Navigating inflation: Soft landing on a moving target

Amid strong signs that the aggressive tightening cycle implemented by monetary authorities to combat inflation may have run its course – with interest rates set to head lower later this year – markets are jubilant. However, some central bankers and economists caution that these celebrations may be premature.

2023 was supposed to be the year that saw a widely expected recession in the US become a reality. Instead, the US economy confounded the consensus by recording the fastest growth of any major economy. Its labor market showed remarkable resilience, with unemployment staying close to cycle lows and wages increasing. Meanwhile, inflation fell sharply in the second half of the year, despite the strong wage data, edging gradually toward the Fed’s 2% target. This combination of wage growth with falling inflation translated to productivity gains in the latter half of the year that weren’t on anyone’s list of 2023 surprises (let alone expectations).

Fed Chairman Jay Powell appeared to signal a major policy turning point during the post-Federal Open Market Committee (FOMC) press conference in mid-December. Given the persistent decline in inflation toward the 2% target, Powell said that he saw grounds for a sustained reduction in interest rates from their current level of 5.25–5.5%.

Powell’s comments took markets by surprise, causing a sharp rally in both bonds and stocks that lasted through the end of the year. The significance of his comments, or the surprise – and probably what caused markets to rally as hard as they did – was that they effectively signaled the abandonment of the “higher for longer” outlook that had dominated over the past couple of years. Economic hardship would no longer be required for a reduction in rates. Lower inflation would be enough. The bar for rate cuts was therefore lowered.

Markets kicked off 2024 in buoyant mood, carried by the December momentum and pricing in six rate cuts in the US this year alone. More recent developments, however, have tested this newfound optimism. The latest inflation figures in the US – the December CPI – came in “hot” at 3.4% (compared with 3.1% in November), reigniting fears in some corners of more secular inflation pressures that will be hard to tame. Had the markets overshot in terms of pricing in a soft landing?

Markets ahead of monetary authorities

The markets appeared to have gotten ahead of the FOMC’s expected trajectory of rate cuts, reflected in recent comments from FOMC members. Policymakers elsewhere have also pushed back against some of these rosy expectations. In Europe, the World Economic Forum in Davos kicked off with ECB President Christine Lagarde warning against market assumptions of early rate cuts. Hot on the heels of these comments, UK inflation figures for December showed an increase (over the prior month’s reading) for the first time in ten months.

Origins of inflation

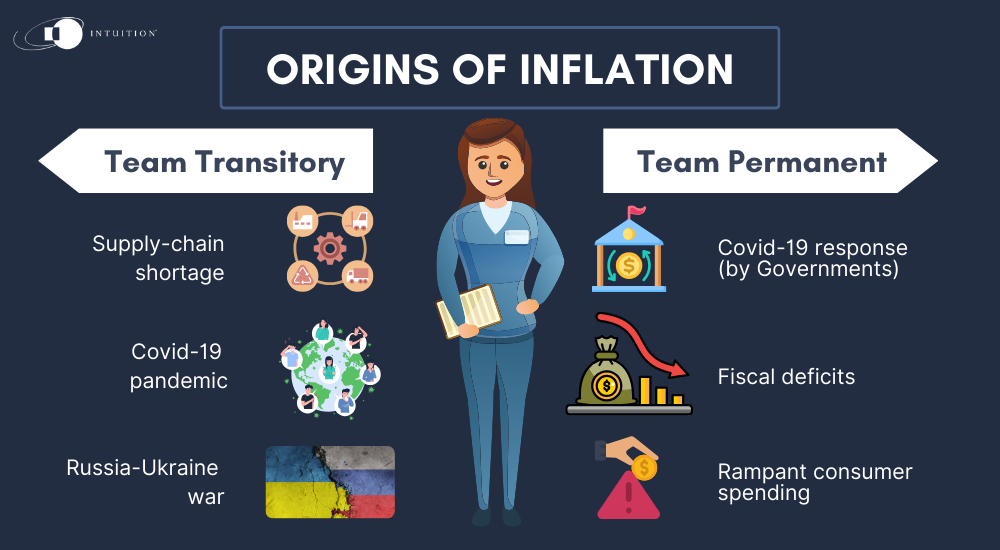

The speed of any rate cuts is conditional on an array of economic factors and will require delicate judgment. It also depends largely on the nature and origins of this latest wave of inflation, which has become a hotly debated topic among economists. Two competing schools of thought have emerged on this.

Team transitory

At one extreme are those economists who believe inflation was always going to be a transitory problem. By extension, they see a soft landing as the most plausible scenario. This group has come to be known as “Team Transitory” (much to the dismay of many economists – including members and sympathizers – who balk at this oversimplification).

Their view can be roughly summed up as follows: The wave of inflation that took hold in late 2021 was driven by supply shortages (cost-push inflation), not demand (demand-pull inflation). The origins of the inflation shock were unique – primarily the COVID-19 pandemic and the supply chain disruptions it caused. Inflation was then further exacerbated by another unique event in February 2022 when Russia invaded Ukraine, sending shockwaves through crucial energy and food markets. This too was clearly a supply-side shock.

Citing the unique origins of this inflation, some of these economists have challenged economic orthodoxy regarding the appropriate cure. If supply was the problem, rather than demand, monetary policy tightening – which aims to bring down inflation by suppressing demand – was the wrong tool. It would do nothing to alleviate the supply disruptions caused by COVID and President Putin’s invasion of Ukraine. Policymakers should instead have implemented measures that would have boosted supply through increased investment. Any fears that such spending might instead stoke inflation are unfounded, in their view.

Team permanent

At the other end of the spectrum are those who believe inflation may be here to stay – or “Team Permanent” (also an unwelcome oversimplification for many economists.)

These more “traditional” economists don’t dispute the role that supply factors played in causing the inflation spike. However, they assign greater significance (than Team Transitory does) to the role that the COVID response (by governments and central banks) played. The extraordinary measures – particularly the fiscal handouts that put money straight into consumers’ pockets – overstimulated demand. Inflation, according to this interpretation, was therefore primarily a demand problem. And the remedy was “traditional” monetary tightening, exactly as central banks did.

The traditionalists worry generally about the fiscal profligacy of the US government (and others), reflected in a fiscal deficit of around 7% (unprecedented ex-recessions). The rampant spending shows no signs of abating. This, they believe, is both unsustainable and testament to populism (on both sides of the “aisle”) that has become increasingly entrenched. It is also hostile to monetary policymakers’ attempts to bring inflation lower and keep it down.

Who’s “winning?”

On the face of it, soft landing advocates (Team Transitory) may appear to have the upper hand in the debate. After all, inflation has come down meaningfully, despite continued government spending and rising deficits. Recession has not only been averted, but has not even looked like a remote threat, at least not in the US. The markets agree and a soft landing is now the consensus view.

However, the traditionalists (Team Permanent) can point to the success of the latest round of tightening in bringing down inflation as evidence that the tried-and-tested measures do work. From their perspective, any “victory laps” by Team Transitory are not only premature, but disingenuous, as the reason for the inflation reduction that they are cheering is the aggressive monetary tightening in 2022 – precisely the sort of hard measures that the traditionalists would have prescribed (but that Team Transitory was dead against).

Outlook

Allowing for differences in opinion within the group, the scenario seen as most plausible for Team Transitory is that inflation continues lower and reaches 2% soon. At this level, real interest rates would now be standing at around 3% (using a crude measure of current policy rates less inflation), which means they have plenty of room to go lower. Both equity and bond markets should perform decently in this scenario. Monetary authorities have little to fear from lowering interest rates, and this will not cause a resurgence of inflation. Instead, the key risk they see is that the Fed and other central banks – fearing a return of inflation or for whatever other reason – do not cut rates enough.

The Team Permanent camp (also allowing for divergent views within) believes that cuts to interest rates will not happen in a vacuum. Just as monetary tightening succeeded in bringing down inflation by suppressing demand, monetary loosening will stimulate demand. The main risk then, from their perspective, is that loose monetary conditions cause inflation to come roaring back, supported by an inflation-friendly backdrop of those more permanent features of our current world (reshoring, populism, and so on).

[What is inflation? Causes, hyperinflation and deflation explained]

Reconciling these views

Recent comments by Fed Governor Christopher Waller provide some reconciliation of these extremes. He said the US was “within striking distance” of the 2% target. However, the Fed should proceed more cautiously than in previous cutting cycles that were in response to economic shocks. The comments would appear to suggest that anyone expecting rapid cuts is likely to be disappointed.

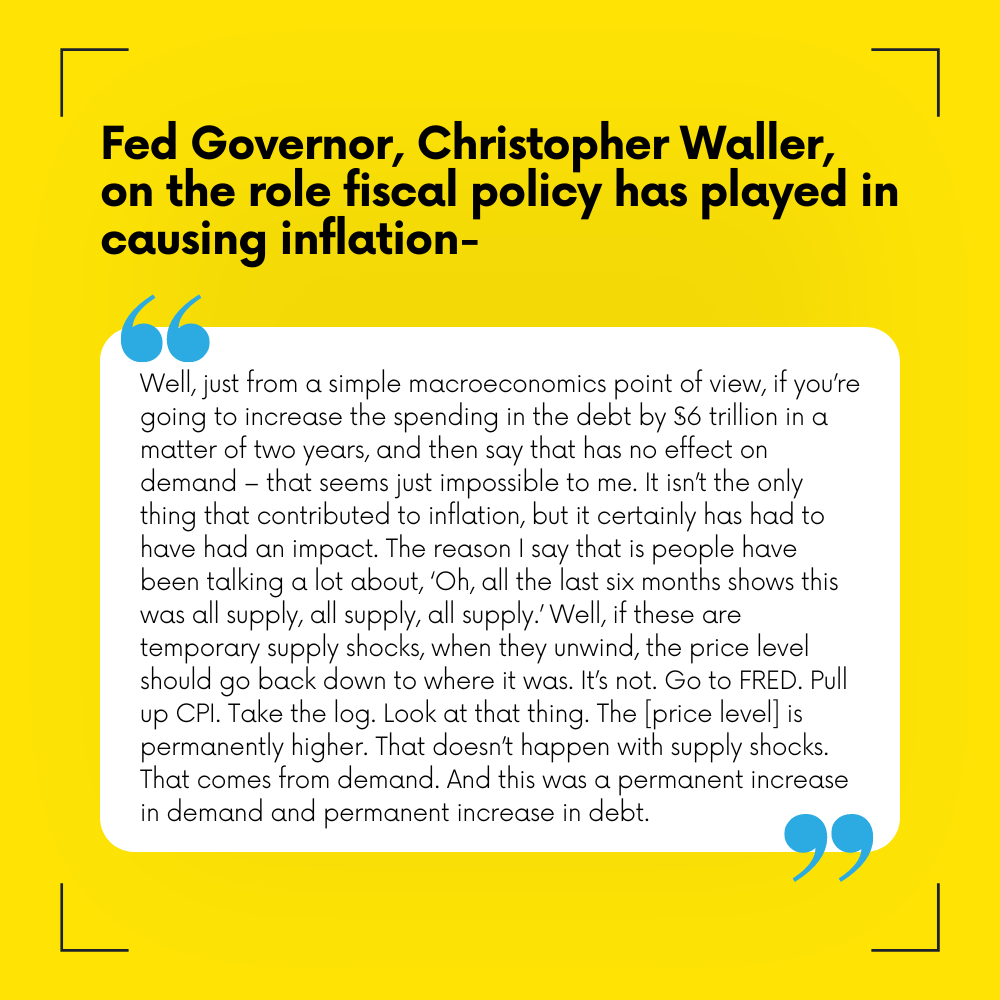

In a subsequent interview, Waller was asked about the role fiscal policy (in other words, demand) had played in causing the inflation the Fed has been fighting. While acknowledging the supply factors, Waller threw quite a large bone to the traditionalists. Let’s conclude by quoting his reply in full:

Intuition Know-How has a number of tutorials relevant to the content of this article:

- Monetary Policy

- Financial Authorities (US) – Federal Reserve

- Employment & Unemployment – An Introduction

- Economic Indicators – An Introduction

- Inflation – An Introduction

- Inflation Indicators

- Fiscal Policy Analysis