MiFID II recently underwent a review, resulting in the proposed deletion of Articles 27 and 28. Article 27 requires firms to publish reports detailing the top five execution venues in which they executed client orders in the preceding year and disclose information on the quality of the execution obtained. Article 28 details the required disclosure format and content relating to this information.

These proposed deletions resulted from claims by market participants that the reports are all but ignored by investors and that the information they provide does not enable investors or other users to make meaningful comparisons. The European Securities and Markets Authority (ESMA), the EU’s financial markets regulator, appears to agree and has directed National Competent Authorities (supervisors) to effectively ignore current reporting obligations in that respect until the MiFID review has been transposed into the national legislation of all the EU Member States.

Intuition Know-How has a number of tutorials relevant to the content of this article:

- Financial Regulation – An Introduction

- Life of a Trade – An Introduction

- Life of a Trade – Execution

- Equity Markets – An Introduction

- Equity Trading – An Introduction

- Financial Authorities (US) – SEC

- MiFID II/MiFIR – Primer

- MiFID II/MiFIR – Key Requirements

- Conflicts of Interest (2024)