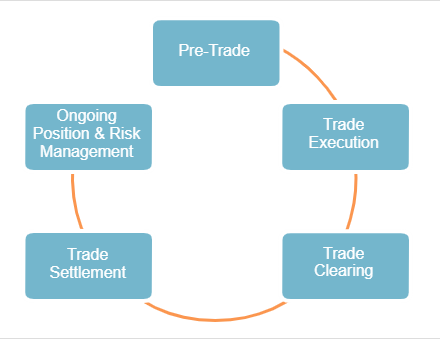

The Trade Life Cycle: 5 Key Stages

For many, a trade simply refers to the moment that two counterparties engage in a transaction, such as the exchange of cash for a bond in a securities trade or the exchange of two currencies in an FX trade.

In reality, for a trade to take place, significant planning and follow-up is required.

Therefore, a deeper understanding of trading requires understanding the entire trade life cycle – the sequence of events that occurs and processes that are implemented when a trade takes place.

A key element of the pre-trade stage is the process of client onboarding, which is the means by which an institution establishes a relationship with a new client or customer.

Once a client is in the system, the institution is in a position to facilitate the execution of trades on behalf of that client.

After a trade is executed, it must be cleared. Clearing is the process through which the parties to the trade determine and verify the exact details of the transaction and prepare for settlement.

Settlement is a crucial stage as it relates to the actual transfer of value between the parties so that the trade is completed.

Throughout the trade life cycle, and indeed after a trade has been completed, there is a requirement for ongoing position and risk management in order to manage the numerous positions that an institution holds in its portfolio or trading book.

The Trade Life Cycle

To some, the area of trade processing represents one of the less glamorous elements of the financial industry. However, without the efficient management of a trade throughout its life cycle, the trade would be pointless in the first place.

The life cycle of a trade refers to the sequence of events that occurs and processes that are implemented when a trade takes place.

[Intro to Economic Analysis: 8 Key Learning Areas]

Understanding this lifecycle is important for:

- Investors and other parties that engage in trading

- Institutions such as banks and brokers that facilitate trading

The life cycle demonstrates that trading is about much more than two counterparties engaging in a transaction. Instead, for a trade to take place, an extensive and careful process is implemented before, during, and after the trade.

Stage 1: Pre-Trade

Pre-trade preparation for an institution includes the development of systems, processes, and protocols to ensure that:

- All trading facilitated through the institution complies with relevant laws and regulatory requirements

- Data related to all trading and the trade life cycle is captured and preserved

- Appropriate legal agreements, such as ISDA documentation for OTC derivatives trades, are used when trades are made

- Counterparty credit risk is understood to ensure suitability of counterparties

- Appropriate collateral is collected and managed

- Risks associated with positions are understood and managed

- Appropriate controls are put into practice throughout the trade life cycle

[Best execution: US looks to eliminate conflicts]

Stage 2: Trade Execution

Once a client is in an institution’s system, the institution is willing to facilitate trading on behalf of that client.

The client’s motivation for trading may be:

- A cash need

- The need to hedge a position

- The need to diversify its portfolio

- The desire to monetize a view, such as the view that a specific stock will increase in value

Whatever the motivation, the client must communicate with the institution to place orders when it wishes to engage in trades. The nature of a client’s orders can vary. For example:

- Some orders require that trading take place at a specific price while other orders do not.

- Some orders require that trading take place immediately while others condition trading on a specified price level being met.

- Some orders may require that trading take place within a certain amount of time while others do not.

The institution then works to execute the trade and inform the client of its execution. Trades may be executed not only on exchanges but using a wide range of systems and trading venues.

Note that, in addition to executing trades on behalf of clients, some institutions may also execute trades on their own account.

[Basel III, Basel IV, Basel III Endgame, & Basel 3.1: Terminology Explained]

Stage 3: Trade Clearing

When a trade is executed, the agreed transaction does not complete immediately. We can distinguish between three dates associated with a trade:

Trade Date

This is the date that the counterparties agree to trade. While the counterparties agree to trade on this date, the exchange of cash for securities, or the exchange of currencies in the case of an FX trade, does not actually take place on this date. Instead, the exchange takes place at a specified future date depending on the underlying product and market.

Value Date

The value date is the date that the counterparties to a trade are contractually obligated to exchange cash for securities, or one currency for another in the case of an FX trade. Note that while the counterparties are contractually obligated to engage in the exchange on the value date, they may fail to do so in practice.

Settlement Date

This is the date that the counterparties actually exchange cash for securities. It may differ from the intended settlement date (value date). If a trade does not settle on the date that it was contractually scheduled to take place, then a settlement fail has occurred.

Once a trade is executed, an extensive clearing and settlement process is implemented to finalize the trade. Trade clearing refers to the process through which the counterparties to the trade and their agents determine and verify the exact details of the transaction and prepare for settlement. Trade settlement refers to the completion of the agreed-upon transaction.

The process through which trade clearing is implemented includes the following steps:

Trade Capture

Trade capture refers to an institution’s initial recording of executed trades. Only basic information is initially captured, such as the underlying asset or currencies, price, amount/quantity, and trade date and time.

Trade Enrichment

Trade enrichment refers to the process of applying additional information to a trade to facilitate processing of the subsequent stages of the trade life cycle. The type of data included in the trade enrichment stage includes the value date, securities identifiers, legal details, and detailed counterparty information.

Trade Validation

Trade validation is a final check on the information that an institution has gathered in relation to a trade. The validation process provides the institution with an opportunity to identify problems before communication with other entities begins in relation to the trade.

Trade Confirmation/Affirmation

Trade confirmation is the process through which trade details are verified and agreed between direct participants to a trade, for example, between two institutions that are both trading on behalf of their clients.

Trade affirmation is the process through which trade details are verified and agreed between the direct and indirect participants to a trade, for example, between an institution that has traded on behalf of a client and the client itself (the institution is the direct participant while the client is the indirect participant).

Trade Reporting

Trade reporting refers to the reporting of transactions using an approved reporting mechanism.

Settlement Instructions

The final step that takes place before settlement is the preparation of settlement instructions.

Stage 4: Trade Settlement

Trade settlement refers to the completion of the agreed-upon transaction. Settlement is a crucial stage as it represents actual exchange of value. Settlement therefore requires careful management, protocols, and safeguards.

Broadly, there are two types of settlement method:

Delivery-versus-Payment (DVP)

DVP refers to settlement whereby securities are only delivered if payment is made and payment is only made if securities are delivered. For example, if a trade involves the purchase of shares of a stock, then both the cash and shares are exchanged simultaneously.

Free-of-Payment (FOP)

FOP refers to settlement whereby the delivery of the securities and payment of funds take place separately. This form of settlement is risky for the counterparty that delivers first as the other counterparty may not deliver.

Stage 5: Ongoing Position & Risk Management

Throughout the trade life cycle, there is a requirement for ongoing position and risk management. This refers to the management of the numerous positions that an institution holds in its portfolio, otherwise known as its trading book.

Some examples of position and risk management activities include:

- Managing corporate actions

- Managing counterparty credit risk

- Trade reconciliation

- Measuring profit and loss (P&L)

- Measuring risk and sensitivity

- Preparing internal and external reports

Conclusion

In conclusion, the lifecycle of a trade refers to the sequence of events that occurs and processes that are implemented when a trade takes place.

There are five main stages:

- Pre-Trade

- Trade Execution

- Trade Clearing

- Trade Settlement

- Ongoing Position and Risk management