Private funds feeling the pressure

For at least a decade, private assets – equities, credit, real estate, and other alternative assets that are not publicly traded – had been experiencing a boom, driven by the growing popularity of alternative assets after the global financial crisis of 2007-2009 and a broad bull market in asset prices, underpinned by extraordinarily low interest rates. While the relative performance of alternative assets was mixed, they did well in absolute terms, and the period was highly lucrative for alternative asset managers who charge higher fees than more traditional managers. But the private asset business is now beset by a number of headwinds, set in motion by higher interest rates.

The boom in private assets was born out of the historically low interest rate regime that prevailed for more than a decade as central banks worldwide dealt with the consequences of the global financial crisis. According to a recent report by the International Organization of Securities Commissions (IOSCO), private funds have grown fivefold since 2008, with assets under management now standing at USD 13 trillion.

The emergence of higher inflation in 2021 forced central banks to reverse course and hike rates aggressively. The bigger “surprise,” however, has been the persistence of inflation, even amid much higher rates. This has led central banks to signal their intent to hold rates “higher for longer,” dampening the prospects of a “soft landing” that many were hoping for. This combination has slashed public and private asset values and darkened the outlook for the private sector, where the impact on asset values may not yet have been fully felt.

Higher rates to slash private asset values

Whereas publicly quoted assets – such as stocks, bonds and exchange-traded funds – can be valued instantaneously, private assets are typically valued on a quarterly basis. This lag effectively makes them less transparent, subject to sudden, sharp corrections, and regulators have frequently expressed concerns about the scope for price manipulation arising from the lack of transparency. The IOSCO report highlights potential asset value markdowns as a key risk to the private assets sector.

For private funds, interest rate “normalization” means that portfolio companies face higher rates on existing borrowing (which is typically floating rate), as well as on new and refinanced borrowing. IOSCO notes that market participants believe these risks to be “especially stark” over the medium to long term. While private equity firms are believed to have accumulated a significant amount of “dry powder” (capital committed by investors but not yet invested), it is unclear how much and whether this will be sufficient to cushion the blow to invested assets.

In private credit, flexible financing arrangements may help portfolio companies navigate short-term market strains, but defaults are likely to increase over the medium to long term. IOSCO expects “significant impacts on concentrated sectors that have become reliant on a constant flow of affordable funding.”

Meanwhile, privately held real estate assets (both equity and debt) are thought to be particularly vulnerable, with severe drawdowns in publicly quoted real estate proxies (the stocks and bonds of homebuilders, and REITs, for example) potentially signaling tough times ahead.

Outlook for hedge funds

For hedge funds, the implications are more nuanced. Insofar as most hedge funds use leverage in their strategies, they are on aggregate vulnerable to higher borrowing costs.

However, not all hedge fund strategies are alike. The levels of leverage used, as well as the liquidity of the traded assets, vary considerably from strategy to strategy.

Those that require large amounts of leverage to exploit minor price discrepancies – fixed income arbitrage, for instance – may well suffer, as may funds that invest in illiquid assets, which they can get stuck in (a risk similar to that facing private equity funds). But strategies that trade primarily in liquid assets, with relatively low leverage, should be able to pare down risk quickly. Then there are those strategies that may even profit handsomely from the volatility that the rates turmoil generates. Global macro and directional systematic strategies are traditionally best placed to benefit from such regimes – provided, of course, that they get the direction right.

Excess leverage the key concern

The primary concern for regulators is excess leverage and the systemic risk it might pose. Hence, the Financial Stability Board (FSB), an international body that monitors the global financial system, has developed a comprehensive work program to address the potential threat to financial stability posed by leverage in nonbank financial institutions (NBFIs). The emphasis is on hedge funds, given the potential transmission of risk through their prime brokers to the broader financial system (prime brokers, which are the main providers of leverage to hedge funds, are also typically arms of large, systemic investment banks). At a minimum, the FSB will demand greater transparency from the hedge fund sector, and is likely to recommend that banks demand more collateral from this sector.

New SEC regulations addressing private funds

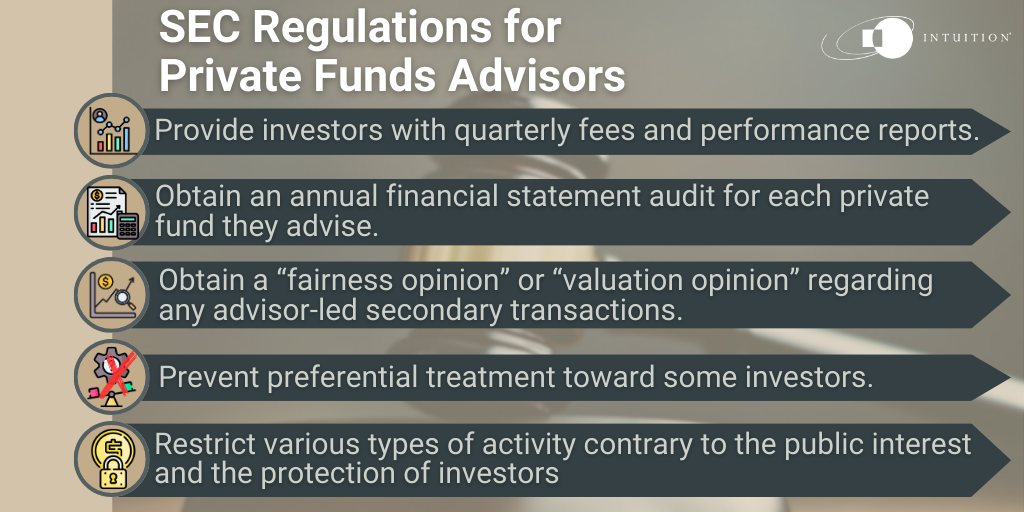

Amid these gathering storm clouds, the US Securities and Exchange Commission (SEC) has announced a set of new requirements aimed at increasing transparency, fairness, and accountability for the private funds industry. The new SEC regulations include rules that oblige private fund advisors to:

- Provide investors with quarterly fees and performance reports

- Obtain an annual financial statement audit for each private fund they advise

- Obtain a “fairness opinion” or “valuation opinion” regarding any advisor-led secondary transactions

- Prevent preferential treatment toward some investors – when it comes to fund redemptions, for example

- Restrict various types of activity contrary to the public interest and the protection of investors, such as the charging of any fees and expenses that do not fall within the fund’s specified fee structure (for example, fees relating to an investigation of the advisor)

These measures are echoed by comments from IOSCO regarding conflicts of interest in private finance, such as those that can arise between the investors in a single asset manager’s separate investment products – if, for example, the firm’s debt fund lends to portfolio companies in one of its equity funds. IOSCO also points to conflicts of interest in some aspects of valuations, transaction negotiation practices, and general partner-led secondary markets.

Given the challenges posed by the increased cost of debt, some funds may be required to seek equity financing, at potentially unfavorable valuations given the stress already seen in public equity markets.

Intuition Know-How has a number of tutorials relevant to the content of this article:

- Private Equity – An Introduction

- Private Equity – Investing

- Private Debt

- Hedge Fund – An Introduction

- Hedge Funds Strategies

- Hedge Funds – Investing

- Real Estate – An Introduction

- Real Estate – Investing

- Real Estate – Valuation

- REITs

- Monetary Policy

- Financial Authorities (US) – SEC