Big Four Accounting Firms Enter The ESG Reporting Fray

Companies’ attempts to transition to a more socially responsible, sustainable model have long been plagued by the challenge of measuring progress. With no universal reporting formats, businesses have struggled to monitor their environmental, social, and governance (ESG) performance. There have been various attempts at building a comprehensive, standardized framework, but so far, no single candidate has emerged victorious. Instead, companies use a patchwork of different formats, metrics, and standards. Can a recent joint effort by the Big Four accounting firms and the World Economic Forum (WEF) to develop a comprehensive set of benchmarks succeed where so many have failed?

Click here to learn how we are helping our clients with ESG.

ESG investing has grown exponentially in recent decades as more and more investors seek to channel money into companies that have a positive impact on the world. However, despite its rapid growth, the ESG investment sector has been dogged by persistent issues with quality and reporting.

Too often, companies with high ESG ratings are proved to have serious problems that current reporting rules missed and many investors are confused by the plethora of different standards, benchmarks, metrics, and frameworks that litter the ESG reporting landscape. At the heart of these issues is the fact that there is no single, universal set of standards for measuring, monitoring, and reporting on ESG performance. As a result, even companies with a deep commitment to social responsibility can find it difficult to document their successes and identify areas that need improvement. Worse yet, bad actors can take advantage of the confusion to claim ESG credentials they have no real right to.

These problems mean that developing a standardized reporting framework has become a key objective for the ESG investment industry. Unfortunately, various attempts to do so have been stymied by a lack of uptake, disagreement over standards, and the challenges inherent in developing a comprehensive framework that works for all industries.

The Big Four enter the fray

In a bid to solve the problem, the Big Four accounting firms – KPMG, EY, Deloitte, and PwC – collaborated with the World Economic Forum (WEF) and the International Business Council (IBC) to produce a white paper titled Measuring Stakeholder Capitalism: Towards Common Metrics and Consistent Reporting of Sustainable Value Creation.

The paper outlines the results of a six-month open consultation process aimed at developing a comprehensive ESG reporting framework that the IBC hopes will be adopted by 120 or so global companies it counts as members.

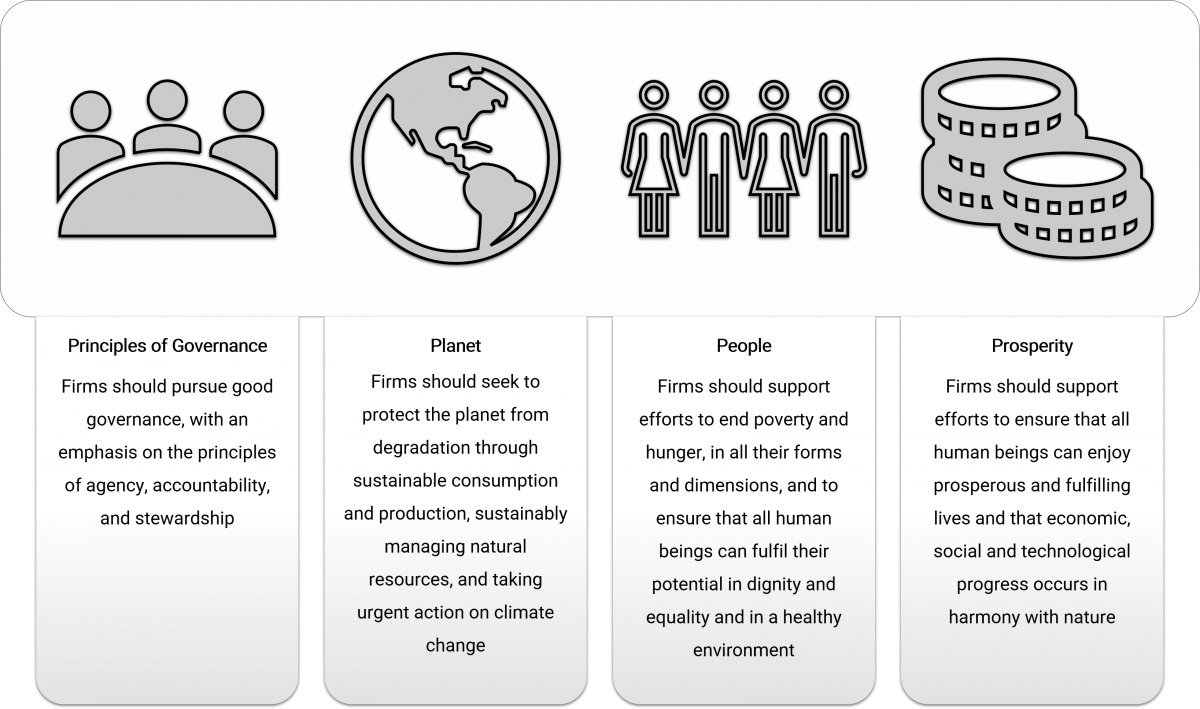

The framework is arranged around four pillars. Each pillar has a set of core metrics that are used to measure a company’s performance, as well as a set of expanded metrics that provide additional detail. For the most part, the 21 core metrics and 34 extended metrics are based on existing measures borrowed from popular reporting frameworks. Many of the governance metrics are taken from the GRI Reporting Standards, for example, and many of the environmental metrics are borrowed from the Recommendations of the Task Force on Climate-Related Financial Disclosures (TCFD). Several metrics from the Sustainability Accounting Standards Board (SASB) Standards and the Greenhouse Gas (GHG) Protocol, among others, are also referenced.

The Four Pillars

Source: World Economic Forum. Measuring Stakeholder Capitalism. September 2020.

Will it work?

Some are cautiously optimistic about the potential uptake of the WEF/IBC framework. If the members of the IBC adopt the framework, that could give it a boost as the IBC’s membership includes many prominent global firms.

However, rival frameworks are emerging. Around the same time that the WEF/IBC published their white paper, a coalition of sustainability standard-setters including the Carbon Disclosure Project, the Climate Disclosure Standards Board, the Global Reporting Initiative, the International Integrated Reporting Council, and the Sustainability Accounting Standards Board announced their own joint initiative. In a document titled Statement of Intent to Work Together Towards Comprehensive Corporate Reporting, the standards-setters outlined their plan to develop a comprehensive global standard for ESG reporting.

This suggests that the WEF/IBC framework – while an important step along the road to a global standard – may not be the final word in sustainability reporting.

Intuition Know-How has a number of tutorials that are relevant to ESG investing and reporting:

- ESG & SRI – Primer

- ESG & SRI – An Introduction

- ESG & SRI – Investing

- ESG Factors

- SRI Strategies

- ESG & SRI Reporting (Coming Soon)

- Green Assets (Coming Soon)

- ESG & SRI Scenario – Retail (Coming Soon)

- ESG & SRI Scenario – Institutional (Coming Soon)

- Corporate Governance

- Corporate Social Responsibility (CSR)